Valuation Process

CALCULATE INVENTORY

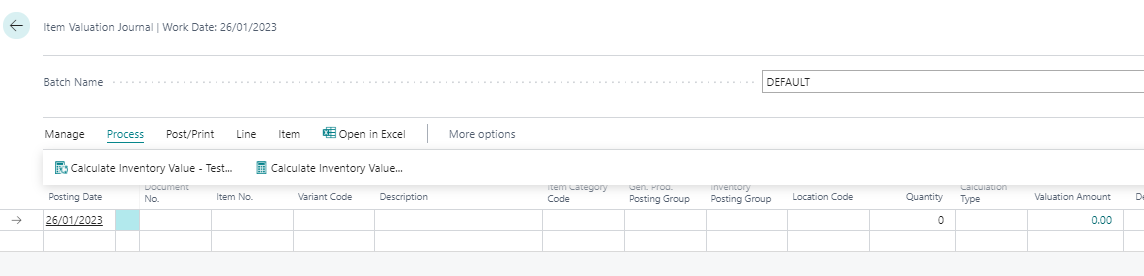

The valuation of the stock values is carried out via the Item valuation journal by means of the function Calculate Inventory Valuation...

|

|---|

| Figure Item Valuation Journal - Calculate Inventory |

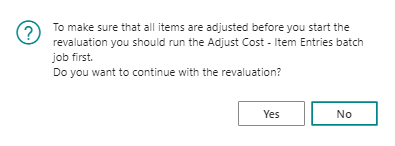

The current warehouse value is calculated on the basis of the existing cost prices. Therefore, before the valuation run, the batch processing Item Entries bath job should be carried out first. The function Calculate Inventory Value ... therefore draws the user's attention to this with the following message:

|

|---|

| Figure Message Adjust Cost - Item Entries |

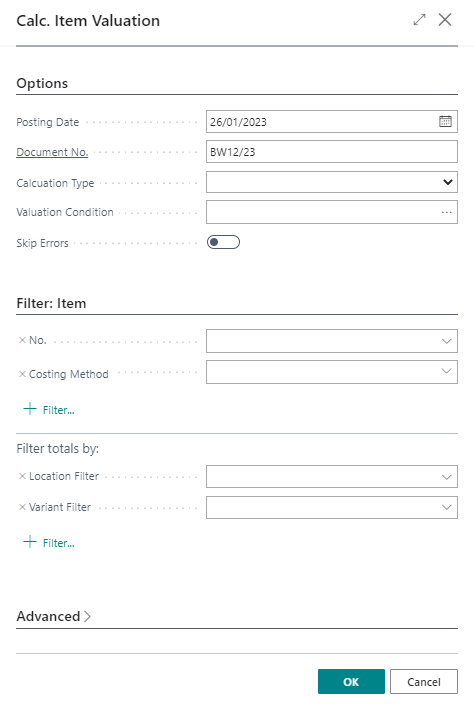

The following settings can be specified in the request window of the function:

|

|---|

| Figure Calculate Item Valuation |

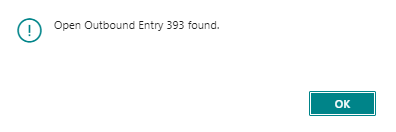

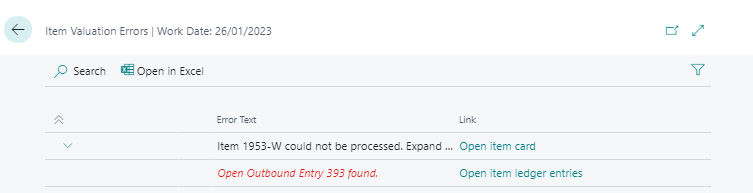

Items with a negative stock level must be filtered out for the valuation run or the check mark must be set for Skip Error, as otherwise they would be revalued. If an item with a negative stock level is not filtered out or the check mark for Skip Error is not set, a message appears - the stock value calculation is aborted. Example message:

|

|---|

| Figure Example Message - Open Outbound Entry |

| Option | Description |

|---|---|

| Posting Date | Select here the date for the postings of this function. It will be preset with the working date and can be changed. |

| Document No. | Enter here the Document number to be used for the entries. |

| Calculation Type | The following options are available: |

| Valuation Conditions | Here you can set a filter on the Valuation Conditions to be applied, if this field remains empty, all Valuation Conditions will be applied. |

| Skip Errors | Activate this field to skip e.g. items with negative stock. At the end of the valuation run, a message is displayed and an error log can be viewed:  |

Item Valuation Journal

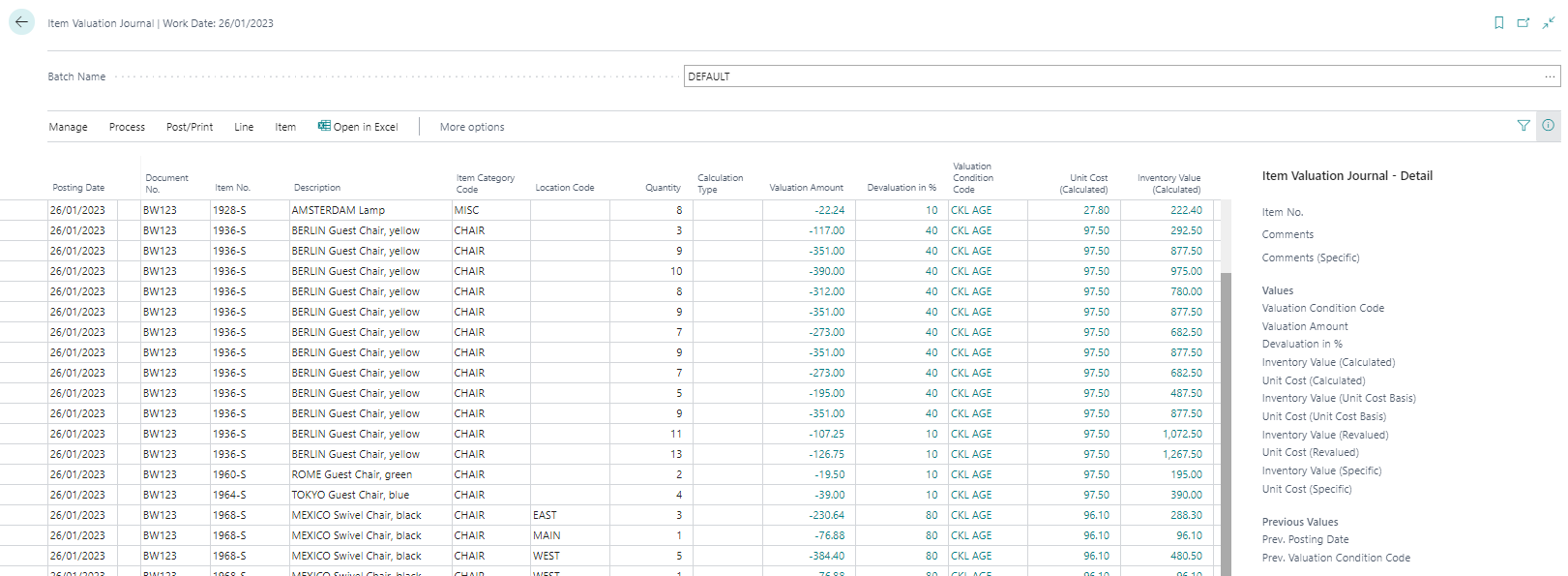

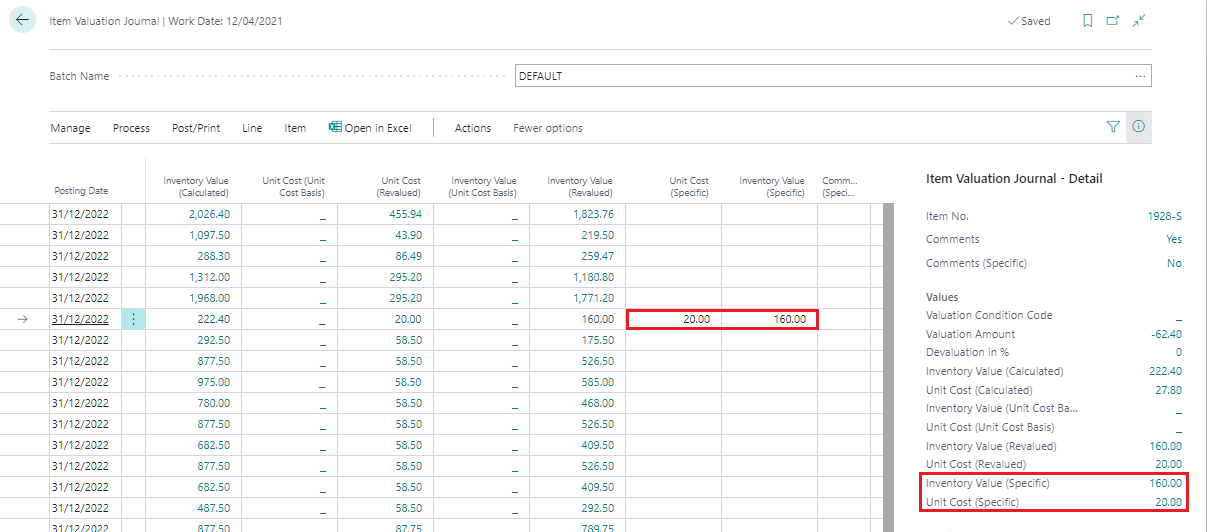

Example of a filled Item Valuation Journal:

|

|---|

| Figure Item Valuation Journal |

For each item entry that was taken into account in the valuation run, a line is set here with the values of the valid valuation condition. In the info field on the right, the values for the currently selected line are displayed in detail. Description of the fields in the journal lines:

| Option | Description |

|---|---|

| Posting Date | With this date, the posting of the valuation amounts takes place. |

| Document No. | The valuation amounts are posted with this document number. |

| Item No. | The Item is displayed here. |

| Variant Code | Variant booked for the item. |

| Description | Posting description, pre-populated with the description of the item. |

| Item Category | Item category of the Item. |

| Gen. Prod. Posting Group | General Product posting group of the item. |

| Inventory Posting Group | Inventory posting group of the item. |

| Location Code | Storage location booked for the item. |

| Quantity | Displays the remaining quantity of the item on the posting date. The composition of this quantity can be tracked via the compensation certificate. |

| Calculation Type | The calculation type with which the valuation run was carried out is displayed here. |

| Valuation amount | The determined amount (difference to the existing cost amount) for the valuation is entered here. |

| Devaluation in % | The applied devaluation percentage is displayed here. |

| Valuation Condition code | The valid valuation condition applied is stored here. |

| Unit Cost (calculated) | This field shows the existing Unit Cost before the valuation. |

| Inventory value (calculated) | This field shows the existing stock value before the valuation. |

| Unit Cost (Unit Cost Basis) | This field shows the underlying cost price from the 1st valuation run in the 2nd valuation run. |

| Unit Cost (Revalued) | This field shows the Unit Cost recalculated using the valid valuation condition. |

| Inventory Value (Unit Cost Basis) | In the 2nd valuation run, this field shows the underlying bearing value from the 1st valuation run. |

| Inventory Value (Revalued) | This field shows the new warehouse value determined on the basis of the valid valuation condition. |

| Unit Cost (specific) | An individually determined Unit Cost can be entered in this field. |

| Inventory Value (specific) | The stock value relevant to the individually set Unit Cost is displayed here. |

| Comment (specific) | This shows whether a remark has been stored for the individually defined cost price. |

| Applies-to Entry | Here the serial number of the item to be valued. |

| Global Dimension | Specifies one of the two global dimension codes defined in the general ledger setup. |

| Shortcut Dimension | Specifies the code of the shortcut dimension. |

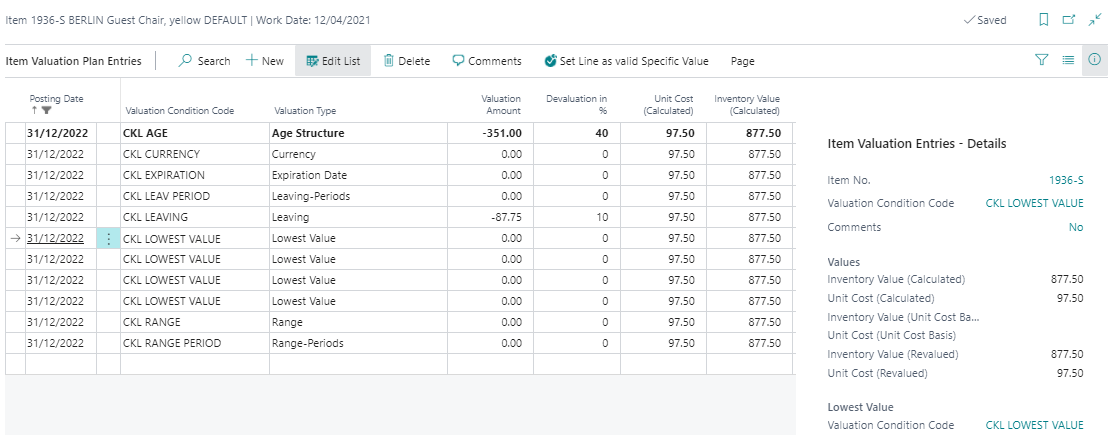

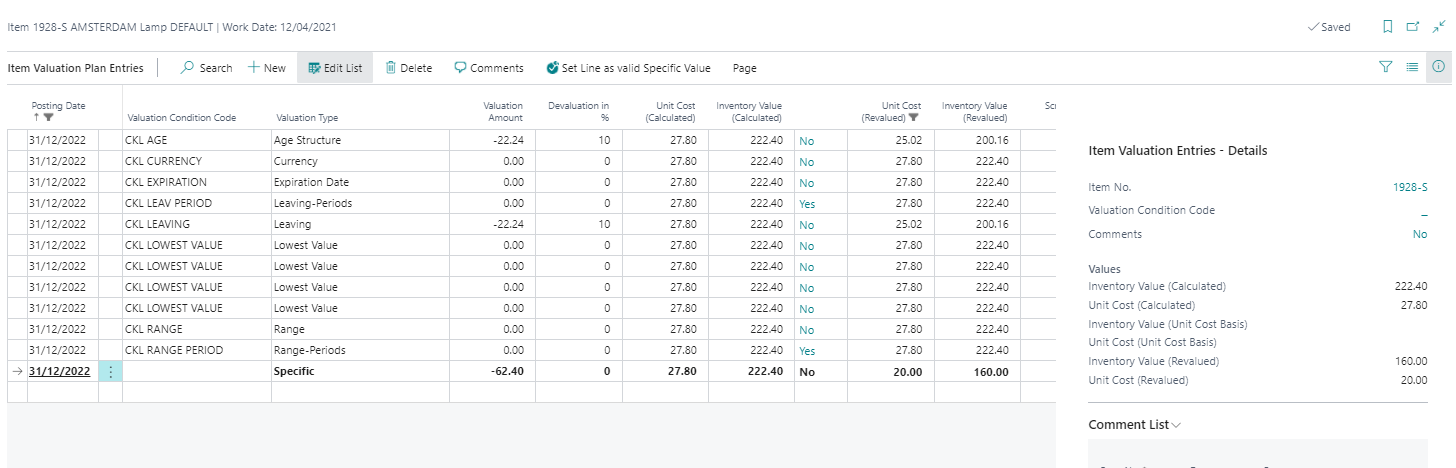

An Item Valuation Plan Entry has been created per journal line and valuation condition. The valid value is marked and highlighted accordingly:

|

|---|

| Figure Item Valuation Plan Entries |

Item Valuation Plan Entries

Description of the fields in the item valuation plan entries:

| Option | Description |

|---|---|

| Posting Date | With this date, the posting of the valuation amounts takes place. |

| Item No. | The Item is displayed here. |

| Description | Booking description, pre-populated with the description of the item. |

| Quantity | Displays the remaining quantity of the item on the posting date. The composition of this quantity can be tracked via the compensation certificate. |

| Unit of Measure Code | Displays the posted unit of the item. |

| Valuation Condition Code | The valid valuation condition applied is stored here. |

| Valuation Type | Displays the rating type selected for the rating condition. |

| Valuation Amount | The determined amount (difference to the existing cost amount) for the valuation is entered here. |

| Devaluation in % | The applied devaluation percentage is displayed here. |

| Unit Cost (calculated) | This field shows the existing cost price before the valuation. |

| Inventory Value (calculated) | This field shows the existing stock value before the valuation. |

| Unit Cost (Unit Cost Basis) | This field shows the underlying Unit Cost from the 1st valuation run in the 2nd valuation run. |

| Inventory Value (Unit Cost Basis) | In the 2nd valuation run, this field shows the underlying bearing value from the 1st valuation run. |

| Unit Cost (Revalued) | This field shows the unit cost recalculated using the valid valuation condition. |

| Inventory Value (Revalued) | This field shows the new warehouse value determined on the basis of the valid valuation condition. |

| Scrap Value (LCY) | The scrap value stored in the valuation condition is indicated here. |

| Valid Value | The item valuation plan entry with the highest devaluation is marked as a valid value and highlighted. |

| Item Ledger Entry No. | Here the serial number of the item to be valued. |

| Entry No. | A sequential number is assigned to uniquely identify the entry. |

A comment can be entered for each item valuation plan entry via the menu ribbon. For example, in the case of a manual individual value adjustment, a comment can be entered to explain why this was carried out for a selected item. During the valuation, all procedures that apply to the respective item are always calculated. If several valuation conditions apply to the item, the condition with the highest devaluation (due to the lowest value principle) is marked as the valid value. This value can later be transferred to the general ledger.

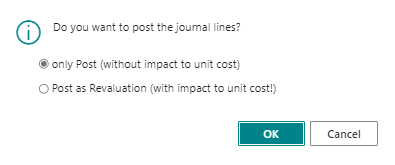

Post Item Valuation Journal

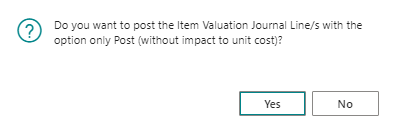

The lines posted via the Post function in the Item Valuation Journal are saved centrally as item valuation entries. This means that even after several periods, the Item valuation register can still be used to trace which quantity was valued for which valuation condition. For reasons of transparency, all Item valuation plan entries are also posted, not only the one with the respective valid value. In this way, it is always possible to see how the various valuation amounts came about. If Choice was selected as the posting type in the Item Valuation Setup, the following query appears first when booking:

|

|---|

| Figure Selection of Posting type |

If another option has been selected, the following message appears directly when posting:

|

|---|

| Figure Message - Post Item Valuation Journal |

After posting, the journal is deleted and a register with entries is created.

Item Valuation Journal

Description of the fields in the Item Valuation Journal:

| Option | Description |

|---|---|

| No. | Indicates the number of the item valuation register. |

| Creation Date | the date on which the entries were posted in the register. |

| Creation Time | Indicates the time when the entries were posted in the register. |

| User ID | Indicates the ID of the user who posted the entries. |

| Source Code | Indicates the source code for the items in the register. |

| Journal Batch Name | Indicates the batch name of the Item Journal from which the items were posted. |

| From Entry No. | Indicates the first item valuation entry number in the register. |

| To Entry No. | Indicates the last item valuation entry number in the register. |

|

|---|

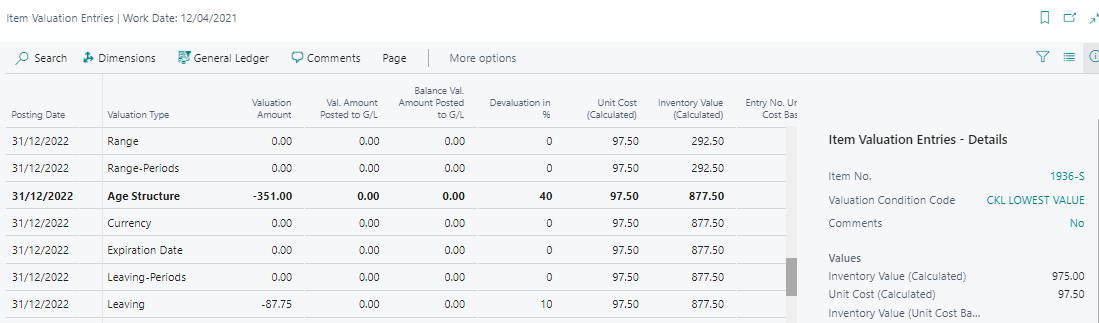

| Figure Item Valuation Entries |

Item Valuation Entries

Description of the fields in the item Valuation Entries:

| Option | Description |

|---|---|

| Posting Date | With this date, the posting of the valuation amounts takes place. |

| Balance Posting Date | This date is set for a subsequent valuation run. It indicates the date on which the offsetting entry of the current valuation run was made by a new valuation. |

| Document No. | The entry was posted with this document number. |

| Item No. | The Item is displayed here. |

| Description | Booking description, pre-populated with the description of the item. |

| Quantity | Displays the remaining quantity of the item entry on the posting date. The composition of this quantity can be tracked via the compensation certificate. |

| Unit of the Measure Code | Displays the posted unit of the item entry. |

| Valuation Condition Code | The valid valuation condition applied is stored here. |

| Valuation Type | Displays the rating type selected for the rating condition. |

| Valuation Amount | The determined amount (difference to the existing cost amount) for the valuation is entered here. |

| Val. Amount Posted to G/L | This field is filled when the valuation amounts are posted to the general ledger. |

| Balance Val. Amount Posted to G/L | This field is filled when new values are posted to the general ledger with the next valuation and the previously existing valuation is counter-posted. |

| Devaluation in % | The applied devaluation percentage is displayed here. |

| Unit Cost (Calculated) | This field shows the existing unit cost before the valuation. |

| Inventory Value (Calculated) | This field shows the existing inventory value before the valuation. |

| Entry No. Unit Cost Basis | Shows the sequential number of the item valuation plan entry created in the first valuation run and on which the calculation is based in the 2nd valuation run. |

| Unit Cost (Unit Cost Basis) | This field shows the underlying cost price from the 1st valuation run in the 2nd valuation run. |

| Inventory Value (Unit Cost Basis) | In the 2nd valuation run, this field shows the underlying bearing value from the 1st valuation run. |

| Unit Cost (Revalued) | This field shows the unit cost recalculated using the valid valuation condition. |

| Inventory Value (Revalued) | This field shows the new inventory value determined on the basis of the valid valuation condition. |

| Scrap Value (LCY) | The scrap value stored in the valuation condition is indicated here. |

| Valid Value | The item valuation plan entry with the highest devaluation is marked as a valid value and highlighted. |

| Item Ledger Entry No. | Here the entry no. of the item entry to be valued. |

| Reversed | If the items have been cancelled (e.g. by a new Valuation on the same date), this is indicated here. |

| Entry No. | Displays the sequential number of the entry. |

Functions for posted Valuation Entries

Functions in the Item Valuation Register:

| Option | Description |

|---|---|

| Reverse Register | With this function all item valuation entries of a register can be cancelled. A new register with cancellation entries is created, all items are marked as cancelled. |

| Set Balance Posting Date | If in the item valuation setup the field Set Balance Posting Date with the option Item or Item&Location&Variant is occupied, a new valuation run will only trigger an offsetting entry for the Items that are now also valued. If the option is set in this way, the Set Balance Posting Date function is needed if an item is no longer valued in a new valuation run because, for example, it no longer has stock. The item is no longer proposed in the item valuation journal and thus the counter booking date is not set. The function can be used to set the date manually and make the offsetting entry in the general ledger. |

Example of the use of the balance posting date:

- As at 31.12.2020, a valuation was posted, items A1 and A2 were taken into account.

- The valuation was posted as at 31.12.2021 and will remain in place until a valuation is made again.

- As of 31.01.2021, a new valuation will be made and item A2 will no longer be valid at that time.

- ➔ Item or Item&Location&Variant option in the item valuation setup: the valuation items of item A2 from 31.12.2020 are automatically posted out. To do this, the Set Balance Posting Date function must be executed manually.

- ➔ Option All Entries: The offsetting entry is always made, regardless of whether the item is still in stock or not.

See also the note in the chapter Post Valuation Amount to G/L.

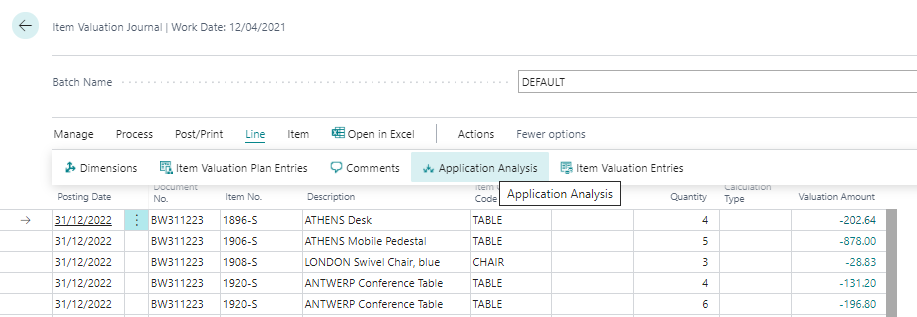

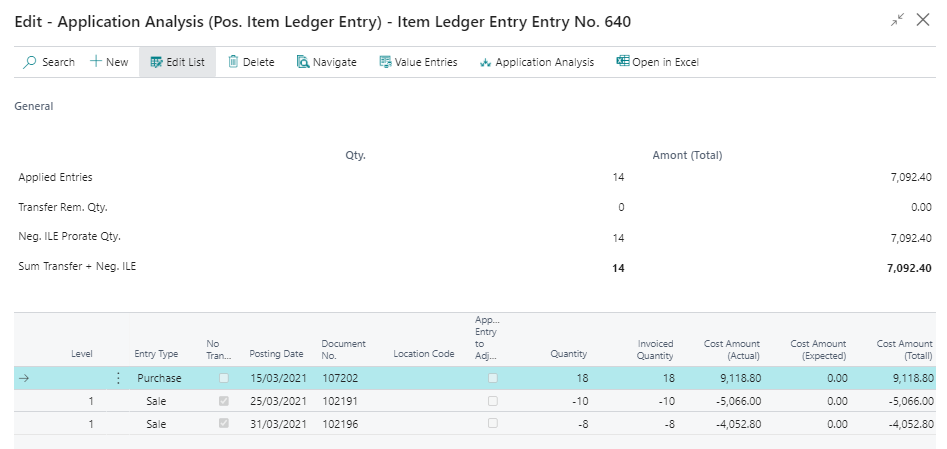

APPLICATION ANALYSIS

With the application analysis, the warehouse stock used as a basis for the warehouse calculation can be traced.

|

|---|

| Figure Item Valuation Journal - Application Analysis |

In the upper part of the window the totals of the cleared entries are shown, in the rows the item entries are listed individually:

|

|---|

| Figure Application Analysis |

INDIVIDUAL VALUE ADJUSTMENT

Each item can be corrected manually in the valuation run via an individual value adjustment. The individual value adjustment is then the valid value recognised in the closing date balance sheet. A individual value adjustment can be made directly in the Item valuation journal via the field Unit Cost (Specific) or Inventory Value (Specific).

|

|---|

| Figure Unit Cost Specific |

Warnung

The individual value adjustment overrides all other conditions. Although the valuation according to the valuation conditions may have calculated a higher devaluation amount, the individual value adjustment is still marked as a valid value.

By entering the new unit cost, a new item valuation plan entry is automatically created in the background and marked as a valid value:

|

|---|

| Figure Item Valuation Plan Entries - Specific |

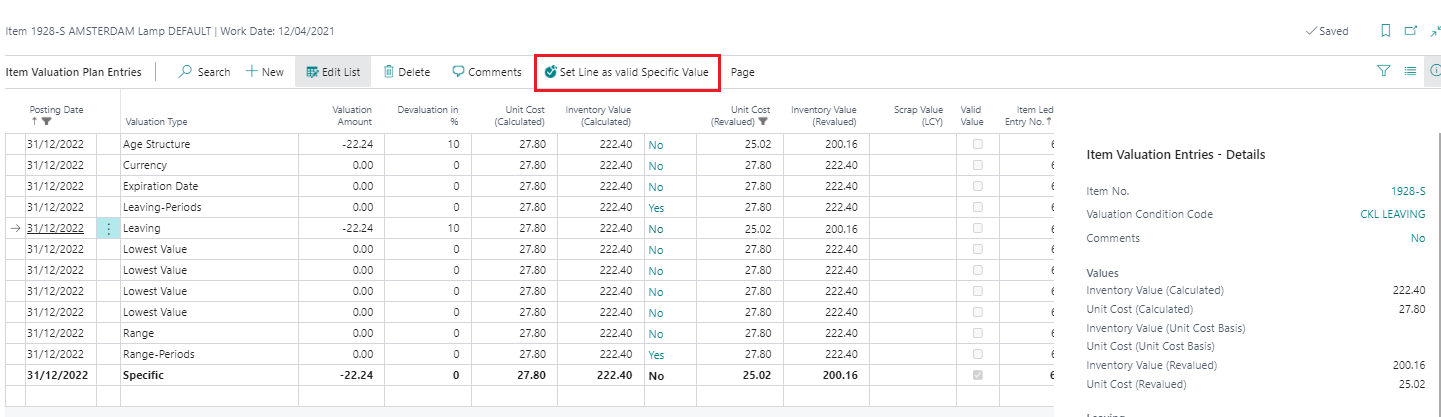

In addition, a valuation amount determined by the valuation run can be set as a valid value using the function Set Line as valid Specific Value. In the following view, the valuation condition CKL RANGE calculated the highest devaluation amount and was therefore set as a valid value.

|

|---|

| Figure 1 - Set Line as valid Specific Value |

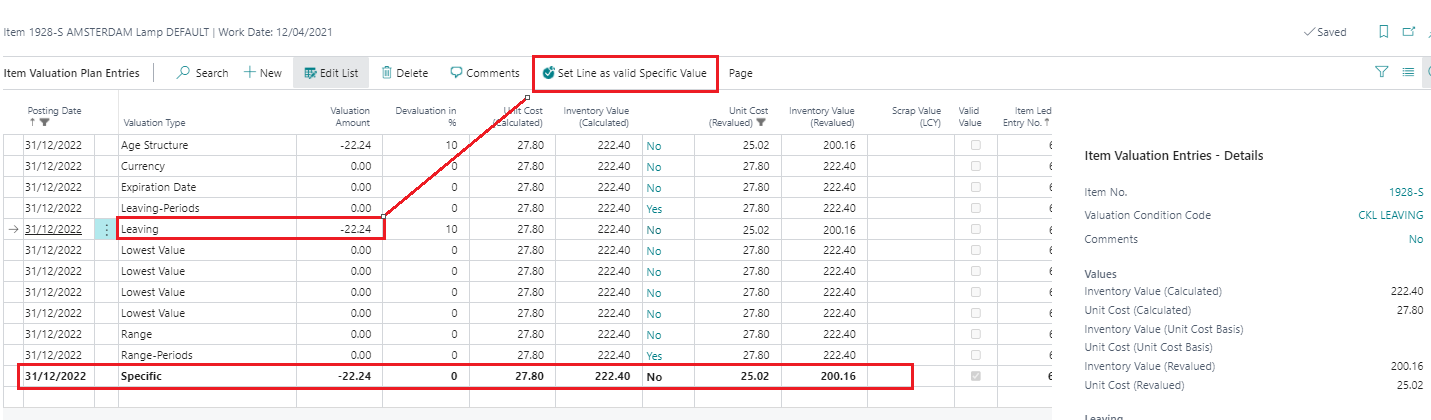

If, however, the valuation condition CKL LEAVING is to be set as a valid value, the row must be marked, and the function Set Line as valid Specific Value must be activated.

|

|---|

| Figure 2 - Set Line as valid Specific Value |

After the function has been carried out, another line is created with the valuation type specific and the corresponding valuation amount. It is marked as a valid value.

POST VALUATION AMOUNT TO GENERAL LEDGER

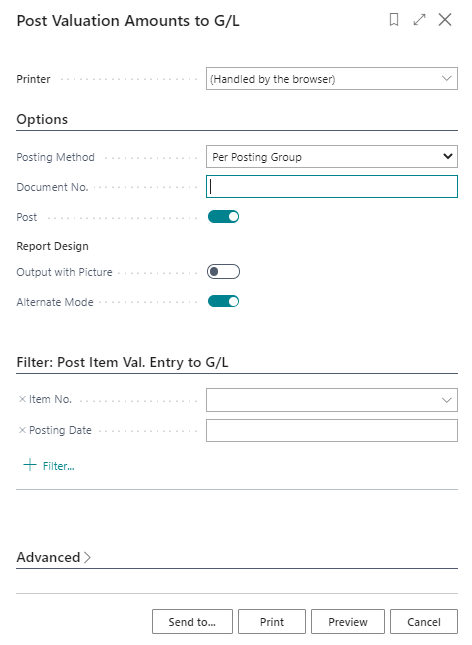

If the valuation has been posted without affecting the unit cost, the values can then be transferred to G/L using the Post Valuation Amounts to G/L function. If the automatic inventory posting is activated in the Item Valuation Setup, this posting has already taken place with the posting of the Item valuation Journal. When posting the valuation with impact to unit cost, value entries were also created for the item entries in addition to the item valuation entries. The posting to the G/L is then made using the standard functionality Post Inventory to G/L. The call is made in the Valuation 365 menu via Post Valuation Amount to G/L. The following options can be set in the batch processing request window:

|

|---|

| Figure Post Valuation Amount |

| Option | Description |

|---|---|

| Posting Method | The following options are available: Per Posting Group or Per Entry. Either totals per posting group combination (inventory posting group) are made on the G/L accounts or individual postings. |

| Document no. | This document number is used for posting to G/L if you post per posting group. The document number does not have to be entered when posting per entry. |

| Post | This switch must be activated to make an entry in the G/L. Otherwise a preview of the entries is shown. |

| Output with picture | Indicates whether the image set up for the client within the company data (e.g. company logo) should be output on the report. |

| Alternating representation | Specifies whether every second line in the report should be alternated/shaded. |

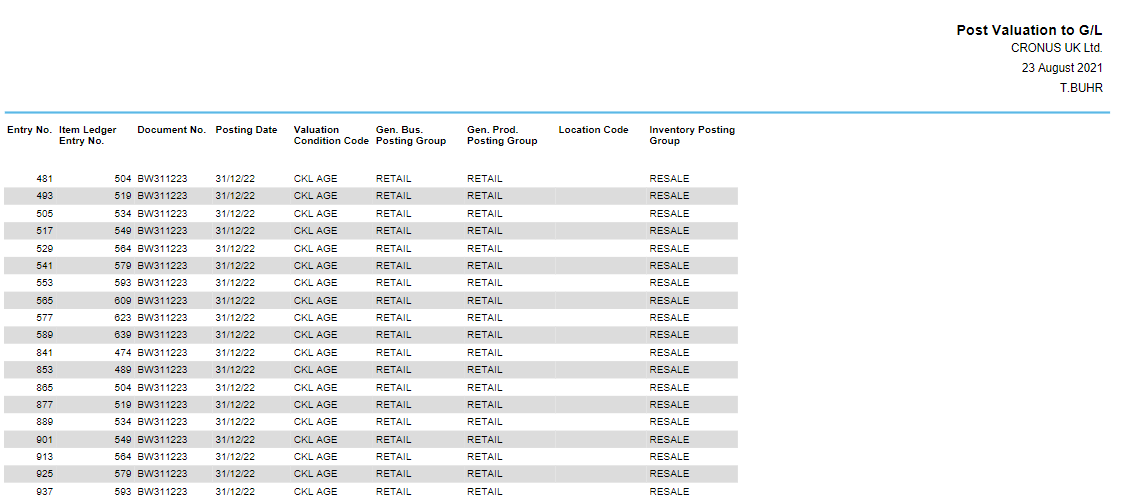

In addition, filters can be set on the item valuation entries to be considered. The following figure shows an example of the posting report:

|

|---|

| Figure Report - Post Valuation |

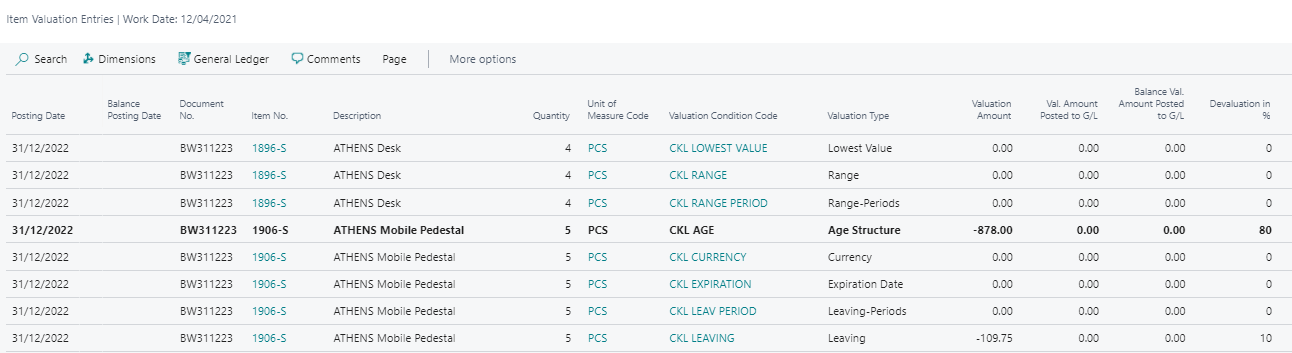

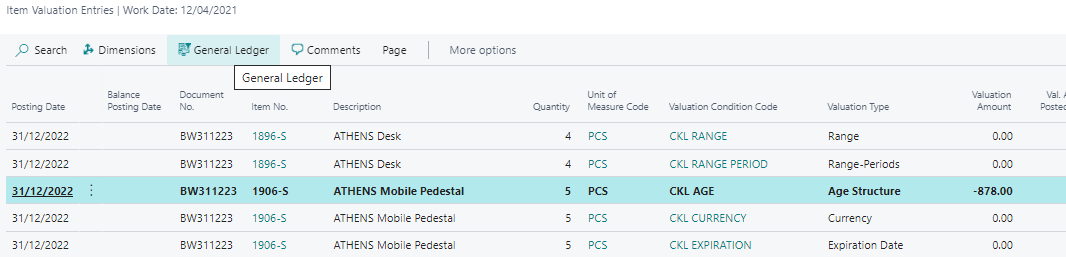

The posted G/L entries have a direct link to the item valuation entries. This makes it possible to later reconstruct how the respective valuation amounts were composed and which valuation conditions were applied. In the item valuation entries, you can branch to the general ledger entries via the General Ledger button.

|

|---|

| Figure Item Valuation Entries - General Ledger |

|

|---|

| Figure Item Valuation Entries - GL Entries |

Information

With the posting of the valuation amounts to the G/l, the balance posting of a previous valuation already posted is also made - provided it is a posting without impact to unit cost. See also the example in chapter Functions for Posted Valuation Items.

Tip

With the function Post Val. Amounts to G/L - Test you can check whether all necessary facilities are available before posting. If, for example, a necessary combination is missing in the Val. General Posting Setup, a corresponding error message is issued here.

|

|---|

| Personal support available at www.ckl-software.de/en/ |