Basics

GENERAL

Version

This manual describes the contents of Valuation 365 for Microsoft Dynamics 365 Business Central.

Structure of the Online help

This online help describes the functions of the areas:

- Basics

- Valuation Conditions

- Valuation Process

- Analysis

- Development

The online help contains the description of the individual fields as well as a process description for their use. For further information on the fields, please contact your Microsoft Dynamics partner or contact info@ckl-software.de.

VALUATION 365

Valuation 365 is a special ISV solution based on Microsoft Dynamics 365 Business Central®. This is a special function extension of the ERP standard solution from the manufacturer Microsoft. This enables you to prepare and value current assets correctly and reliably within the framework of your annual financial statements or reporting date analysis in accordance with special valuation specifications and your own valuation conditions. Valuation 365 supports Microsoft Dynamics 365 Business Central® users who, for example, have a high number of items, a large number of item groups, high value items, high stock values or items with expiry dates when valuing current assets. The Valuation 365 module is completely based on the item movements in Microsoft Dynamics 365 Business Central®. Each stock is interpreted according to the assigned valuation condition and a devaluation amount is suggested for the posting. The lowest value is always marked as val-id as a result of all active and used valuation conditions. The user can change or adjust the value manually via an individual value adjustment. The following concrete advantages result for the user from the use of Valuation 365:

- Valuation of assets as at the balance sheet date.

- Further support of this valuation topic compared to the Microsoft Dynamics 365 Business Central® standard (revaluation functionality insufficient).

- All valuation operations can be carried out without impact to unit cost. The original cost price remains unchanged and ensures that the original production costs are retained.

- Integrated valuation functionality in Microsoft Dynamics 365 Business Central®.

- No time-consuming determination of the valuation values in Excel or other external calculation tools necessary.

- In Valuation 365, different periods (per week, month, quarter or year) can be stored for the valuation of the assets.

- Posting proposals can be created, which can then be posted to separate accounts via a separate account assignment matrix.

- The valuation amounts are automatically reversed in subsequent periods at the next valuation.

- Derivation (conditions and principles) and traceability of the Valuation results directly in Microsoft Dynamics 365 Business Central®.

- For a data migration, a separate table can be used in which the historical acquisition/access date is stored. Thus, the data is enriched by external information.

- The most recent Valuations can be displayed in the Item.

- Items with the same voucher number and posting date can be searched for using a function. This allows the underlying posting items and documents to be displayed. This ensures traceability within Microsoft Dynamics 365 Business Central® at all times.

- Mapping of the "strict lowest value principle" and the associated conditions.

- Acceptance towards third parties (auditors, tax auditors) increases.

- The conditions and valuation amounts used for the valuation are directly evident and can be derived in an integrated manner....

- The report for determining the current warehouse value is automatically expanded to include the valuations.

- Simulations, result previews and individual analyses of a planned or completed Valuation.

- What-if" analyses increase transparency and control effect as well as the effectiveness on the company result (balance sheet & P&L).

- The values determined by simulation can be posted to own accounting accounts to be defined via a new function.

- Freely definable Valuation simulations can be created.

- High time saving

- Valuation with just a few clicks and through a lean Valuation process

- No need for a third-party application, e.g. Excel

- Fast processing of the Valuation and elimination of errors

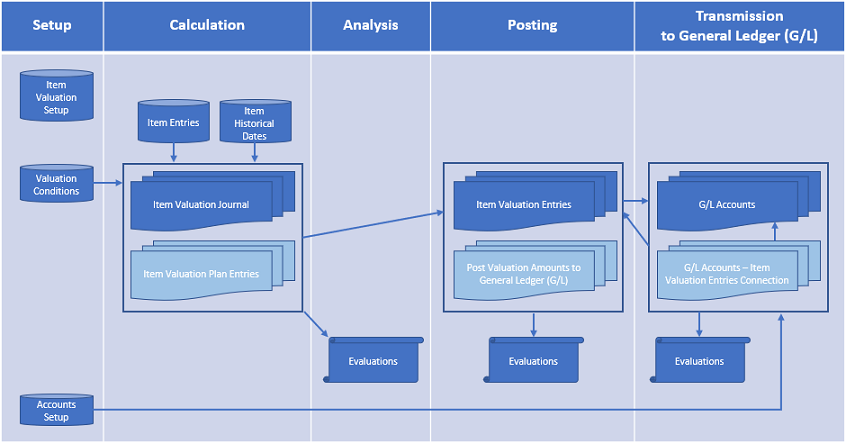

STRUCTURE AND FUNCTION SEQUENCE IN VALUATION 365

The basic structure of the module Valuation 365 with the necessary tables and functionalities is described here. Exemplary structure for "Post Without Impact to Unit Cost ":

|

|---|

| Figure Post without impact to Unit Cost |

The structure of Valuation 365 can be visualised, as can be seen in the figure. For a better description, the following phases have been marked in the figure:

- Institution

- Calculation

- Analysis

- Booking

- Transfer to finance.

Setup phase

In order to use the functions of the module, some facilities are required. Detailed information on this is described in further chapters Basics and Valuation Condition.

Calculation phase

After the necessary set-up data has been created, the actual activity in Valuation 365 begins with the calculation of the inventory in the Item Valuation Journal. The basis for a valuation are the item entries. All open and invoiced items (item ledger entries that have a remaining quantity) are valued on the basis of the cost price according to the Valuation Conditions applicable to the item. For each line, so-called Item Valuation Plan Entries are generated in the background. These Item valuation plan entries represent the Valuation Conditions that apply to the item and show the current stock value and the valuation for the item. If several Valuation Conditions apply to the Item ledger entries, the condition for which the Item ledger entries experiences the highest devaluation (due to the lowest value principle) is marked as the valid value. However, if necessary, the valid value can also be changed manually in the Item Valuation Plan Entries in the form of a valid single value. The valid value can later be transferred to the general ledger. The Item Historical Data tables form a further basis for the calculation. There, for example, the date of Item receipt (date of origin) can be stored. This is relevant, for example, in the case of a data transfer, as the original date of the Item receipt (e.g., 02.05.2017) is overwritten with the date of the transfer (e.g., 31.12.21). Without the Item Historical Data table, for example, the transfer date would be used for a valuation according to age structure and not the correct date of origin of the Item. As a result, the Item would be rated better than permissible due to the newer date.

First analysis phase

The valuations can be analysed with the help of various reports even before the valuation amounts are posted. For example, individual Valuations can be created with item valuation - analysis reports. Valuations can be made according to different groupings or a result preview/simulation of the Item valuation plan entries can be made.

Posting phase

In the next step, the newly calculated and analysed warehouse values are posted. There are two possibilities here. Either the valuation amounts are posted without influence on the cost price or with influence on the cost price. An entry affecting the cost price corresponds to a revaluation of the valued item ledger entries. This type of entry generates value items. The revaluation takes place according to the procedure in the revaluation journal and results in the revalued stock values with impact to unit cost.

Warning

In the next Valuation run, this would not result in a Valuation on the original value, but on the already devalued values.

Information

Items with costing method average cannot be posted as revaluation (with impact to unit cost) via the Item Valuation Journal. Items with costing method average should always be valued as a whole on item level and not individually on item ledger entry level. In Valuation 365, each individual item ledger entry is valued with a positive remaining quantity. Therefore, the standard Item Revaluation Journal must be used for items with the costing method average.

Which type of booking is to be carried out can be defined in the item valuation setup. The lines posted via the Item valuation journal are saved centrally as Item valuation entries. This means that even after several periods, the Item valuation register can still be used to trace which quantity was valued when and for which condition. The Item valuation plan entries of the non-valid values are also posted as Item valuation entries for reasons of transparency. In this way, it can be traced how the various valuation amounts came about. The individual item valuation entries can be viewed more closely via the item valuation register. It is also possible to check whether the valid item valuation entries have already been transferred to the financial accounting and whether the offsetting entry has already been made in the subsequent period.

Transfer to general ledger

In the final phase, the valuations are posted to the general ledger. The accounts to which the valuation amounts are posted as revaluation (with impact to unit cost) in the case of a booking are determined via the general posting setup or inventory posting setup, as in Microsoft Dynamics 365 Business Central® Standard. The accounts to which the valuation amounts are posted when a posting is made without impact to unit cost are defined in the valuation general posting setup and valuation inventory posting Setup.

Information

When posting without impact to unit cost, the offsetting entry of the valuation amounts is made automatically at the next valuation posting. The posting of the valuation amounts takes place, for example, on 31.12.23. The reversal (offsetting entry) of these posted valuation amounts then takes place on the next valuation run (for example, 31.12.24). The valuations are posted in the general ledger on the valuation date and are reversed with the next valuation run. The standard (posting with impact to unit cost), on the other hand, does not dissolve the valuation amounts after the valuation date and actually changes the cost price. This leads to a distorted result if, for example, an item is to be valued for which only the original value may be used for the valuation.

Provided that the item valuation entries have been transferred to the general ledger and because of this G/L entries have been created, a link between the two entries is created in the G/L entries - item valuation entries. In this way, it is later possible to trace which G/L entries result from which item valuation entries and vice versa.

BASICS

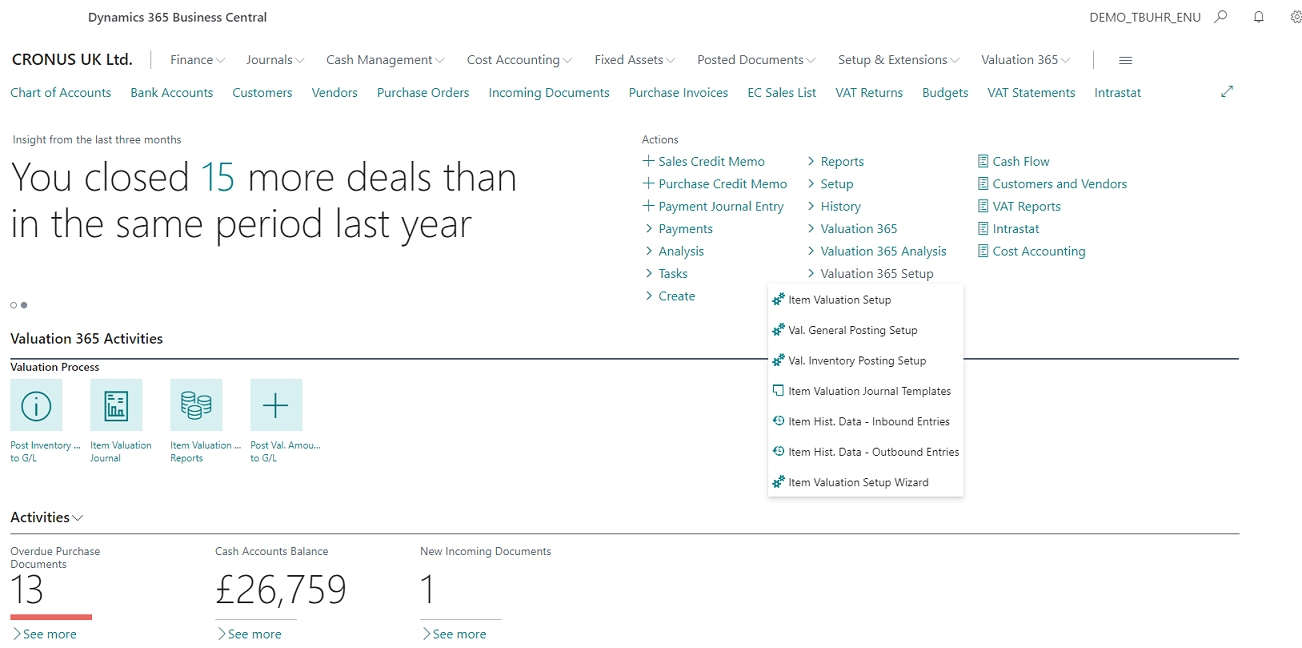

Role Centre

The module is integrated into the role centre Accountant of Microsoft Dynamics 365 Business Central® and can be accessed from there. In addition, there are branching options in the Item overview and Item card.

|

|---|

| Figure Accountant - Access Valuation 365 |

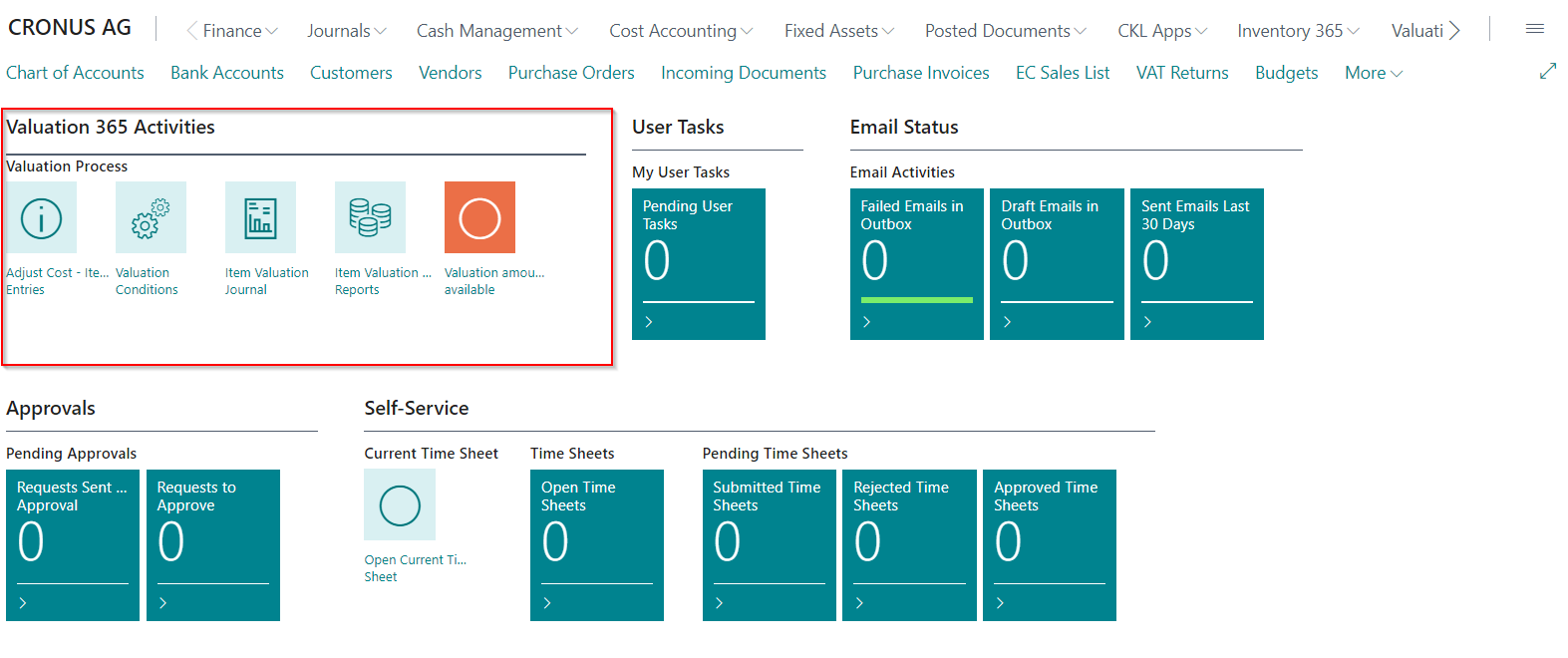

Valuation 365 Activities

The Accountant role center has also been extended to include the Valuation 365 Activities. This shows the basic process for performing a valuation.

|

|---|

| Abb. Accountant - Valuation 365 Activities |

The valuation process is shown as follows:

- Adjust Cost - Item Entries. You should run the Adjust Cost - Item Entries batch job, before you can revalue items..

- Valuation Conditions. View or edit information about valuation conditions.

- Item Valuation Journal. Open the item valuation journal to calculate inventory value for posting.

- Item Valuation Analysis Reports. Open the item valuation analysis reports to view valuation data from different angles.

- Visual indication if item valuation entries have not been transferred to general ledger.

- Red = There are valuation amounts available for transfer to general ledger.

- Green = There are no valuation amounts available for transfer to general ledger.

Valuation 365 Setup

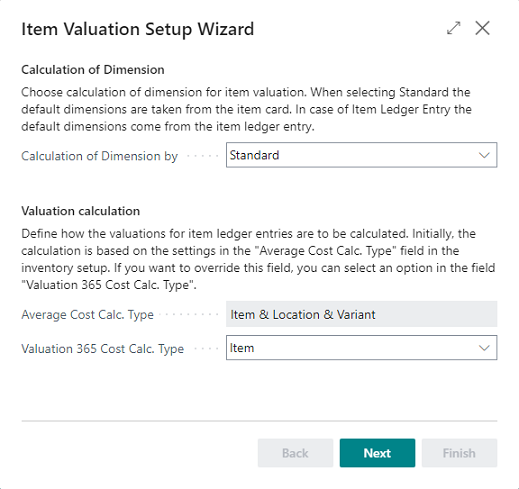

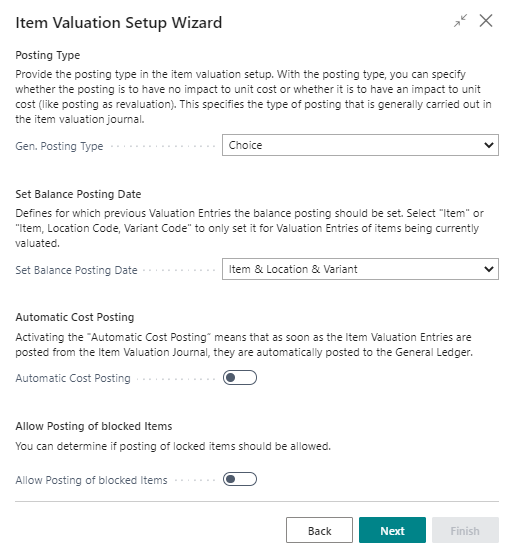

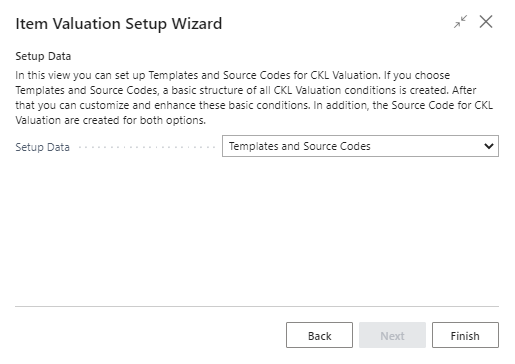

With the Item Valuation Setup Wizard function, basic setup parameters for the module can be created and stored in the system. In doing so, the furnishing fields of the Item Valuation Setup described in more detail and can be defined step by step. In addition, Source codes can be generated and stored for posting the Item valuation journals and the valuation regulation. In addition, a basic framework of all Valuation Conditions can be created, which can then be used as a basis for the Valuation. The conditions can be individually changed and extended.

|

|---|

| Figure Item Valuation Setup Wizard - Step 1 |

|

|---|

| Figure Item Valuation Setup Wizard - Step 2 |

|

|---|

| Figure Item Valuation Setup Wizard - Step 3 |

The fields of the Item Valuation Setup are described in more detail in the following section. This data is generated by the wizard:

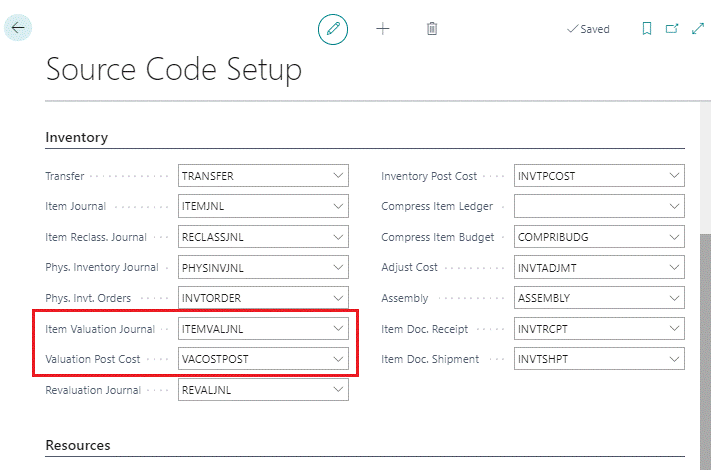

Within the source code setup, the field Item valuation journal is filled with the code ITEMVALJNL and the valuation Post Cost is filled with the code VACOSTPOST. From the Item valuation registers it’s for example possible, to recognised from which journal the register was created.

|

|---|

| Figure Source Code Setup |

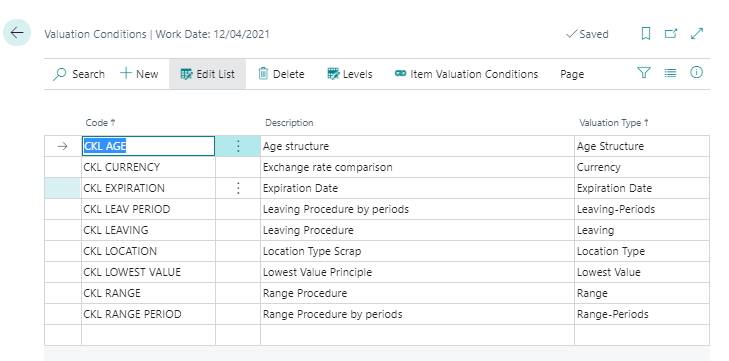

Valuation Conditions are created for all Valuation types:

|

|---|

| Figure Valuation Conditions |

Data Classification

Due to the General Data Protection Regulation, Microsoft has integrated the property "Data Classification" for each field in the database. This property has been set for all CKL fields so that it is always possible to determine which personal values are available in the database.

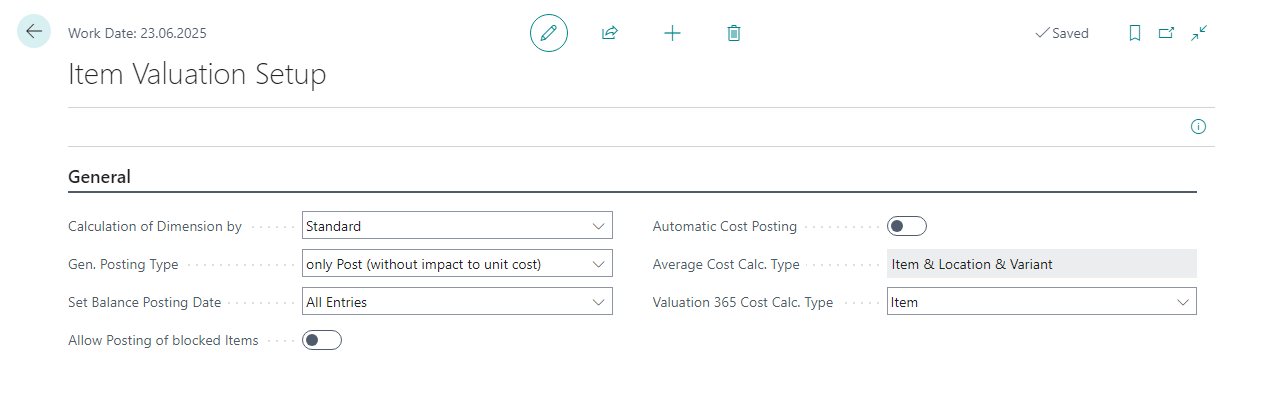

Item Valuation Setup

A central Setup in Valuation 365 is the Item Valuation Setup window. Basic settings for the use of the module are defined here.

|

|---|

| Figure Item Valuation Setup |

| Option | Description |

|---|---|

| Calculation of Dimension by | Select here which dimensions are to be used in the Valuation. With the option Standard, the default dimensions from the item card are used. For item ledger entries, the posted dimensions of the item are used. |

| Gen. Posting Type | The Gen. Posting type determines whether the booking in the Item valuation journals is to be made without or with impact to unit cost. With the option Choise, a query is made for each booking procedure as to how to proceed. The other options are: Only Post (without impact to unit cost) or Post as revaluation (with impact to unit cost). |

| Set Balance Posting Date | Here you can define whether all items of the previous valuation (item valuation entries with an earlier posting date) are to be offset/resolved (option: all entries) when a valuation posting is made. Alternatively, only the items (options: Item or Item & Location & variant) for which the new valuation takes place should be offset/resolved. This allows, for example, a partial valuation of new items. A detailed example of this can be found in the chapter Functions in Item valuation register. |

| Allow Posting of blocked Items | By setting this switch, a rating of blocked items can be made possible. |

| Automatic Cost Posting | If Automatic Cost Posting is set, when the item valuation entries are posted from the Item Valuation journal, the posting to general ledger is also made automatically. The Post Val. Amounts to G/L report, which can be used to manually transfer the item valuation entries to G/L, is then not necessary. |

| Average Cost Calc. Type | This option can be defined in the Inventory Setup and specifies how valuations are calculated for items. Item: The Valuation is calculated per item in the company. Item & Location & Variant: The Valuation is calculated per item for each location and for each variant of the item in the company. This means that the valuation of this item depends on where it is stored and which variant, such as color, of the item you have selected. This filters, for example, the item ledger entries relevant for determining the valuation condition range, range-periods, leaving, leaving-periods and lowest value. It also impacts the filtering for the Period Incoming Entry field. |

| Valuation 365 Cost Calc. Type | This option can be defined on top of the "Average Cost Calc. Type" field in the inventory setup. If you want to override the field in the inventory setup, you can select an option in the field "Valuation 365 Cost Calc. Type" and specify how valuations are calculated for items. " ": The Valuation is calculated based on the "Average Cost Calc. Type" field from the Inventory Setup. Item: The Valuation is calculated per item in the company. Item & Location & Variant: The Valuation is calculated per item for each location and for each variant of the item in the company. This means that the valuation of this item depends on where it is stored and which variant, such as color, of the item you have selected. This filters, for example, the item ledger entries relevant for determining the valuation condition range, range-periods, leaving, leaving-periods and lowest value. It also impacts the filtering for the Period Incoming Entry field. |

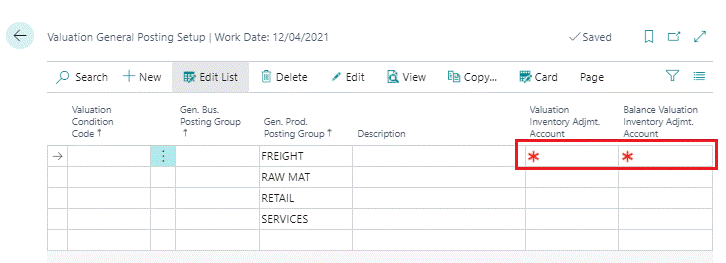

Valuation General Posting Setup

The income statement accounts to which the valuation is to be posted are stored in the Valuation General Posting Setup. The accounts can be defined separately for the combinations of valuation condition code, gen. bus. posting group and gen. product posting group. At a minimum, the gen. product posting group must be filled. The valuation condition code and the gen. bus. posting group are used for further breakdown and separation of the valuation amounts on the income statement accounts.

|

|---|

| Figure Valuation General Posting Setup |

| Option | Description |

|---|---|

| Valuation Inventory Adjmt. Account | Select here the G/L account to which the change due to the valuation in the income statement is to be posted. |

| Balance Valuation Inventory Adjmt. Account | This G/L account in the income statement is posted when the existing valuation is reversed in the subsequent period. |

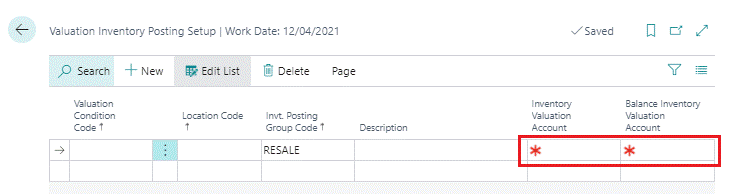

Valuation Inventory Posting Setup

The balance sheet accounts to which the valuation is to be posted are stored in the valuation inventory posting setup. The accounts can be defined separately for the combinations of valuation condition code, location code and invt. posting group code. At a minimum, the invt. posting group code must be filled in here. The valuation condition code and the location code are used for further breakdown and separation of the valuation amounts on the balance sheet accounts.

|

|---|

| Figure Valuation Inventory Posting Setup |

| Option | Description |

|---|---|

| Inventory Valuation Account | Select here the G/L account to which the change due to the valuation in the balance sheet is to be posted. |

| Balance Inventory Valuation Account | This G/L account in the balance sheet is posted when the existing valuation is reversed in the subsequent period. |

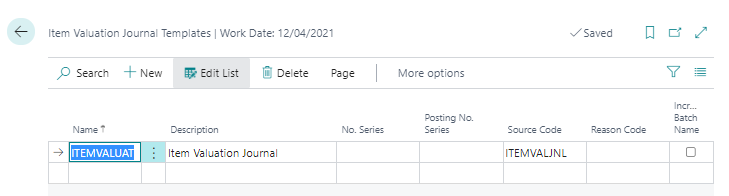

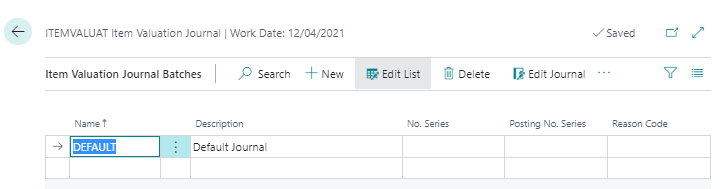

Item Valuation Journal Templates and Batches

The posting of valuations is done via Item Valuation Journals. Journal templates and batches are used for this. When the journal is opened for the first time, a new template and a new batch are automatically created. Any number of additional templates and batches can be defined. The templates and batches are set up in the same way as the already known logic for the journals of the other sections.

|

|---|

| Figure Item Valuation Journal Templates |

|

|---|

| Figure Item Valuation Journal |

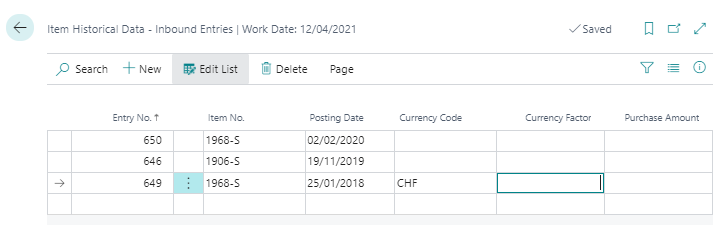

Item Historical Data

In the table Item Historical Data – Inbound Entries the posting date of the item ledger entries can be overwritten for the valuation or the original currency factor of the item can be entered. During a data transfer, the original posting date of the item entries is usually replaced with the migration date. The original date can then be entered in the table Item Historical Data – Inbound Entries to be able, for example, to carry out a valuation according to age structure on the basis of the original date.

|

|---|

| Figure Item Historical Data - Inbound Entries |

| Option | Description |

|---|---|

| Entry No. | Select here the Entry No. of the item entries for which you want to enter a different booking date. |

| Item No. | After selecting the Entry No., the item no. from the selected item is automatically taken over and displayed. |

| Posting Date | Enter the original posting date of the item receipt here. |

| Currency Code | If this incoming item is an acquisition that was originally booked in a foreign currency, you can enter the corresponding currency code here. |

| Currency Factor | This field serves as information and can be filled with the currency factor of the original conversion of the foreign currency. |

| Purchase Amount | Enter the original purchase amount in the specified currency here. |

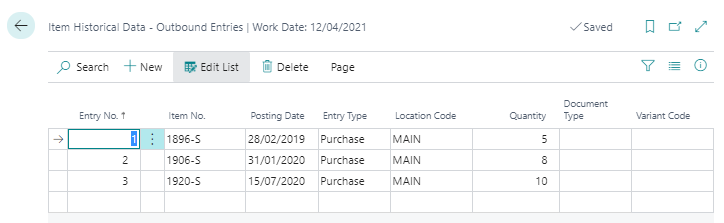

In addition, the table Item Historical Data – Outbound Entries is available for the maintenance of the outgoing items. Historical data on disposals/consumptions etc. can be entered here. This is relevant if there is no history of the disposals in the system and they are relevant for a valuation by leaving or range of coverage.

|

|---|

| Figure Item Historical Data - Outbound Entries |

| Option | Description |

|---|---|

| Entry No. | Assign a unique sequential number here for the outbound entries you wish to deposit. |

| Item No. | Select the number of the item to which this entry applies. |

| Posting Date | Here you enter the date on which the item was originally moved. |

| Entry Type | Select which entry type the item movement is. |

| Location Code | Enter here the location to which this item refers. |

| Quantity | In this field you enter the posted quantity. |

| Document Type | Select the document type of the item movement here. |

| Variant Code | If necessary, specify the variant of the item here. |

|

|---|

| Personal support available at www.ckl-software.de/en/ |