Valuation Conditions

GENERAL INFORMATION ON THE VALUATION CONDITIONS

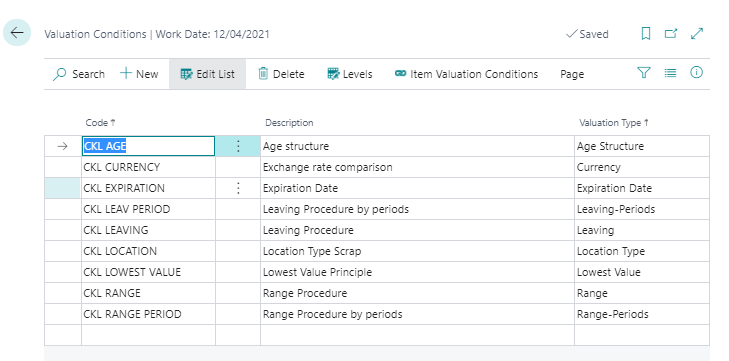

The Valuation 365 module is completely based on the item movements in Microsoft Dynamics 365 Business Central®. Each movement is interpreted according to the assigned valuation conditions and proposed for valuation. The lowest value from all valid Valuation Conditions is always marked as valid. The user can manually change or adjust the value or set another valid value via an individual value adjustment. Overview of the Valuation Conditions proposed by the setup wizard:

|

|---|

| Figure Valuation Conditions |

An example has been created here for each possible Valuation type.

| Option | Description |

|---|---|

| Code | Enter a unique code for the Valuation condition here |

| Description | Here you can enter a descriptive text for the valuation condition. |

| Valuation Type | The Valuation type determines the criteria according to which the devaluation is to take place: Range, Leaving, Expiration Date, Age structure, Location type, Currency, Lowest value, Range periods or Leaving periods. Depending on the Valuation type, further parameters must be defined in the Valuation condition levels. |

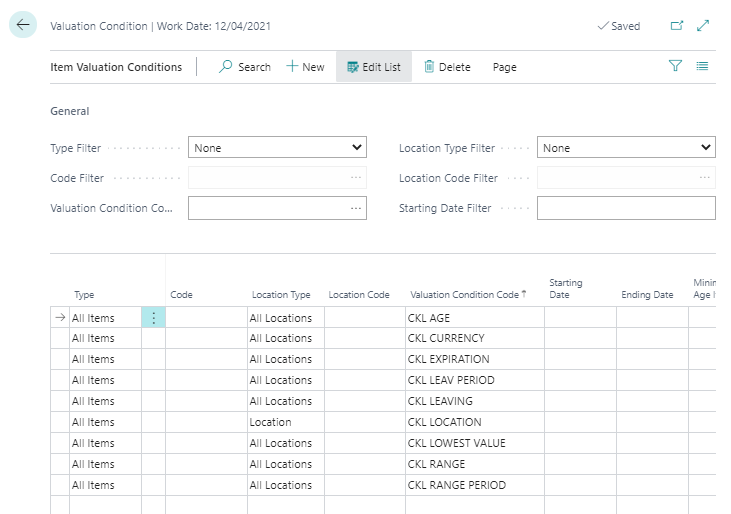

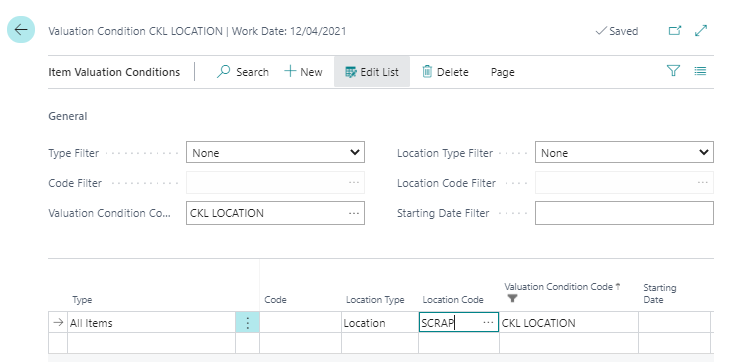

The valuation with the help of Valuation 365 is carried out in compliance with the lowest value principle. The devaluation Conditions are defined by certain criteria and can be stored in the Valuation Condition -> Levels list. These criteria are described in more detail in the following sections for each valuation type. The assignment of the Valuation condition to the corresponding Items (i.e. which Valuation condition may apply to a certain Item) can be done via List Valuation condition Item Valuation Conditions. Alternatively, this window can also be called up via the Item overview. The following page shows an example setup:

|

|---|

| Figure Item Valuation Conditions |

The item Valuation Conditions define which item, storage location, start date, etc. is taken into account for a valuation condition. The Valuation Conditions can be applied to any combination of item characteristics.

Example:

- The valuation condition location type only applies to items that are in the location SCRAP.

- The valuation condition leaving only applies to Items with the gen. product posting group FREIGHT.

In the General tab, various filters can be set so that only the applicable Item Valuation Conditions are displayed. The conditions are defined in the lines.

| Option | Description |

|---|---|

| Type | Here you can determine which Items are to be taken into account for the valuation. For example, it can be entered that only items with the inventory posting group RESALE are to be taken into account for a corresponding valuation condition. Options are: Item, Item tracking, Item category, Gen. Product posting group, Inventory posting group or All Items. |

| Code | Depending on the type, it can be defined here in more detail for which codes (e.g. Item numbers or categories) the valuation condition should apply. |

| Location Type | In the location type, you can enter which location should be taken. A location can be entered directly, or specific locations can be entered via the location filter. Options are: Location, Location filter or All Locations. |

| Location Code | Depending on the location type, it can be defined here in more detail for which locations the valuation condition should apply. |

| Valuation Condition Code | Indicates the valuation condition to be taken. |

| Starting Date | Indicates from which date the valuation condition is applied. |

| Ending Date | Indicates the date from which the valuation condition is no longer applied. |

| Minimum Age Item | The condition is only applied if the corresponding item has been in stock for a certain time (e.g. at least 2 years - 2J). |

| Ignore low-Levels | If this field is activated, only this Valuation condition is taken. All others are ignored. |

FILTER OPTIONS IN THE VALUATION CONDITION LEVELS

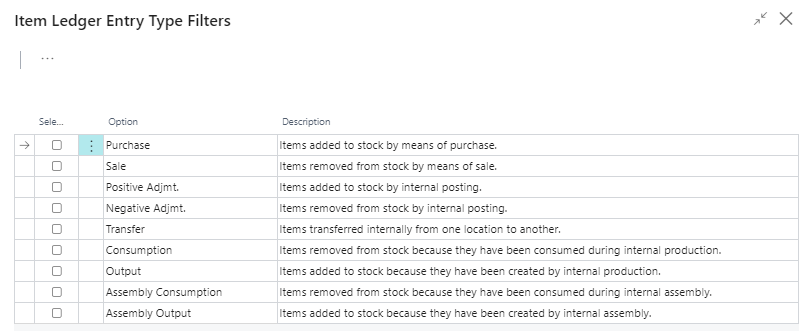

In the Valuation Conditions levels, filters can be set on the type and posting type of the item ledger entries. This makes it possible to further limit the item entries to be taken into account in the calculation of the valuation. To facilitate the selection of these options, a selection list can be opened in the corresponding fields. The necessary options can then be selected here by ticking them. Overview of the filter options for the item entry types:

|

|---|

| Figure Item Ledger Entry Type Filters |

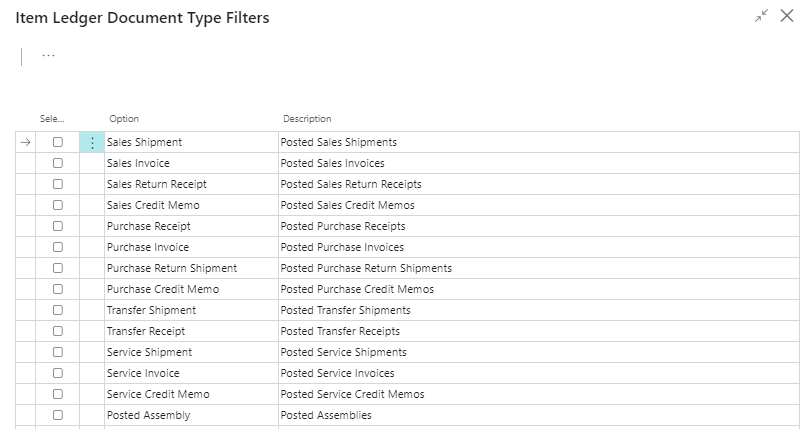

Overview of the filter options for the document types:

|

|---|

| Figure Item Ledger Document Type Filters |

The application of the filters is explained in more detail per Valuation condition in the following sections.

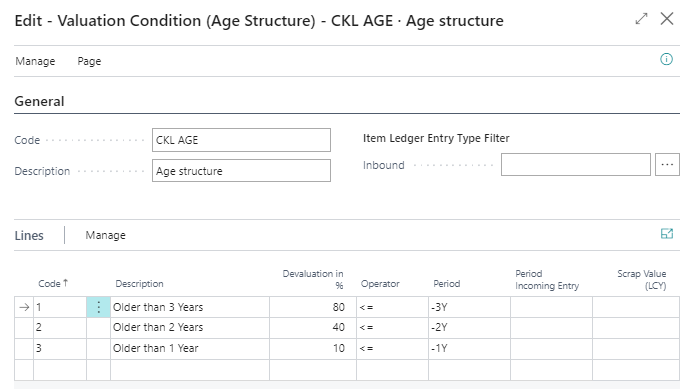

AGE STRUCTURE

Using a variable Condition regarding age structures, items that have been in stock for a very long time can be individually devalued. For example, serial number items with a location period of over 3 years are devalued by 80 % and slow-moving items with a storage period of over 2 years by 40 %.

|

|---|

| Figure Valuation Condition Age Structure |

The posting date of the first posting item is relevant for the valuation. Within the valuation Condition it can be defined for the period Incoming entry whether the condition is only applied if, for example, no item entry of the type receipt (the entry type can be determined with the Item Ledger Entry Type Filter Inbound) has been posted in the last 6 months. When evaluating according to age structure, the order of the rows created must be observed. The system works from the top line to the bottom. For example, it first checks whether there are location items that are 3 years old or older (first line). Then the next line is processed, which checks whether there are location items that are 2 years old or older, and so on.

The fields for the Valuation Condition must be filled in as follows:

General

| Option | Description |

|---|---|

| Item Ledger Entry Type Filter Inbound | Here you can set a filter on the item type. This is used for all incoming item entries, only item entries with this type are taken into account in the calculation. The filter is used in conjunction with the field Period Incoming Entry. Example: The valuation condition should only be applied if there are no Item ledger entries of the type Positive Adjmt. (Item entries type filter inbound) in the last 6 months (period Incoming entry = -6M). If an item is already 5 years old, it is devalued by 80%. With this filter, however, it can now be determined that this only happens if no receipt has been posted within the last 6 months. This way the movement of the item can be taken into account - the item has old stock but is still moved recently. |

Lines

| Option | Description |

|---|---|

| Code | Enter here a unique code for the corresponding level of the Valuation condition. |

| Description | Enter here a meaningful description for the corresponding level of the Valuation condition. |

| Devaluation in % | Here you define by how many percent of the original value should be devalued. If you enter a positive value, the current value is decreased. If you enter a negative value, it will be increased. |

| Operator | Select a logical operator that determines whether the stock valuation takes place before (<), after (>) or within the period defined by the date formula. |

| Period | Enter a date formula that defines a period before, after or in which - depending on the operator - the stock valuation should take place. |

| Period Incoming Entries | If a date formula is stored here, item entries are only included in the calculation after this period. If there are incoming item entries in this period, this level of the Valuation Conditions is not applied. |

| Scrap value (LCY) | Enter the lowest valuation amount to which an existing stock value should be lowered. Calculated new values are raised to this lower limit if they are below the scrap value. If you do not enter a scrap value, the calculated new values will not be affected. |

Example:

- Item entries (1) of the kind = purchase from 02.05.2019

- Item entries (2) of the type = purchase from 05.03.2020

- Item entries (3) of the type = purchase from 01.05.2021

- There will be a valuation run as of 30.06.2021

- Item entries (1) is older than 2 years and is devalued by 40%.

- Item entries (2) is older than 1 year and is devalued by 10%.

- Item entries (3) is younger than 1 year and is not devalued

Reminder

If the value -6M is set in the field Period Incoming entries in each valuation line, then in this example no devaluation is determined for any of the items, as the last incoming item was posted in the past 6 months.

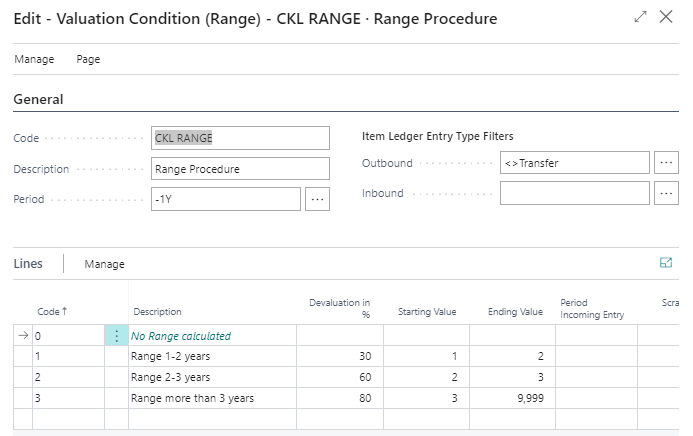

RANGE

In this Valuation, a key figure is determined and used as a basis on the basis of individually defined limits, which results from the division of the stock and the outflows within a reference period. In the case of valuation by range of coverage, it must first be determined how long the stock will presumably last for future requirements. Different methods can be used to determine the range. Therefore, two Valuation Conditions are available in Valuation 365 with which the calculation of the range can be carried out:

- With the valuation condition range, the range of coverage is determined on the basis of the stock on hand on the key date divided by the absolute demand of the period.

- With the valuation condition range periods, the range of coverage is calculated according to the average stock of the periods divided by the average demand per period.

Both Valuation Conditions are considered in more detail below.

Tip

If no range of coverage can be determined by the valuation condition Range or Range periods (for example, due to non-existent departure of items), an exception must be defined within the valuation condition level. An exception can only be defined within the valuation condition levels with code 0, i.e. in the line with code = 0 you can define which valuation factor is used if no range of coverage could be determined. If no range could be calculated and the level with code = 0 does not exist, the condition is ignored.

Valuation Condition Range

The determination of the range using the following formula:

Range in period = stock on the reporting date / absolute need of the period

|

|---|

| Figure Valuation Condition Range |

The system calculates the range based on the following parameters:

General

| Option | Description |

|---|---|

| Period | e.g. -1Y. The system totals the disposals in the last year (this is the number of negative entries). |

| Item Ledger Entry Type Filter Outbound | Here, for example, it can be filtered that no stock transfers are to be taken into account for the range calculation. In the case of the range of coverage, a warehouse stock on the key date and disposals within a certain period are calculated. This filter can be used to determine which type of outflows are to be taken into account. |

| Item Ledger Entry Type Filter Inbound | A filter can be set here on the incoming item entries. Only items with this filter are then taken into account in the calculation. |

Lines

| Option | Description |

|---|---|

| Code | Enter here a unique code for the corresponding level of the Valuation condition. |

| Description | Enter here a meaningful description for the corresponding level of the Valuation condition. |

| Devaluation in % | Here you define by how many percent of the original value should be devalued. If you enter a positive value, the current value is decreased. If you enter a negative value, it will be increased. |

| Starting value / ending value | These two fields determine, in relation to the length of the period in the header, for which period the item entries are to be taken into account. |

| Period Incoming entries | If a date formula is stored here, item entries are only included in the calculation after this period. If there are incoming item entries in this period, this level of the Valuation Conditions is not applied. |

| Scrap value (LCY) | Enter the lowest valuation amount to which an existing stock value should be lowered. Calculated new values are raised to this lower limit if they are below the scrap value. If you do not enter a scrap value, the calculated new values will not be affected. |

Example:

- Stock on the reporting date: 200 pieces (positive remaining quantities of the item entries)

- Quantity of negative posting entries: 40 disposals in the defined period

- Range: 200/40 = 5 years

- The range is greater than three years. A devaluation of 80% would thus take place.

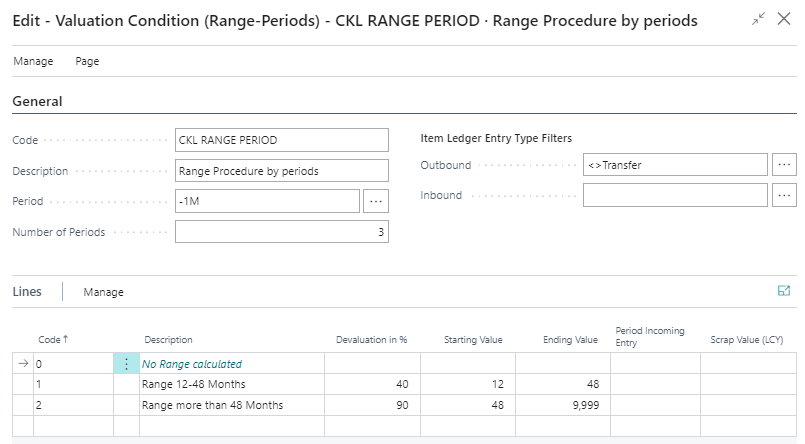

Valuation Condition Range-Periods

The range by period is determined according to the following formula:

Range in period = average stock of the period / average need of the period

|

|---|

| Figure Valuation Condition Range-Periods |

General

| Option | Description |

|---|---|

| Period | A date formula can be entered here for the calculation of the average stock and outgoings, e.g. -1M (consideration of stocks monthly). |

| Number of Periods | e.g., 3. The system calculates the average stock and outgoing based on the last 3 periods. Average stock level: From the valuation date backwards, the 3 stock levels are calculated according to the date formula and the stock level before the 3rd period. These stock levels are then added up and divided by 4. Outgoings: The system adds up the outgoings of the last 3 months and divides them by the number of periods. |

| Item Ledger Entry Type Filter Outbound | Here, for example, it can be filtered out that no stock transfers are to be taken into account for the range calculation. |

| Item Ledger Entry Type Filter Inbound | Here you can set a filter on the incoming item entries. Only item entries with this filter are then taken into in the calculation. |

Example:

- Average stock of the periods: 600 pieces (average calculated from the individual periods).

- Average quantity of negative posting entries: 40 disposals per period on average

- Range: 600/40 = 15 months

- The range is greater than 12 months. A devaluation of 40% would thus take place.

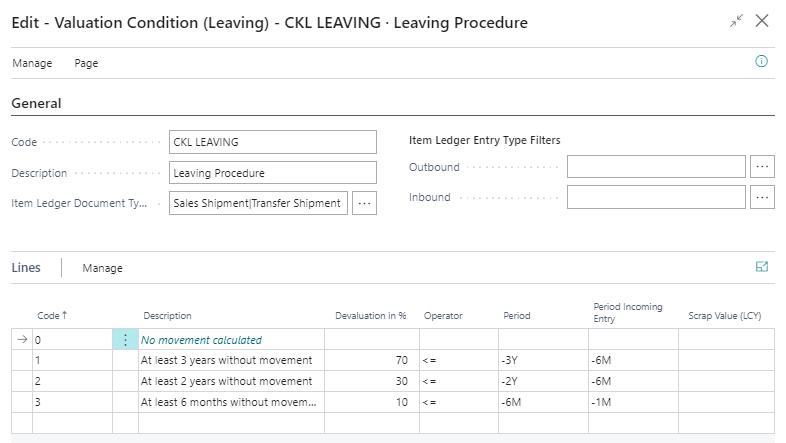

LEAVING

The leaving procedure defines whether an item had a outgoing from sales, assembly or production consumption within a certain period. If the item falls into one of these categories, the item can be devalued over freely definable limits of the entries. There are two ways to -determine the movement within a period in Valuation 365. Both methods are explained in more detail below.

Tip

If no movement could be determined by the valuation condition Leaving or Leaving Period (for example, due to non-existent outgoings), an exception can be defined within the valuation condition level. The valuation factor for this exception can only be defined with code 0 within the valuation condition levels. If no movement could be calculated and the level with code = 0 does not exist, the level with the largest difference is used (e.g., the valuation factor of the level with 4 years without movement is used and not the valuation factor of the level with 2 years without movement).

Information

If there are only receipts for the item so far and no outgoings has been posted, no devaluation takes place according to this valuation type!

Valuation Condition Leaving

In the case of valuation after leaving, the date of the last negative item entry without stock transfer is determined. The devaluation is carried out on the basis of this date.

|

|---|

| Figure Valuation Condition Leaving |

The following fields are relevant for this Valuation condition:

General

| Option | Description |

|---|---|

| Item Document Type Filter | All item ledger entries of the type stock transfer with a negative quantity are determined when calculating the most recent departure. This filter can also be used to determine which stock transfers (e.g. only sales delivery) are to be taken into account. |

| Item Ledger Entry Type Filter Outbound | Here, for example, it is possible to filter which type of item ledger entry (except stock transfers) with a negative quantity are to be taken into account when determining the most recent departure. |

| Item Ledger Entry Type Filter Inbound | Here you can set a filter on the item ledger entry type. The filter is used in conjunction with the field Period Incoming Entry. For example, you can define that the valuation condition is only applied if there are no item entries of the type receipt in the last 6 months. |

Information

The filters for item ledger document type and item ledger entry type (outbound) are not applied together when determining the outgoing entries. Rather, it is determined whether Outgoing entries with type = transfer and the corresponding document types or there are outgoing entries with the corresponding item type. If either of these applies, the relevant valuation condition level comes into play.

Lines

| Option | Description |

|---|---|

| Code | Enter here a unique code for the corresponding level of the Valuation condition. |

| Description | Enter here a meaningful description for the corresponding level of the Valuation condition. |

| Devaluation in % | Here you define by how many percent of the original value should be devalued. If you enter a positive value, the current value is decreased. If you enter a negative value, it will be increased. |

| Operator | Select a logical operator that determines whether the stock valuation takes place before (<), after (>) or within the period defined by the date formula. |

| Period | Enter a date formula that defines a period before, after or in which - depending on the operator - the stock valuation should take place. |

| Period Incoming items | Here you can specify whether the condition is only applied if, for example, no receipt has been posted in the last 6 months. In the example: With regard to the Item ledger entries type filter Incoming (e.g. Purchase |

| Scrap value (MW) | Enter the lowest valuation amount to which an existing stock value should be lowered. Calculated new values are raised to this lower limit if they are below the scrap value. If you do not enter a scrap value, the calculated new values will not be affected. |

Example 1:

- Item entries of the type = purchase from 01.03.18 - 30 pieces

- Valuation as at 30.06.21

- As there are no outgoings up to this point, there is no valuation of the item.

Example 2:

- Item entries of the type = purchase from 01.03.2018 - 30 pieces

- Item entries of the type = sale from 10.05.2018 - 10 pieces

- Valuation as at 30.06.21

- The item entry is devalued by 70% as there have been no additions in the last 6 months and the last disposal was more than 3 years ago.

Example 3:

- Item entries of the type = purchase from 01.03.2018 - 30 pieces

- Item entries of the type = sale from 10.05.2018 - 10 pieces

- Item entries of the type = sale from 10.02.2019 - 1 piece

- Valuation as at 30.06.21

- The item entry is devalued by 30% because there have been no additions in the last 6 months and the last disposal was more than 2 years ago.

Example 4:

- Item entries of the type = purchase from 01.03.2018 - 30 pieces

- Item entries of the type = sale from 10.05.2018 - 10 pieces

- Item entries of type = stock transfer with document type stock transfer issue / receipt of 15.03.2021 - 5 pieces

- Valuation as at 30.06.21

- There is no devaluation of the item because a stock transfer has taken place in the last 6 months.

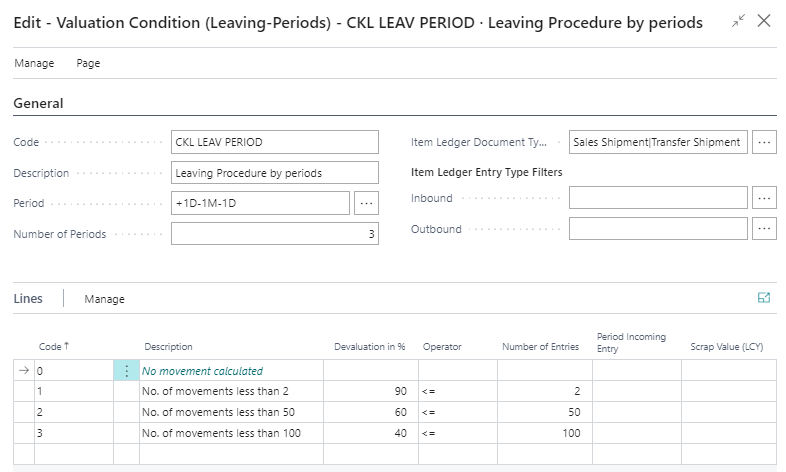

Valuation Condition Leaving-Periods

With the valuation by disposal period, the negative item entries within a defined period are added up. I.e. the amount of the valuation can be determined based on the movements that occurred in a period. example, if in one of the last 3 months (defined in the fields Period and Number of periods) less than 50 items of a certain Item have been disposed of, a devaluation of 60% is to be applied. In contrast to the valuation condition for disposals, it is not the time of the last outgoing but the frequency within a period that is used for the calculation.

|

|---|

| Figure Valuation Condition Leaving-Periods |

General

| Option | Description |

|---|---|

| Period | This date formula indicates the calculation from the valuation date. |

| Number of Periods | Here it is determined in how many time periods the outgoings are to be searched for. |

| Item Ledger Document Type Filter | A filter can be set here to determine which Item ledger entries are to be taken into account. In the example, all item entries are filtered according to the document type sales shipment |

| Item Ledger Entry Type Filter Outbound | This field can be used to filter which outgoing items are to be taken into account. |

| Item Ledger Entry Type Filter Inbound | Here you can set a filter on the item type. The filter is used in conjunction with the field Period Incoming Entry. For example, you can define that the valuation condition is only applied if there are no item entries of the type Receipt in the last 6 months. |

Lines

| Option | Description |

|---|---|

| Code | Enter here a unique code for the corresponding level of the valuation condition. |

| Description | Enter here a meaningful description for the corresponding level of the valuation condition. |

| Devaluation in % | Here you define by how many percent of the original value should be devalued. If you enter a positive value, the current value is decreased. If you enter a negative value, it will be increased. |

| Operator | Select a logical operator that determines whether the stock valuation takes place before (<), after (>) or within the period defined by the date formula. |

| Number of items | This value, together with the operator, determines which movement may have taken place within the valuation period. |

| Period Incoming entry | Here you can define whether the condition is only applied if, for example, no receipt has been posted in the last 6 months. With regard to the Item entry type filter Inbound (e.g. purchase |

| Scrap value (LCY) | Enter the lowest valuation amount to which an existing stock value should be lowered. Calculated new values are raised to this lower limit if they are below the scrap value. If you do not enter a scrap value, the calculated new values will not be affected. |

Example:

- Item entries of the type = purchase from 01.03.2018 - 30 pieces

- Item entries of the type = sale from 10.06.2021 - 10 pieces

- Item of the type = Sale from 12.06.2021 - 1 piece

- Item entries of type = stock transfer with document type transfer shipment/ receipt of 15.06.2021 - 5 pieces

- Valuation as at 30.06.21

- Devaluation of the item entry by 60%, because in the defined period (= last 3 months / period & number of periods) there are 3 negative movements (item entries).

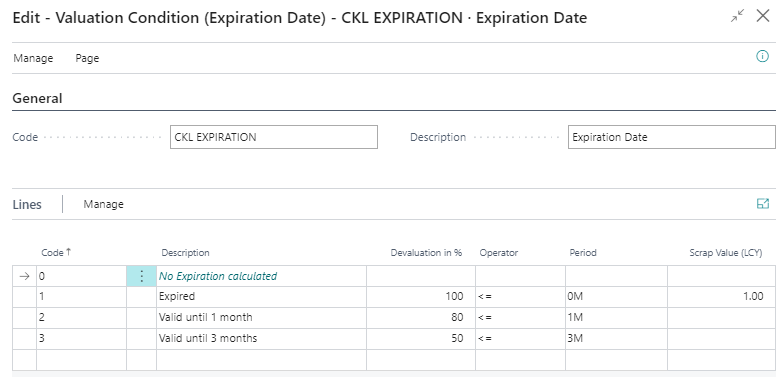

EXPIRATION DATE

For items with item tracking based on batch numbers, a devaluation can be made based on the expiry date of the batch. The expiry date is stored on the item entries and is calculated based on the specifications in the item tracking code or on the item card.

|

|---|

| Figure Valuation Condition Expiration Date |

Lines

| Option | Description |

|---|---|

| Code | Enter here a unique code for the corresponding level of the valuation condition. |

| Description | Enter here a meaningful description for the corresponding level of the valuation condition. |

| Devaluation in % | Here you define by how many percent of the original value should be devalued. If you enter a positive value, the current value is decreased. If you enter a negative value, it will be increased. |

| Operator | Select a logical operator that determines whether the stock valuation takes place before (<), after (>) or within the period defined by the date formula. |

| Period | Here you specify the period for which the item entries are to be taken into account. |

| Scrap value (CLY) | Enter the lowest valuation amount to which an existing stock value should be lowered. Calculated new values are raised to this lower limit if they are below the scrap value. If you do not enter a scrap value, the calculated new values will not be affected. |

In the case of valuation by expiration-date, the valuation amounts are determined on the basis of the item expiry date.

Example:

- Valuation date: 31.12.2023

- Item expiry date: 02.02.2024

- Result: Item has a shelf life of 1 month, devaluation by 80%.

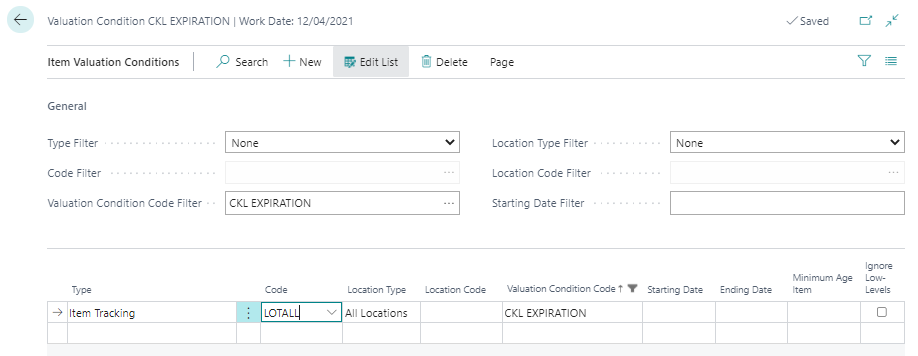

In a separate item valuation condition, it is possible to define which batches that are approaching or have already exceeded an expiry date are to be devalued on the basis of the Item tracking codes. For example, a complete devaluation takes place for medical products that have exceeded an expiry date.

|

|---|

| Figure Item Valuation Conditions - Expiration Date |

In the item valuation conditions, the field Ignore lower levels can be activated. If this field is activated, only the rating by expiry date is taken into account in the item tracking type. All others are ignored.

Tip

If no expiry date could be determined by the expiration-date valuation condition, an exception can be defined within the valuation condition level. A valuation condition level with code 0 can be used to define which valuation factor is used if there is no expiry date for the item. If no expiry date could be calculated and the level with code = 0 was not defined, the condition is ignored.

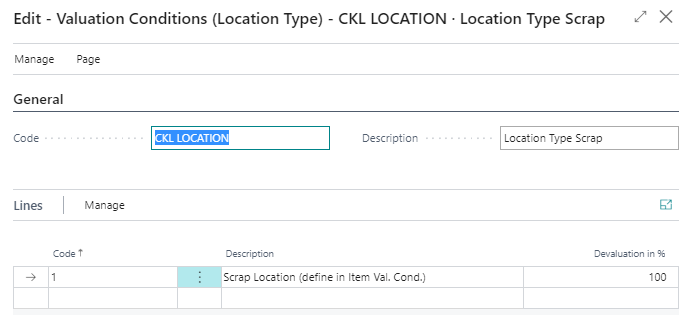

LOCATION TYPE

For example, if items are in a scrap or repair location, they can be individually devalued based on physical location via a factor. For example, item stocks in a scrap warehouse can be devalued to zero euros. For this valuation condition, only one level can be stored with a corresponding valuation factor.

|

|---|

| Figure Valuation Conditions Location Type |

In the Item Valuation Conditions, it is then determined for which storage location, for example, this valuation condition is to be used.

|

|---|

| Figure Item Valuation Conditions - Location Type |

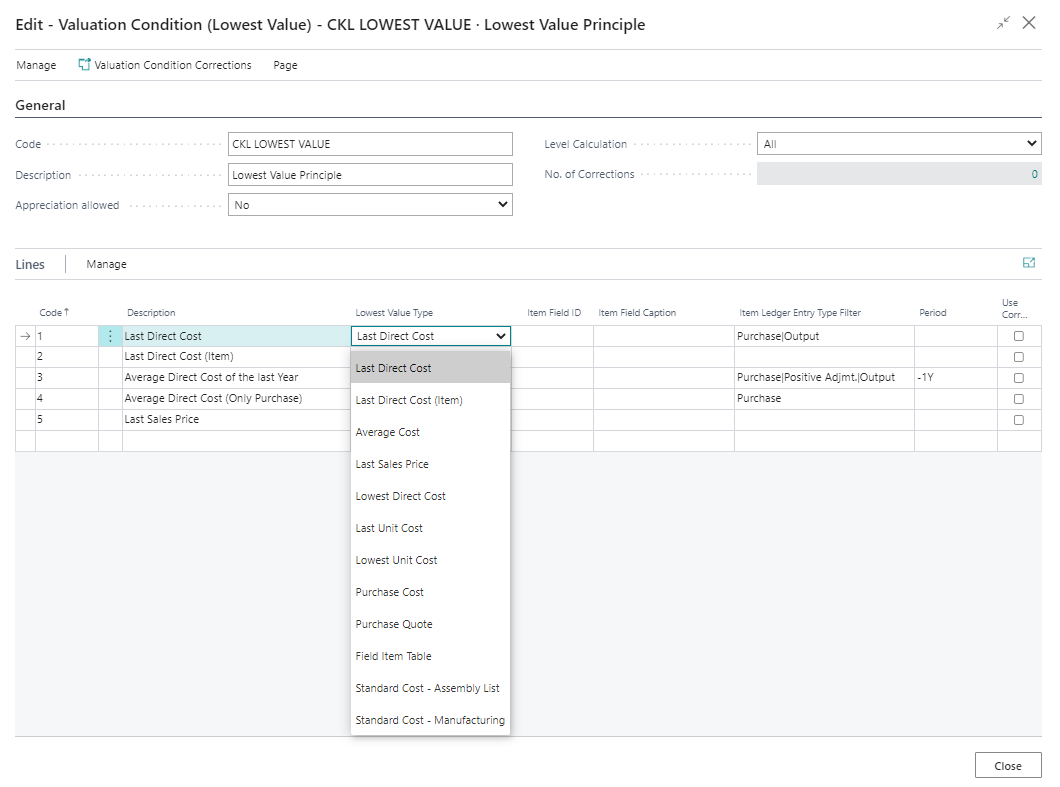

LOWEST VALUE

With the lowest value principle, different prices are compared per item (or storage location) and the lowest one is suggested for valuation (e.g. the average cost price with the last purchase price). Based on the lowest value - type, a certain item price is determined. The following different types are available:

|

|---|

| Figure Valuation Condition - Lowest Value Principle |

| Option | Description |

|---|---|

| Last Direct Cost | The calculation is based on the last purchase price from the Item entries, taking into account the Item entries type filter. |

| Last Direct Cost (Item) | Purchase prise comes from the item card (field Last Direct Cost). |

| Average Cost | The system calculates the average unit cost based on the value entries, taking into account the filter and period. |

| Last Sales Price | invoiced item entry of the type sale |

| Lowest Direct Cost | The system calculates the lowest cost price in the value entries (item type: direct costs cost amount (actual)/invoiced quantity) taking into account the filters and period. |

| Last Unit Cost | The system calculates the latest/most recent cost price (entry type: direct costs |

| Lowest Unit Cost | The system calculates the lowest cost price in the value entries (entry type: direct costs |

| Purchase Cost | If an item has not been purchased for a long time, it can also be valued according to the purchase prices and discounts stored for the item instead of the unit cost. The determination is done via the tables purchase prices and purchase discounts, here the lowest price is used. |

| Purchase Quote | The price stored in the purchase requests is used. All existing requests for the item are determined and the lowest price (line amount / quantity) for the item is used. |

| Field Item Table | Any value field from the item card can be used as the basis for the Valuation. This can be determined via the item field ID. |

| Standard Cost – Assembly List | The valuation is carried out on the basis of the bill of materials. The "Standard Cost is determined as the value for the item via the sales bill of materials or assembly bills of materials. |

| Standard Cost - Manufacturing | The valuation is carried out on the basis of the production bill of materials. The "Standard Cost" is determined as the value for the item via the production bill of materials and routings. |

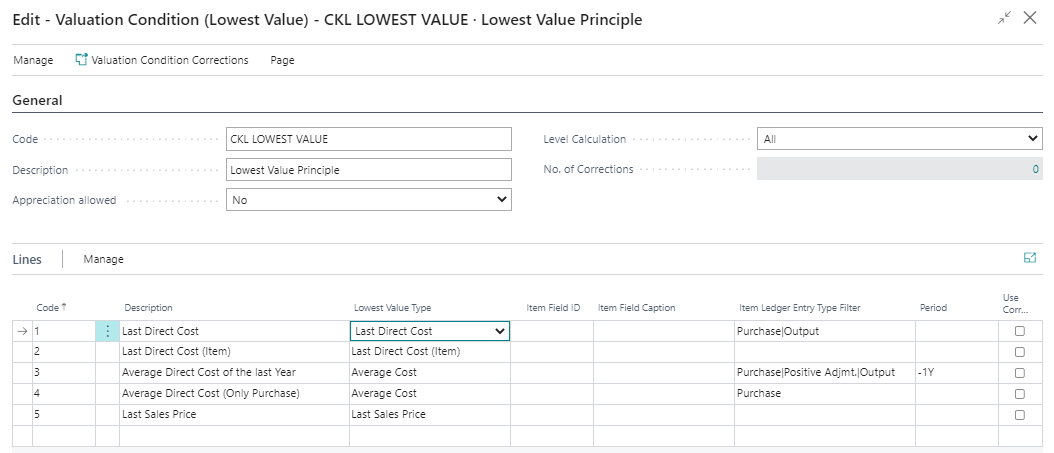

Example of a valuation condition according to lowest value with the corresponding levels:

|

|---|

| Figure Valuation Condition - Lowest Value Principle |

The following additional settings can be made within the valuation condition:

General

| Option | Description |

|---|---|

| Appreciation allowed | This allows you to differentiate between appreciation only for 0-values or a general appreciation when revaluing to a new cost price. If the option No is selected, the item entries are not appreciated by the valuation condition Lowest value. If an item is to be appreciate, the user can choose between 0-Value and Always. With the 0-Value option, only items with a calculated stock value of 0 euros are revalued. With the Always option, item entries with a calculated stock value of >0 are also revalued. |

| Level Calculation | For the determination of unit cost values according to different item types, a step-by-step calculation can be activated in addition to the parallel calculation of all steps. This means that the system first checks the first line when determining the unit cost values. If a value could be determined here or a value could be used for the comparison, the further lines are not considered. If no value can be determined, the next line is checked and so on. |

Lines

| Option | Description |

|---|---|

| Item Ledger Entry Type Filter | Here, for example, it can be filtered that only Item entries of the type actual report are to be taken into account for the determination of the average cost price. |

| Period | e.g. -1Y. starting from the valuation date, the system takes into account the last year for determining the average cost price. |

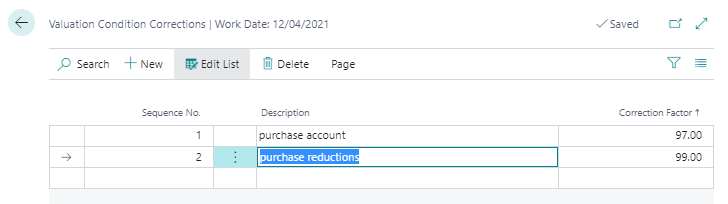

| Use Corrections | If payment reductions such as cash discounts, rebates, refunds, etc. are granted in purchasing, these are not initially included in the cost prices of the Items. However, these can be entered as valuation condition corrections for the valuation condition lowest value:  The call is made in the Valuation Condition - Levels via the menu ribbon. If Use Corrections is set for a level, the corrections are multiplied additively for the unit cost (revalued) after determining the lowest value price. This is then noted in the remarks as a calculation method. The call is made in the Valuation Condition - Levels via the menu ribbon. If Use Corrections is set for a level, the corrections are multiplied additively for the unit cost (revalued) after determining the lowest value price. This is then noted in the remarks as a calculation method. |

Example:

- Item entries of the type = purchase on 01.05.2021 with unit cost 100

- Item entries of the type = purchase on 10.05.2021 with unit cost 200

- Item of the type = purchase on 20.06.2021 with unit cost 60

- Latest unit cost on the item card is 90

- Valuation as at 30.06.2021

- For level 1, 60 is determined as the valuation price.

- For level 2, 90 is determined as the valuation price.

- For level 3 and 4, the valuation price is 360/3 = 120.

- No price is determined for level 5.

- A rating of 60 is given, as this is the lowest value.

CURRENCY (LOWEST VALUE FOREIGN CURRENCY)

This method is suitable for stock transactions made in foreign currency. The valuation is based on the exchange rate originally used at the time of booking or the exchange rate currently maintained in the currency table. The exchange rate with the lower value is used for valuation.

Information

With this condition, no levels can be deposited. The reason for this is that the current currency rate from the currency table is used and tapped. A revaluation or appreciation is carried out on the basis of the currency table.

Example:

- Item entries of the type = purchase with a value of 100$= 80€

- Exchange rate as at 30.06.2021: 1$=0.7€

- Valuation as at 30.06.2021

- Result: The item is devalued by 10€.

|

|---|

| Personal support available at www.ckl-software.de/en/ |