Basics

GENERAL

Version

This manual describes the contents of Inventory 365 for Microsoft Dynamics 365 Business Central.

Structure of the Online help

This online help describes the functions of the areas:

- Basics

- Posting production costs according to Total Cost Method

- Separating inventory accounts by processes

- Analysis of inventory management (subledger) with financial accounting (general ledger)

The online help contains the description of the individual fields as well as a process description for their use. For further information on the fields, please contact your Microsoft Dynamics partner or contact info@ckl-software.de.

OVERVIEW

Functional Scope of Inventory 365

Inventory 365 is a certified special solution based on Microsoft Dynamics 365 Business Central®. It includes a functional extension of the Microsoft Dynamics 365 Business Central® standard solution which enables to apply the Total Cost Method in the Manufacturing area and to differentiate the G/L accounts used in inventory management by processes. Inventory 365 supports Microsoft Dynamics 365 Business Central® users in the following way:

- Income statement postings for production costs based on the Total Cost Method

- G/L account determination for inventory postings, depending on the source and/or reason code

- Analysis of inventory management (subledger) based on value entries for reconciliation with financial accounting (general ledger). During analysis, the system will identify any variances caused by changes of the item’s gen. product/inventory posting group and determine the accounts of the General Posting Setup and Inventory Posting Setup for inventory postings. It is also possible to analyze inventory in transit of the purchase or sales areas incl. associated customers and vendors.

Inventory 365 seamlessly integrates with the Financial Management and Inventory application areas of the Microsoft Dynamics 365 Business Central® system.

Posting Production Costs acc. to Total Cost Method

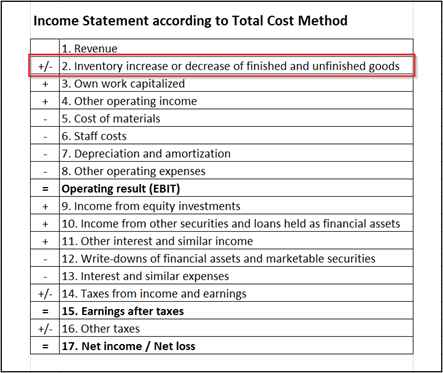

In order to create an income statement by using the Total Cost Method in accordance with section §275 (2) of the German Commercial Code (HGB), it is required to show the inventory increase or decrease of finished and unfinished goods.

|

|---|

| Figure Income statement according to the Total Cost Method |

This means that each value change needs to be reflected in the income statement. In standard Microsoft Dynamics 365 Business Central, income statement postings are not consistently performed for production order postings. Therefore, inventory changes of unfinished and finished goods are missing in the income statement. With Inventory 365, you can perform additional postings in the Manufacturing area by specifying respective accounts in the General Posting Setup and Inventory Posting Setup, which are shown in the income statement account schedule.

Separating Accounts by Processes

In Inventory 365, you can split inventory accounts by the source code which allows to use separate accounts for different processes.

Analysis of inventory management (subledger) with financial accounting (general ledger)

Inventory 365 enables you to analyze the inventory management subledger by considering the value entries based on different criteria. In addition to this, the G/L entries can be included allowing to perform reconciliations between the general ledger and subledger. During analysis, the system will identify any variances caused by changes of the item’s gen. product/inventory posting group and determine the accounts of the General Posting Setup and Inventory Posting Setup specified for inventory postings. With Inventory 365, you can analyze inventory in transit of the purchase or sales areas incl. associated customers and vendors.

Role Center

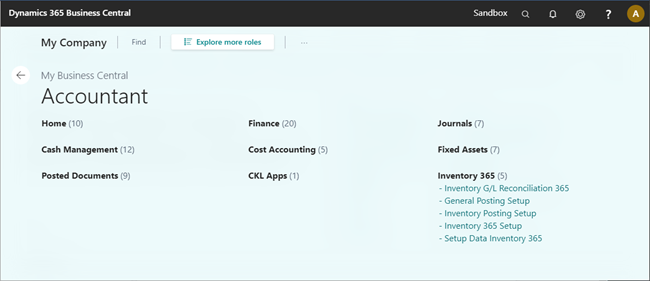

Inventory 365 is integrated in the Accountant role center in Microsoft Dynamics 365 Business Central®.

|

|---|

| Figure Role Accountant |

|

|---|

| Personal support available at www.ckl-software.de/en/ |