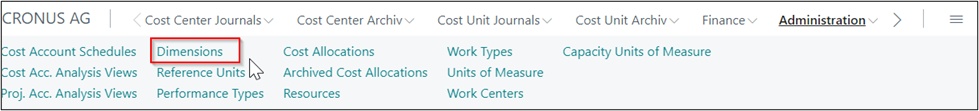

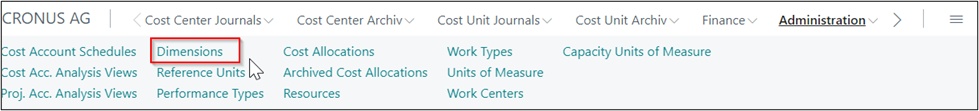

Administration

DIMENSIONS

Dimensions are characteristics which can be added to postings via documents, journals, and budgets. They provide the basis for processing cost accounts and project accounts in Cost Accounting 365.

This results in using global dimension 1 as “cost centers/cost accounts “and global dimension 2 as “cost units/project accounts”.

In addition to these main dimensions, you can post further dimensions, the so-called shortcut dimensions.

For example, the dimensions are used to set up the chart of cost centers as well as the chart of G/L accounts hierarchically, in which related cost centers are categorized in groups by using headings, begin and end totals.

In most cases, cost centers are departments and profit units that are responsible for the costs and revenues of the company to a great extent. Cost centers can be synchronized with the G/L account dimensions.

|

| Figure Administration - Dimensions |

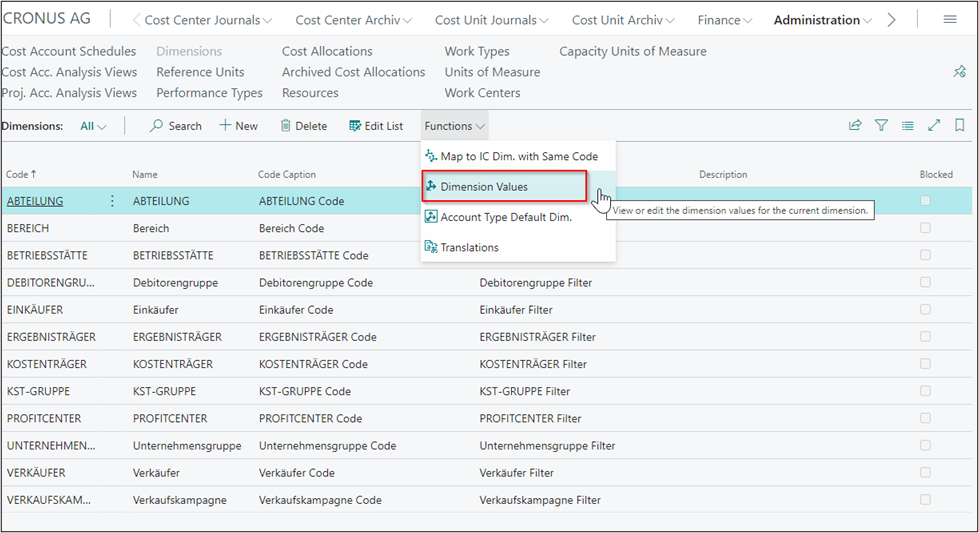

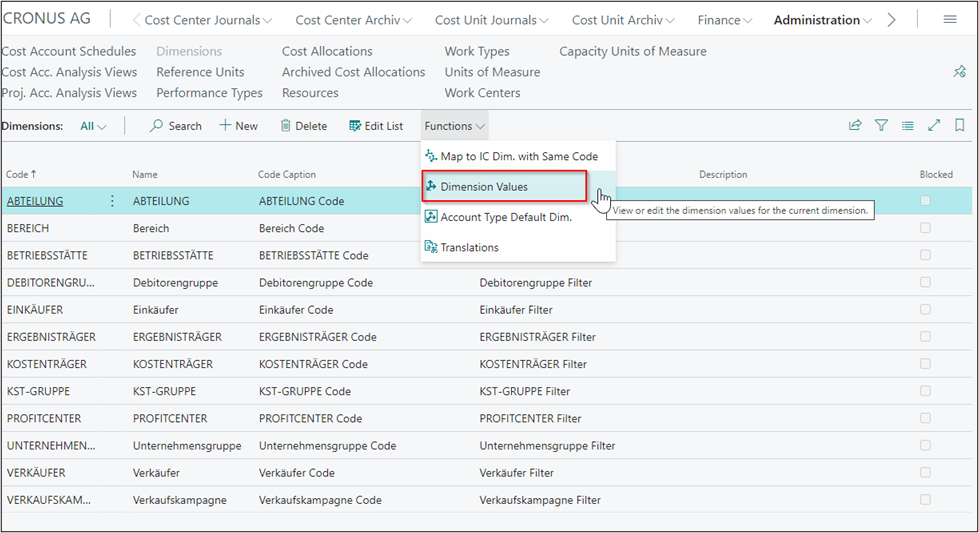

|

| Figure Administration - Dimension Values |

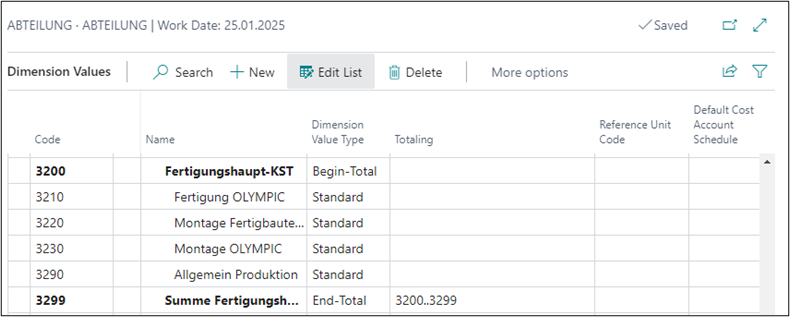

|

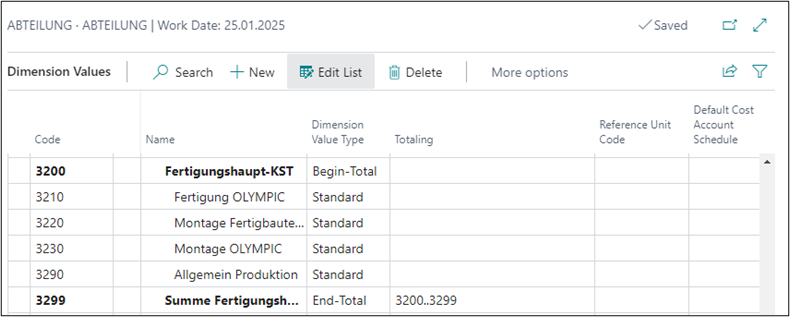

| Figure Example Dimension Values Cost Center |

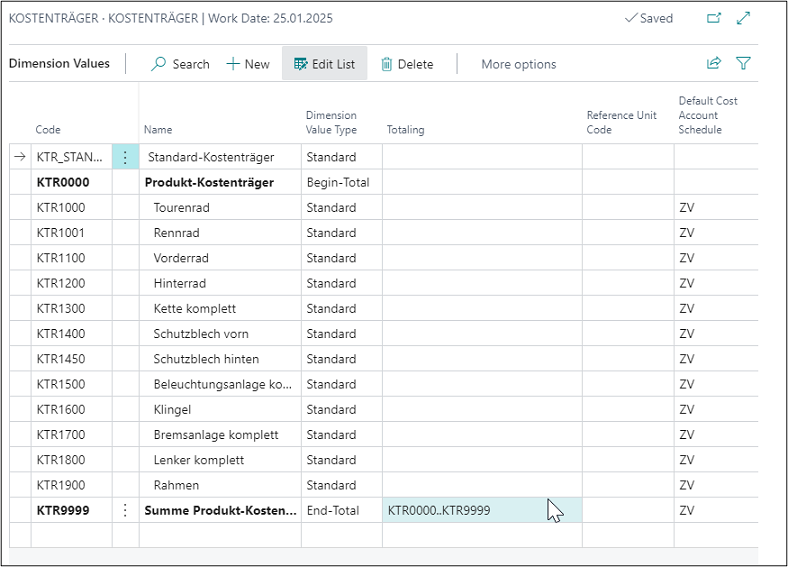

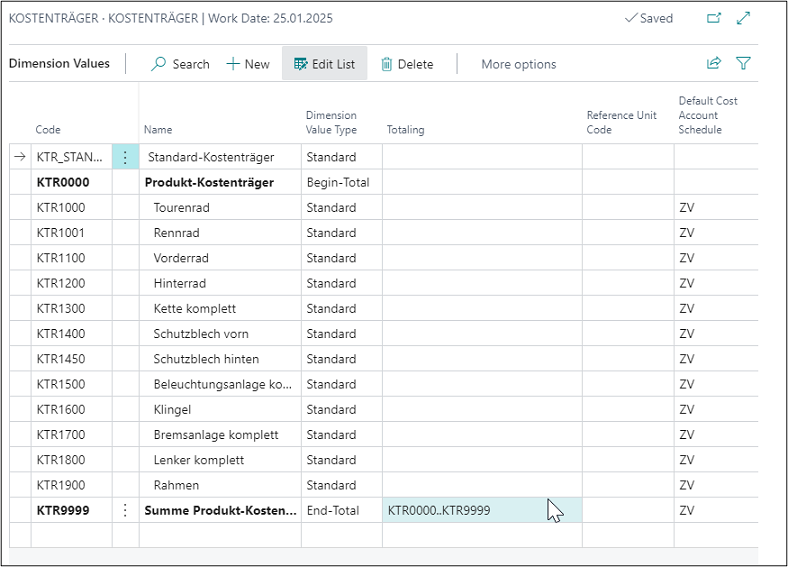

Projects are products, product groups, or performances of a company, the finished products of a company, which ultimately bear the costs. Projects can be synchronized with G/L account dimensions.

|

| Figure Example Dimension Values Cost Unit |

| Option |

Description |

| Code |

This field is used to specify the code for the dimension. |

| Name |

This field is used to specify the description for the dimension. |

| Code Caption |

This field is used to specify the caption of the dimension code. It is shown as the name of the dimension code fields. |

| Filter Caption |

This field is used to specify the caption of the dimension code when used as a filter. It is shown as the name of the dimension filter fields. |

| Description |

This field is used to specify the description of the dimension code. |

| Blocked |

This field is used to specify that the associated record cannot be posted to transactions. |

| Function |

|

| Map to IC Dim. with Same Code |

This field is used to specify which intercompany dimension corresponds to the dimension in the line. If you use a dimension code on an IC sales or IC purchase line, the system will insert the corresponding IC dimension code in the line that is sent to your intercompany partner. |

| Dimension Values |

Here you can show or edit the dimension values for the current dimension. |

| Table Default Dimensions |

This field is used to specify the default dimension settings for the relevant account types, such as customers, vendors, or items. For example, you can specify that a dimension is mandatory. |

| Translations |

This field is used to enter a translation for your dimension. Translated item descriptions are automatically inserted into documents according to the used language code. |

| Dimension Values |

|

| Code |

This field is used to specify the code for the dimension value. |

| Name |

This field is used to specify a name for the dimension value. |

| Dimension Value Type |

This field is used to specify the dimension value type. The following 5 options are available: Default: Select this option if it is a dimension which can be posted, such as a cost center. Heading: Select this option if it is a heading. Total: Select this option if it is a total. Begin-Total: Select this option if it is a begin total. End-Total: Select this option if it is an end total. Note: You can use the “Indent Dimension Values” batch job for automatic totaling if you select the Begin-Total or End-Total option. |

| Totaling |

This field is used to specify an account interval or a list of account numbers. The entries in the account are totaled to form a total balance. The totaling entries depends on the value of the Totaling Type field. |

| Reference Unit Code |

Here you can define a reference unit to be valid and filtered for the dimension value. |

| Blocked |

Here you can specify that the associated record cannot be posted to transactions. |

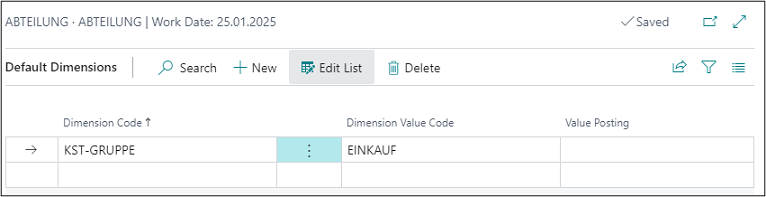

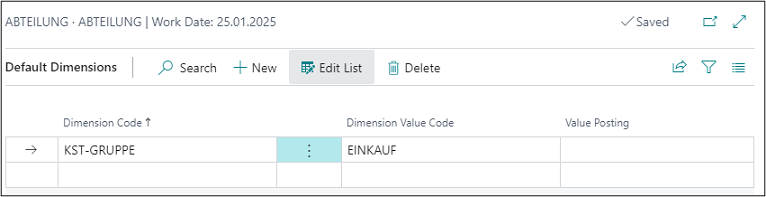

Default Dimensions

For the global dimensions of the General Ledger, you can define default dimensions in Cost Accounting which can be used as additional analyses hierarchies. For example, cost centers can be assigned to operational sites that use reporting per site. All default dimensions available for global dimensions are automatically posted in Cost Accounting. To use default dimensions, you need to create them as separate dimensions.

For this, select More Options -> Related -> Dimensions.

|

| Figure Example Default Dimensions |

| Option |

Description |

| Dimension Code |

This field is used to specify the code for the default dimension. |

| Dimension Value Type |

This field is used to specify the dimension value code that is suggested when using the default dimension. |

| Value Posting |

This field is used to specify how to handle the default dimension and its values. The following options are available: Code Mandatory: If you select this option, a dimension, such as a cost center group, will always be required for posting. Same Code: If you select this option, the same dimension as specified will always be required for posting. No Code: If you select this option, no dimension may be specified during posting. |

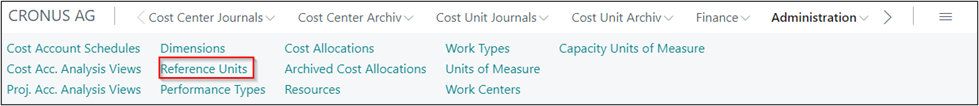

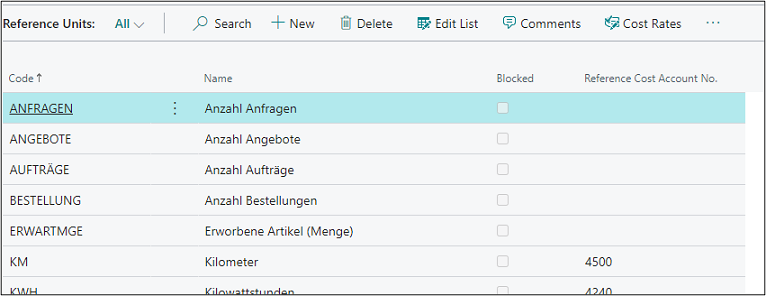

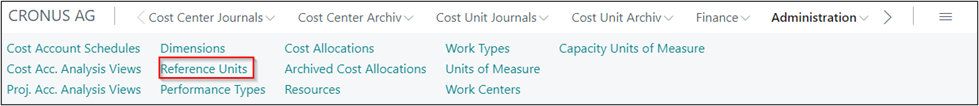

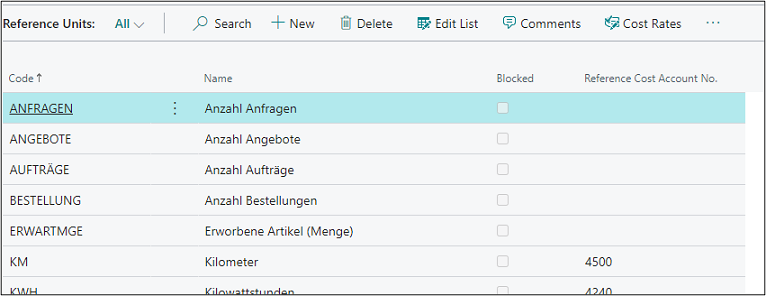

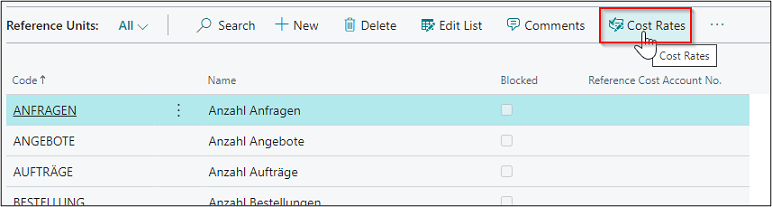

REFERENCE UNITS

Reference units represent the type of performance which is used for the distribution of costs of internal billing processes. By using reference units, cost accounting can be used as a closed system for recording, budgeting, allocating and controlling costs.

In practice, this often includes occupied square meters, number of employees, as well as performances or production hours. Reference units serve as allocation keys to assign costs.

|

| Figure Administration - Reference Units |

|

| Figure Example Reference Units |

| Option |

Description |

| Code |

This field is used to specify the code for the reference unit. |

| Name |

This field is used to specify a name for the reference unit. |

| Blocked |

Place a check mark in this field if you want to block the reference unit so that it can no longer be used. |

| Reference Cost Account No. |

This field is used to define a cost account to be referred to by the Calculate Cost Rates batch job. |

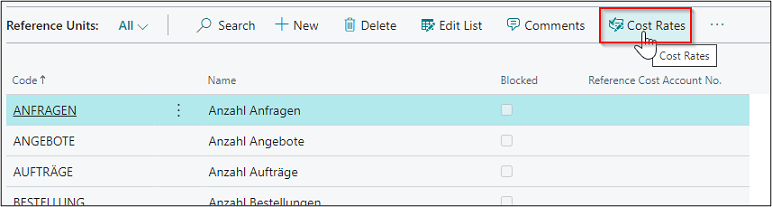

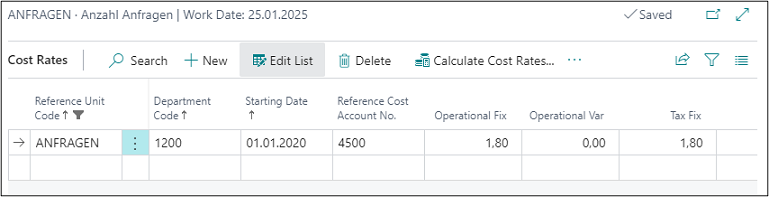

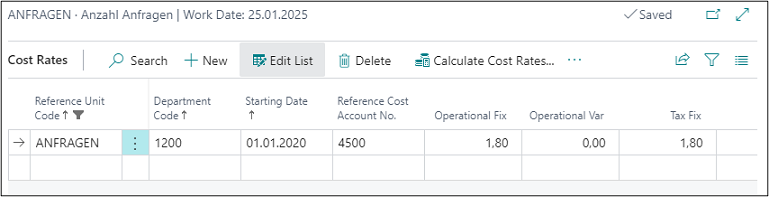

Cost Rates

|

| Figure Cost Rates |

|

| Figure Example Cost Rates |

| Option |

Description |

| Reference Unit Code |

This field is used to specify the code for the reference unit. |

| Department Code |

This field is used to specify a name for the reference unit. |

| Starting Date |

This field is used to specify as starting date for the reference unit. |

| Reference Cost Account No. |

This field is used to define a cost type to be referred to by the Calculate Cost Rates batch job. |

| Operational Fix |

Here you can enter the fix operational cost rate. |

| Operational Var |

Here you can enter the variable operational cost rate. |

| Tax Fix |

Here you can enter a tax related fix cost rate in addition to the operational cost rate. |

| Tax Var |

Here you can enter a tax related variable cost rate in addition to the operational cost rate. |

| Operational Actual Fix |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a default value, which is calculated based on costs and performances. |

| Operational Actual Var |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a default value, which is calculated based on costs and performances. |

| Tax Actual Fix |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a tax related default value. |

| Tax Actual Var |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a tax related default value. |

| Budget Fix |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a default value, which is calculated based on costs and performances of a cost center budget. |

| Budget Var |

This field is automatically populated when running the Calculate Cost Rates batch job. It shows the calculated rate per cost center and will be considered as a default value, which is calculated based on costs and performances of a cost center budget. |

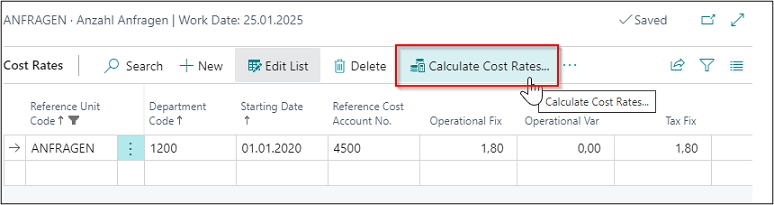

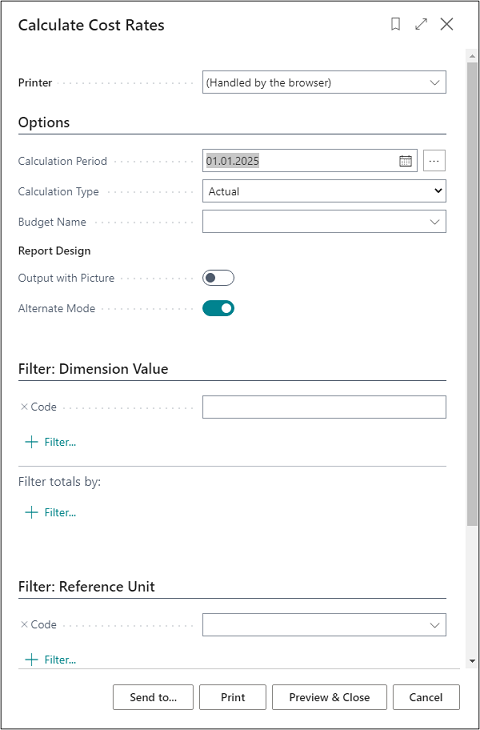

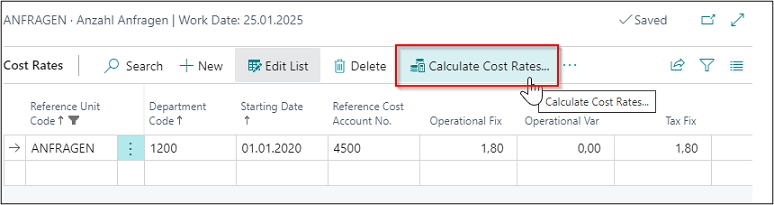

Calculate Cost Rates

Cost rates are used to evaluate the performances of cost centers. By calculating cost rates, the profitability of a cost center can be controlled in a significant manner. This section describes the following topics:

* Cost rates

* Calculating and transferring to default cost rate

|

| Figure Call Calculate Cost Rates |

|

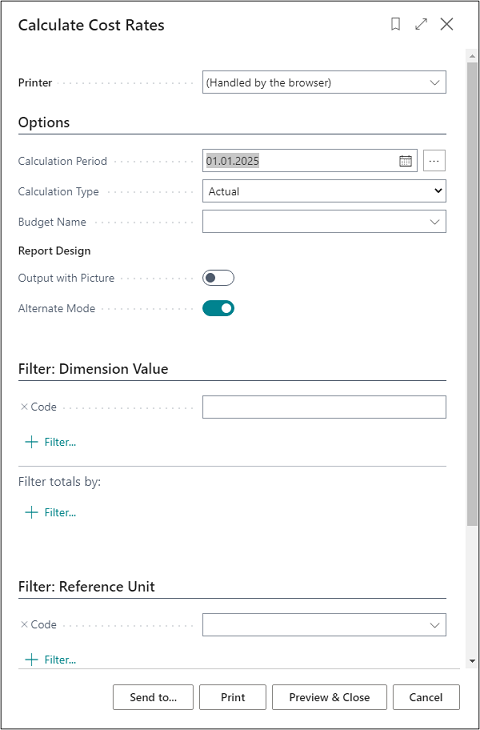

| Figure Calculate Cost Rates |

| Option |

Description |

| Calculation Period |

This field is used to specify the code for the reference unit. |

| Calculation Type |

This field is used to specify a name for the reference unit. |

| Budget Name |

This field is used to specify a budget name. |

| Output with Picture |

Place a check mark in this field if you want to use your company logo in the report. |

| Alternate Mode |

This field is activated by default and represents a section lining within the report. |

| Filter tab: Dimension Value |

|

| Code |

Here you can filter on cost centers for which you want to calculate the cost rates. If you do not specify a filter Here the system will consider all cost centers during cost rate calculation. |

| Filter tab: Reference Unit |

|

| Code |

This field is used to enter the code of the reference unit you want to consider for cost rate calculation. If you do not specify a filter Here the system will consider all reference units during cost rate calculation. |

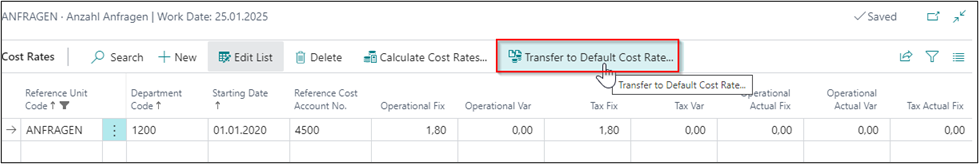

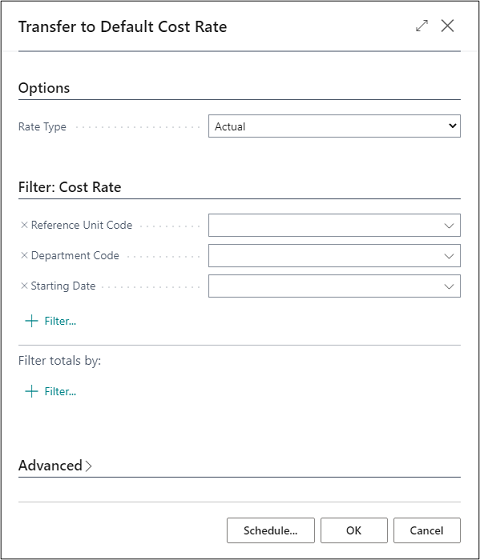

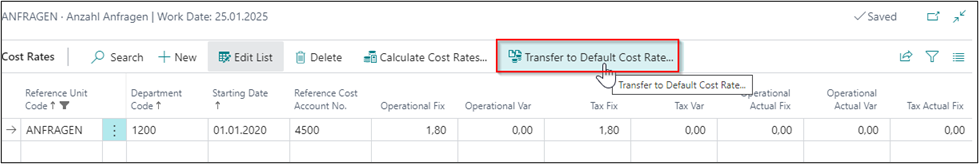

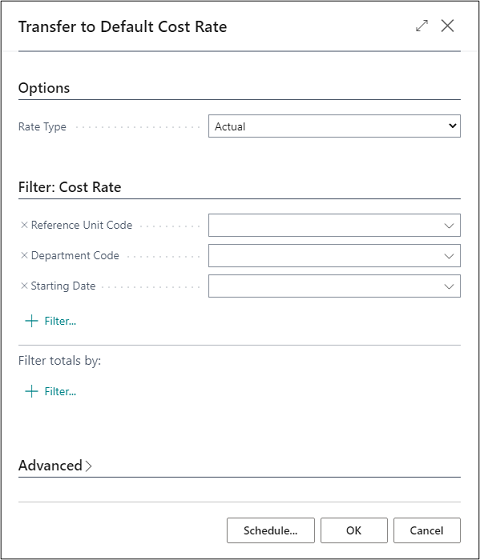

Transfer to Default Cost Rate

|

| Figure Call Transfer to Default Cost Rate |

|

| Figure Transfer to Default Cost Rate |

| Option |

Description |

| Rate Type |

Here you can define the rate type to be used to transfer the cost rates. The following 2 options are available: Actual: If you select this option, the cost rates will be used as actual values in the Operational Fix and Operational Var columns. Budget: If you select this option, the cost rates will be used as budget values in the Budget Fix and Budget Var columns. |

| Reference Unit Code |

Here you can filter the reference unit to be used for the transfer. If no filter is specified in this field, the system will consider all cost rates. |

| Department Code |

Here you can filter the department to be used for the transfer. If no filter is specified in this field, the system will consider all cost rates. |

| Starting Date |

Specify a starting date in this field on which you want the system to start the transfer. |

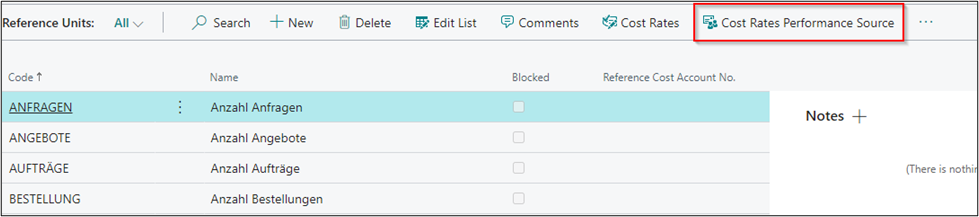

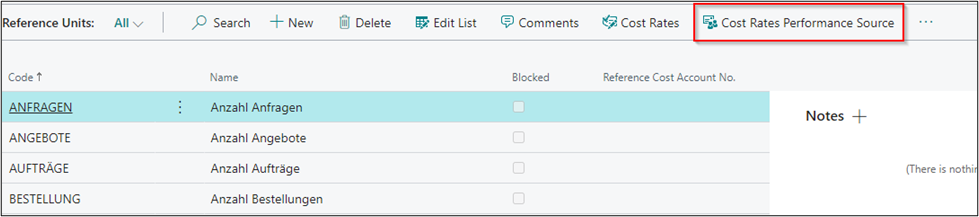

It is not necessarily required to base the cost rates on the specified default cost rates of the reference units. The cost rates can rather be determined or used directly from the master data of the resources and/or the work types or work centers, etc.

Depending on the reference units, cost centers, resources and/or work types or work centers, etc., there is a distinction between fix and variable components of the individual/overhead costs in the cost rates of the performance source.

The calculated variable and fix individual/overhead costs of the original performance posting are used in the cost rate process.

|

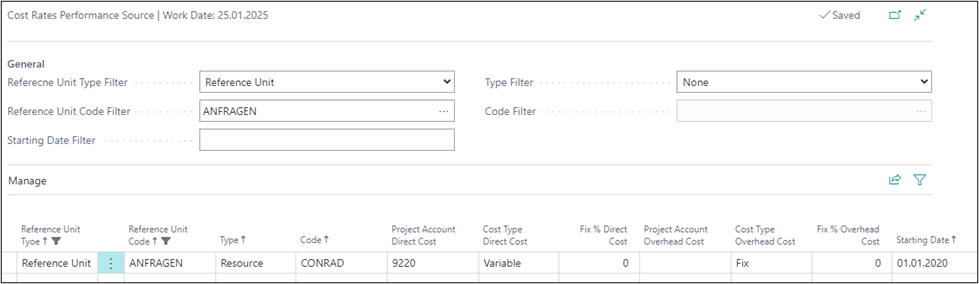

| Figure Call Cost Rates Perfromance Source |

|

| Figure Cost Rates Perfromance Source |

| Option |

Description |

| Reference Unit Type Filter |

Here you can define the reference unit type to be filtered in this window. Reference unit: The type of reference unit represents the possibility of using the original prices of e. g. resources to be considered for cost rate calculation, based on quantities or performances. |

| Reference Unit Code Filter |

This field is used to filter the selected reference unit. |

| Starting Date Filter |

Here you can enter the starting date you want to use for cost rates of the performance origin. |

| Type Filter |

This field shows and filters the different types configured in the columns. The following options are available: Work Type: Specifies whether to determine prices in connection with a work type. Resource: Specifies whether to determine the prices of resources. Work Center (Setup Time): Specifies whether to determine the prices of the work center for setup times. Work Center (Run Time): Specifies whether to determine the prices of the work center for run times. Work Center: Specifies whether to determine the prices of the work center, including setup and run times. Cost Account: Specifies whether to determine the prices of the cost account. All: Specifies whether to determine the prices of all types. None: Indicates that no prices will be determined. |

| Code Filter |

If you have selected a type in the "Code Filter" field, you can filter on a resource, workplace center or cost account code. |

| Reference Unit Type |

Here you can define the reference unit type to be filtered in the window. All: If you select the All option, all existing reference units will be considered. Reference Unit: If you select the Reference Unit option, you can use the original prices of e. g. resources to be considered for distribution, based on quantities or performances. |

| Reference Unit Code |

Here you can define the reference unit you want to set up for price determination. |

| Type |

Here you can define the type to be filtered in this field. The following 2 options are available: Work Type: Specifies whether to determine prices in connection with a work type. Resource: Specifies whether to determine the prices of resources. Work Center (Setup Time): Specifies whether to determine the prices of the work center for setup times. Work Center (Run Time): Specifies whether to determine the prices of the work center for run times. Work Center: Specifies whether to determine the prices of the work center, including setup and run times. Cost Account: Specifies whether to determine the prices of the cost account. All: Specifies whether to determine the prices of all types. None: Indicates that no prices will be determined. |

| Code |

If you have selected the “Work Center” option in the “Type” field, you can directly filter on a specific work center. |

| Project Account Direct Cost |

Here you can enter the account you want to use to post the direct costs. |

| Cost Type Direct Cost |

In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fix amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: The purchase prices will be posted as a mixed amount resulting from a fix percentage. Any amounts that exceed the fix rate will be posted as variable amounts. |

| Fix % Direct Cost |

If you have selected the “Mixed %” option in “Cost Type Direct Cost” field, you need to enter the fix percentage rate you want to use to post the direct costs. |

| Project Account Overhead Cost |

Here you can select the account you want to use to post overhead costs. |

| Cost Type Overhead Cost |

In this field, you can specify the cost type. The following 3 options are available: Fix: Consumption costs will be posted as fix amounts. Variable: Consumption costs will be posted as variable amounts. Mixed %: The purchase prices will be posted as a mixed amount resulting from a fix percentage. Any amounts that exceed the fix rate will be posted as variable amounts. |

| Fix % Overhead Cost |

If you have selected the “Mixed %” option in “Cost Type Overhead Cost” field, you need to enter the fix percentage rate you want to use to post the overhead costs. |

| Starting Date |

Enter the starting date in this field from which you want to apply the performance of price determination. |

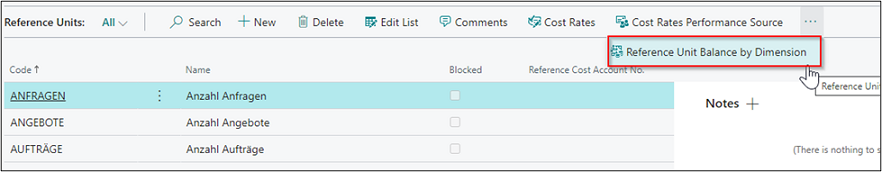

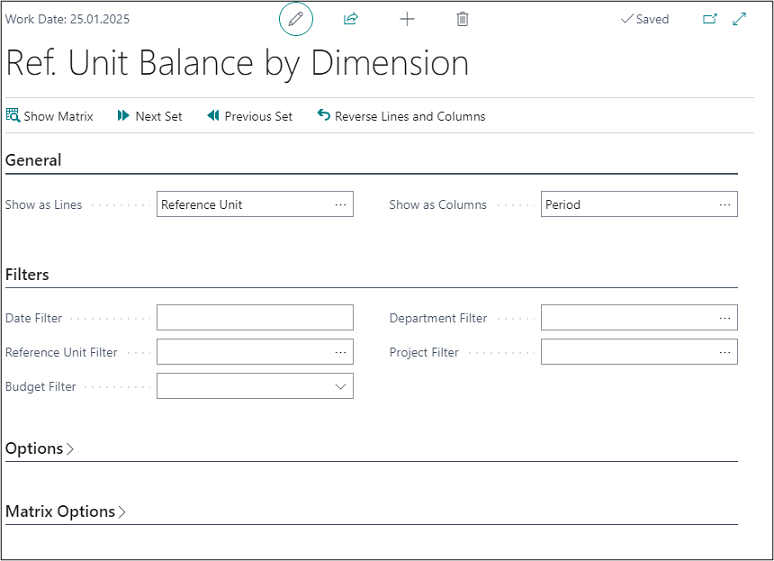

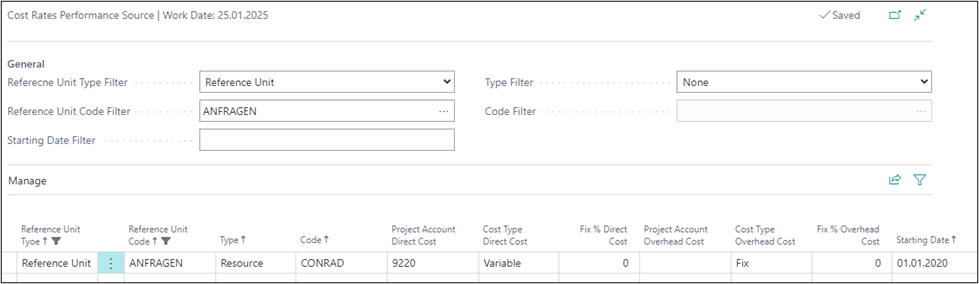

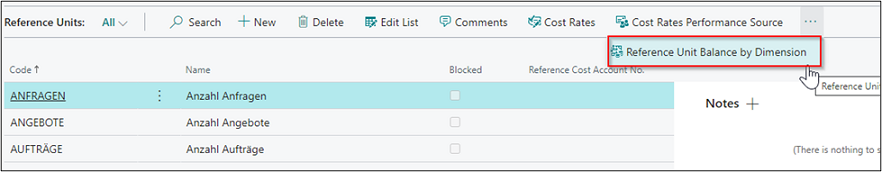

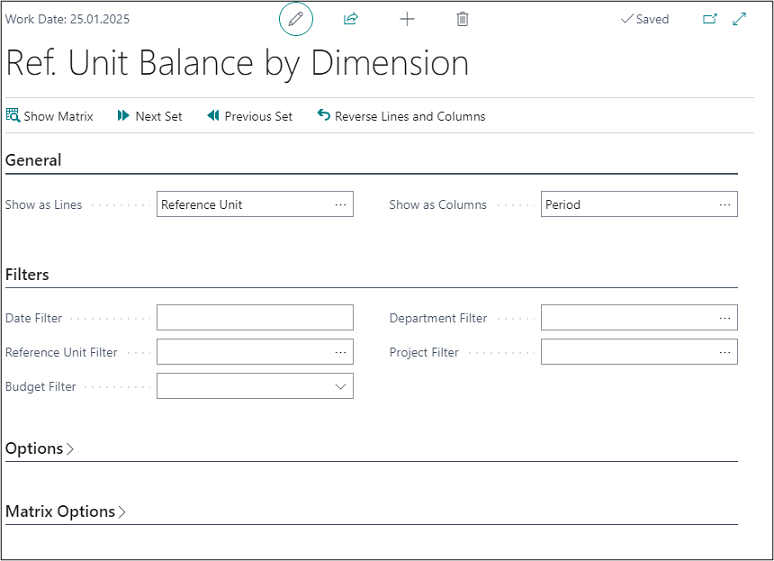

Reference Unit Balance by Dimension

The “Ref. Unit Balance by Dimension” window is used to specify the quantities or performances that have been posted monthly by e. g. using reference units.

|

| Figure Call Reference Unit Balance by Dimension |

|

| Figure Reference Unit Balance by Dimension |

| Option |

Description |

| General tab |

|

| Show as Lines |

Select the parameter in this field to be shown as rows in the matrix window. |

| Show as Columns |

Select the parameter in this field to be shown as columns in the matrix window. |

| Filter tab |

|

| Date Filter |

In this field you can specify a date filter for the reference unit balance. |

| Reference Unit Filter |

Set a filter in this field if you want to see selected quantity or performance postings. |

| Budget Filter |

Set a filter in this field if you also want to see the quantity or performance postings as budgeted quantities. |

| Department Filter |

Here you can filter selected cost accounts to be considered for evaluation. |

| Project Filter |

Here you can filter selected project accounts to be considered for evaluation. |

| Options tab |

|

| Show |

Specify the display type of quantities. The following options are available: Actual Quantities: Select this option if you want to show the posted quantities that have actually been posted. Budgeted Quantities: Select this option if you want to show the budgeted quantities. Variance: Select this option if you want to show the variance between the actual and budgeted quantities. Variance %: Select this option if you want to show the variance percentage between the actual and budgeted quantities. Index %: Select this option if you want to show the percentage index. |

| Show Amount Field |

Specify the display type of quantities. The following options are available: Credit Quantity: Select this option if you want to show the delivered quantities in relation to cost accounts. Project Quantity: Select this option if you want to show the delivered quantities in relation to projects. Debit Quantity: Select this option if you want to show the receiving quantities in relation to cost accounts. |

| Rounding Factor |

Here you can specify to round the delivered quantities to: None, 1, 1000, or 1000000. |

| Show Column Name |

Place a check mark in this field if you want to show the name of the column, e. g. the cost account name. |

| Matrix Options tab |

|

| View by |

In this field, you can specify to display by a specific period type. The following options are available: Day, Week, Month, Quarter, Year, Accounting Period. |

| View as |

In this field, you can specify whether you want to show the quantities as: Net Change: Within a month or year, depending on the specified date filter or Balance at Date: Cumulative balance, depending on the specified date filter. |

| Column Set |

Depending on the specified date filter and the option selected in the “View by” field, this field is automatically filled by the system. |

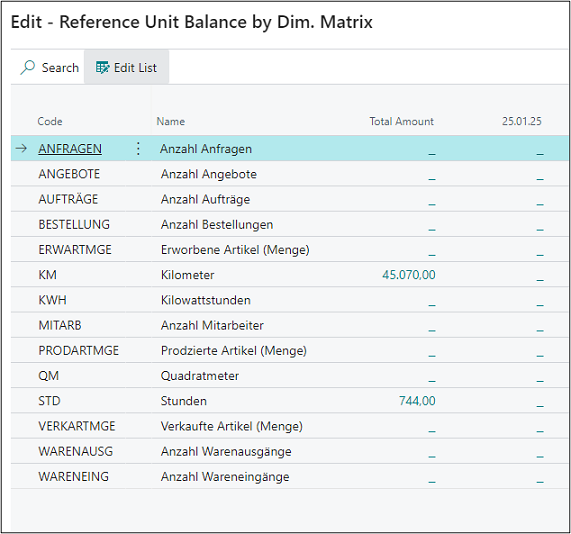

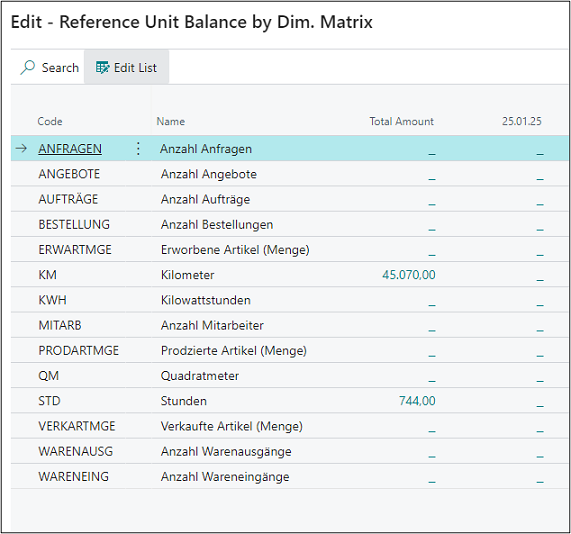

The following results when using the respective reference unit postings.

|

| Figure Reference Unit Balance by Dim. Matrix |

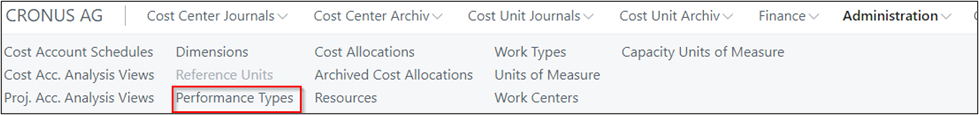

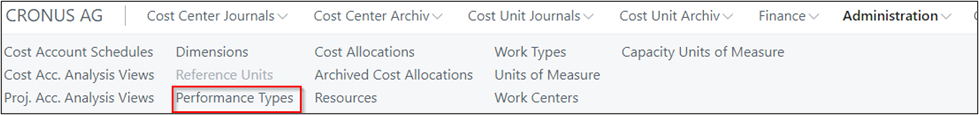

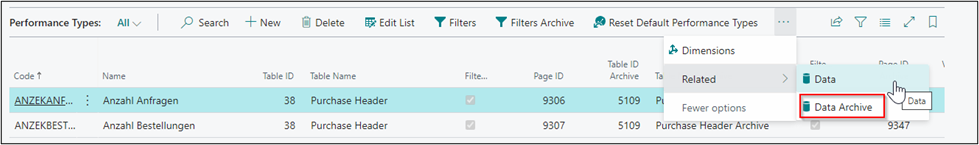

Within the scope of internal performance distribution, it is possible to distribute costs not only based on performances by using the Resources and/or Manufacturing module, but also based on other qualifying key figures/variables that originate from other Microsoft Dynamics 365 Business Central modules.

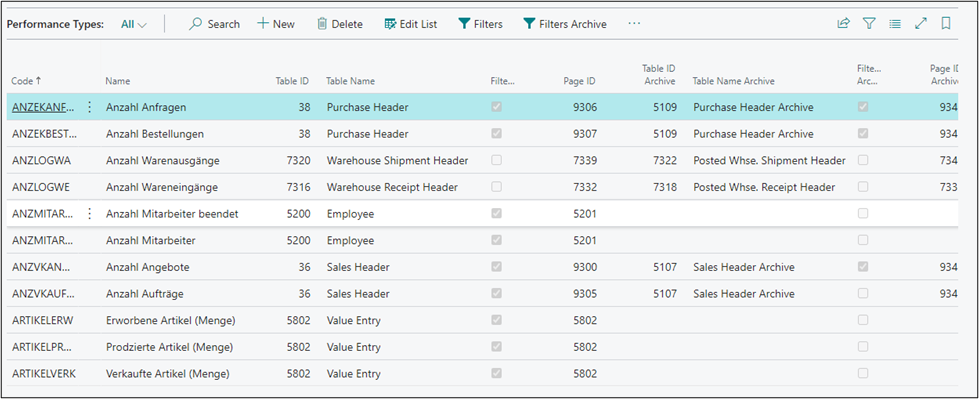

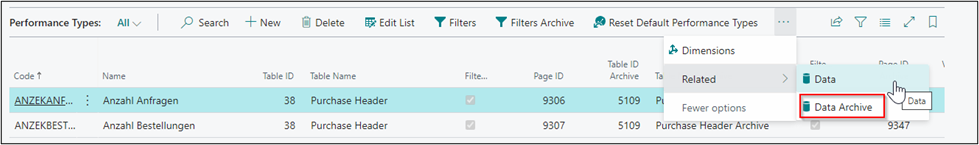

The definition of qualifying key figures/variables, e. g. the number of sales or purchase orders, the number of warehouse receipts or shipments, the number of active employees, etc., can be set up in a flexible manner as performance types and linked with reference units. In this way, the flexible performance types allow you to use a source based internal performance distribution based on meaningful key figures/variables.

|

| Figure Administration - Performance Types |

|

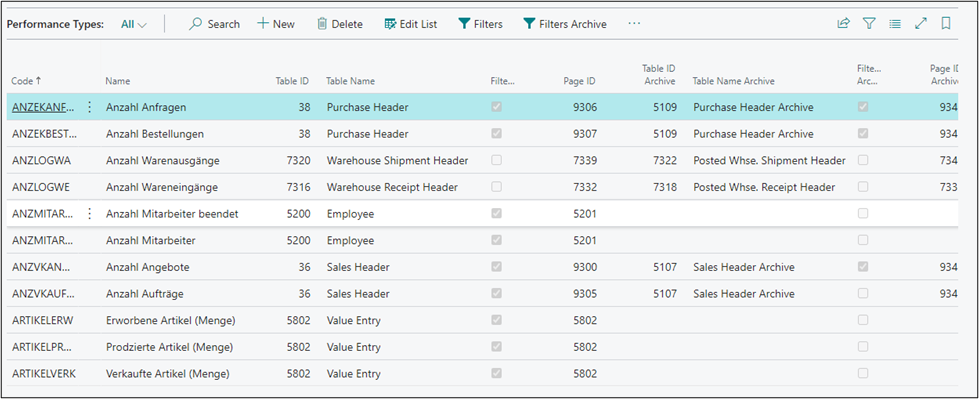

| Figure Performance Types |

| Option |

Description |

| Code |

This field is used to define a code for the performance type. |

| Name |

This field is used to specify a name for the performance type. |

| Table ID |

This field is used to define the table ID from which the application can generate the data. |

| Table Name |

This field will automatically show the name of the table selected in the Table ID field. |

| Filtered |

This field contains a check mark if the data for this table has been filtered. |

| Page ID |

Enter the page ID of the table in this field if you want to show data. |

| Archive Table ID |

If you want to access archived data, you can enter the table ID of the archive here. |

| Archive Table Name |

This field will automatically show the name of the table selected in the Archive Table ID field. |

| Filtered |

This field contains a check mark if the data for this archived table has been filtered. |

| Page ID Archive |

Enter the page ID of the archive in this field if you want to show archived data. |

| Value Type Field ID |

Here you can define the field to be copied, such as "invoiced quantity". |

| Value Field Label |

This field will automatically show the name of the table selected in the Value Type Field ID field. |

| Use Opposite Sign |

Place a check mark in this field if you want to show the data with opposite signs. |

| Performance Date Field ID |

Here you define the date you want to use for the transfer of data, e. g. as posting date, document date, etc. |

| Performance Date Field Name |

This field will automatically show the name of the table selected in the Performance Date Field ID field. |

| Standard Project Account No. |

Here you can enter a project account which will be used if there is no value in the performance entry and no "default" project account number has been specified in the Project Account Setup. |

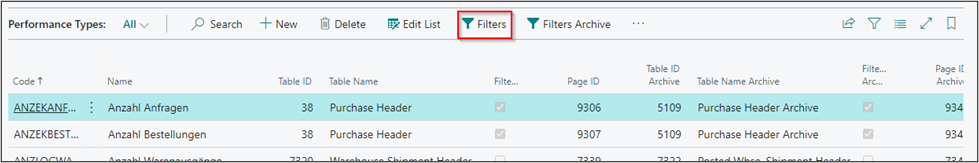

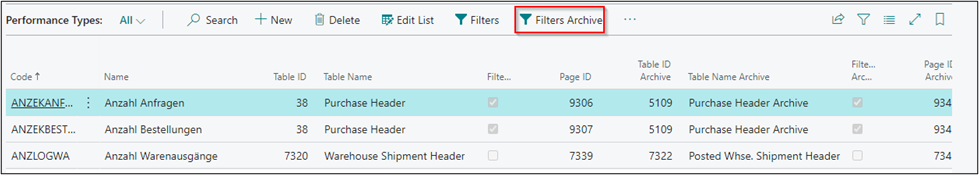

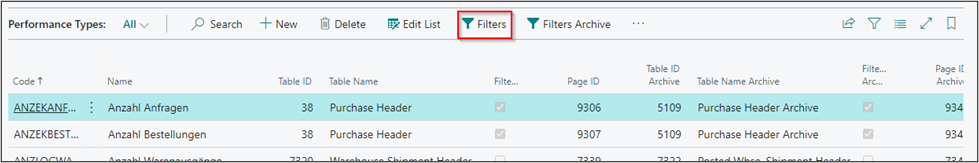

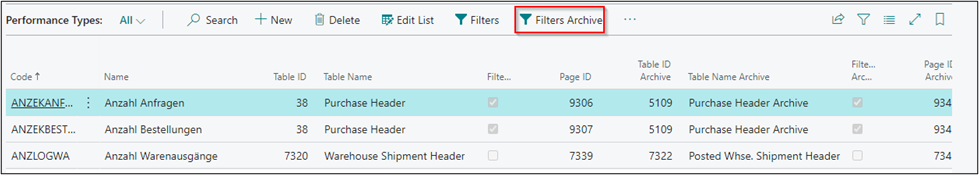

Filter

|

| Figure Performance Type Filters |

|

| Figure Edit Performance Type Filters |

| Option |

Description |

| Field ID |

Here you can select the field ID, such as "1". It describes the field you use to set filters during data transfer. |

| Field Name |

This field automatically shows the name of the table selected in the Field ID field. |

| Field Caption |

This field automatically shows the caption of the table selected in the Field ID field. |

| Field Filter |

Here you can enter a filter, e. g. “=Quote” if you want to generate data only from sales quotes. |

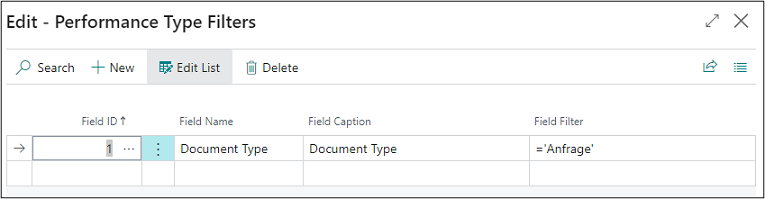

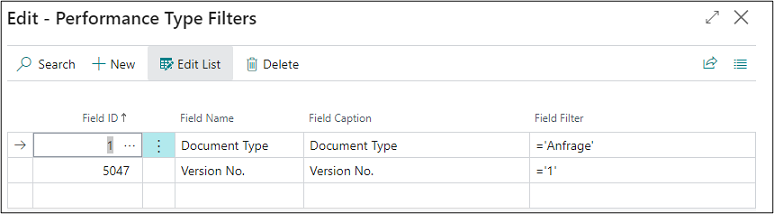

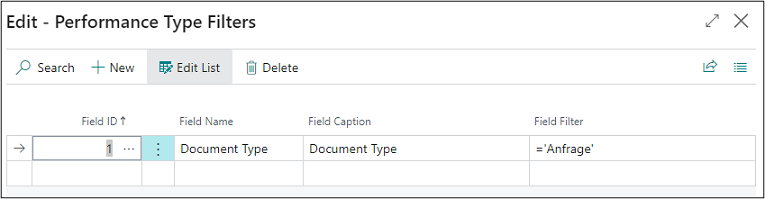

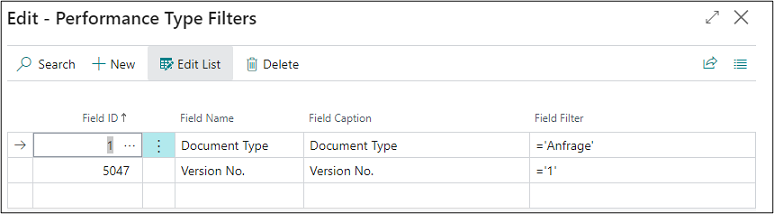

Filter Archive

|

| Figure Performance Type Filters Archive |

|

| Figure Edit Performance Type Filters Archive |

| Option |

Description |

| Field ID |

Here you can select the field ID, such as "1". It describes the field you use to set filters during data transfer. |

| Field Name |

This field automatically shows the name of the table selected in the Field ID field |

| Field Caption |

This field automatically shows the caption of the table selected in the Field ID field. |

| Field Filter |

Here you can enter a filter, e. g. “=Quote” if you want to generate data only from sales quotes. |

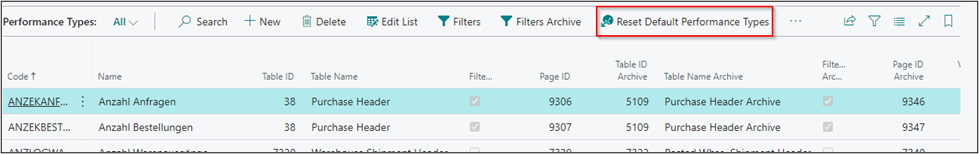

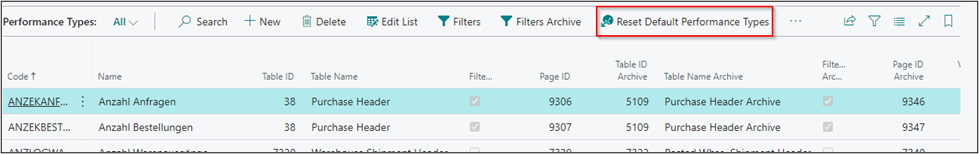

Reset Default Performance Types

If you change or delete default performance types, you can use the Reset Default Performance Types function to restore the default performance types to the original state.

Resetting or restoring default performance types only applies to performance types preset in Cost Accounting 365. This means that any user-defined performance types will not be reset or restored by using this function and will remain in the system.

|

| Figure Reset Default Performance Types |

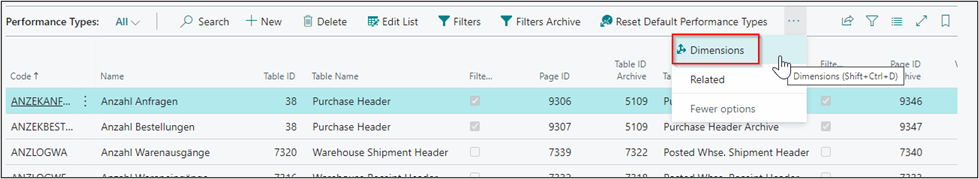

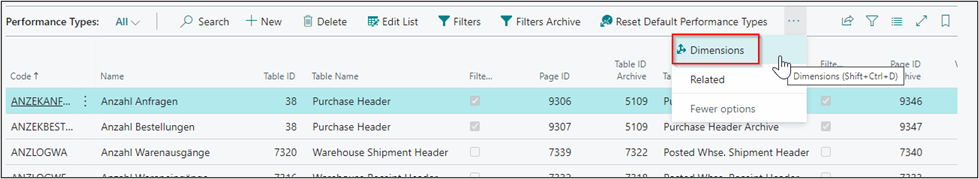

Dimensions

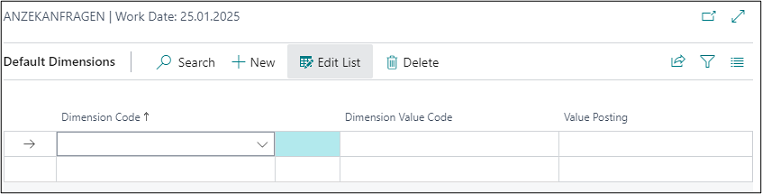

If you want to add the transferred data of the performance types to the preset dimensions, you can define them in the performance types table by using default dimensions.

|

| Figure Performance Types - Dimensions |

|

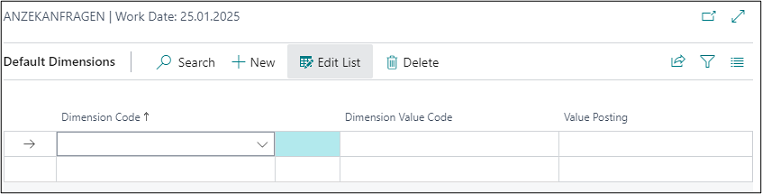

| Figure Default Dimensions |

| Option |

Description |

| Dimension Code |

This field is used to specify the code for the default dimension. |

| Dimension Value Type |

This field is used to specify the dimension value code that is suggested when using the default dimension. |

| Value Posting |

This field is used to specify how to handle the default dimension and its values. The following options are available: Code Mandatory: If you select this option, a dimension, such as a cost center group, will always be required during posting. Same Code: If you select this option, the same dimension as specified will always be required during posting. No Code: If you select this option, no dimension may be specified during posting. |

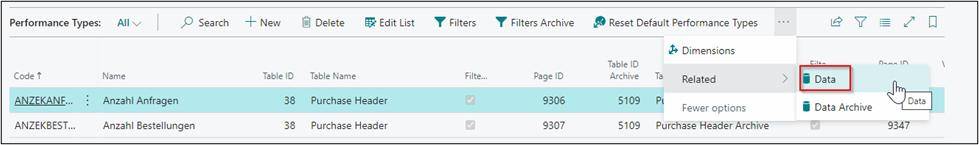

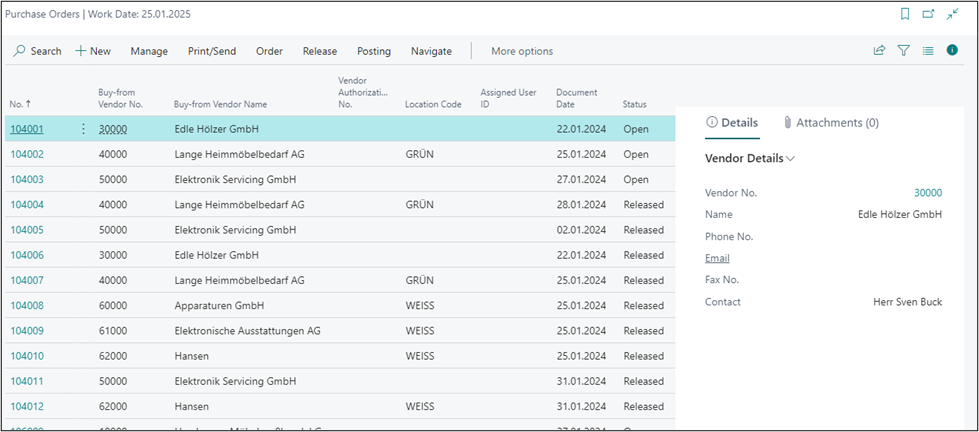

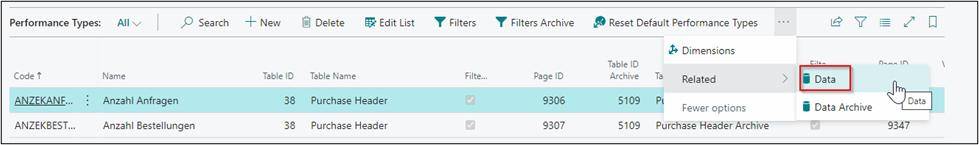

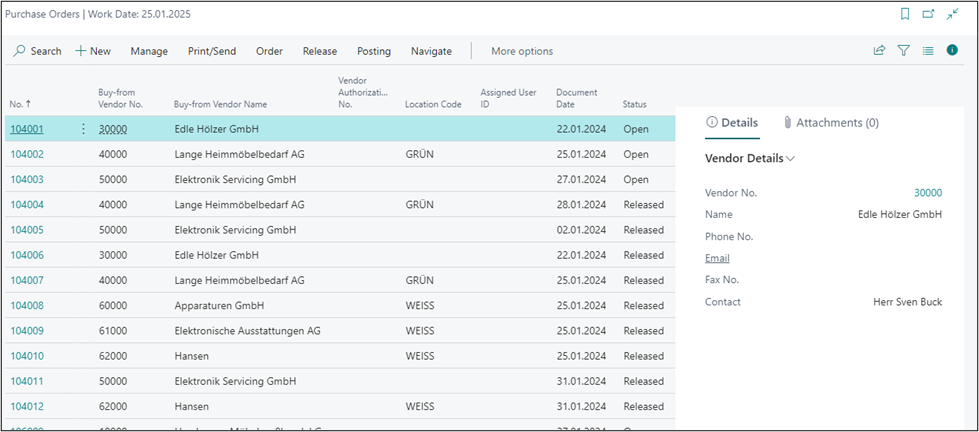

Data

This window shows the purchase orders which are entered in the client based on the specified performance type used as performance type in Cost Accounting 365.

|

| Figure Performance Types - Data |

|

| Figure Example Performance Types - Data |

Data Archive

This window shows the purchase orders which are entered in the client based on the specified performance type used as performance type in Cost Accounting 365.

|

| Figure Performance Types - Data Archive |

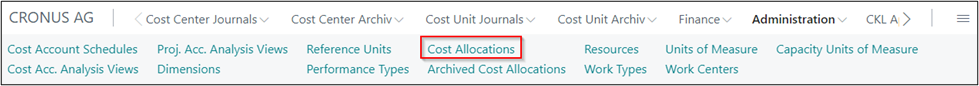

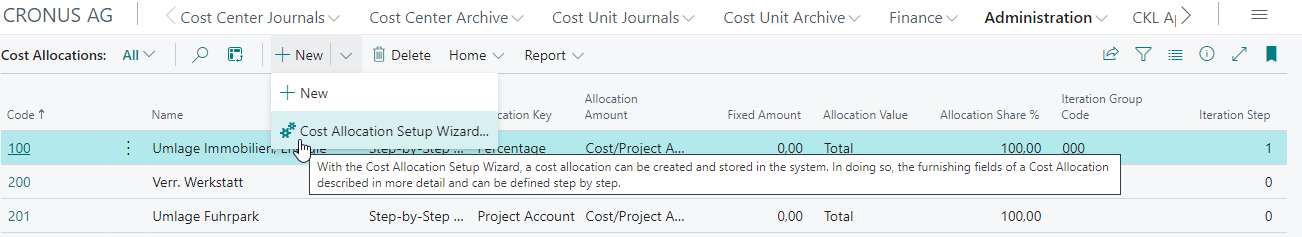

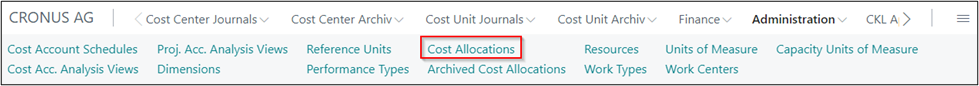

ALLOCATIONS

Allocations are used to perform internal performance distribution between the cost centers. In addition, it is possible to distribute cost center and project amounts to project accounts based on allocations.

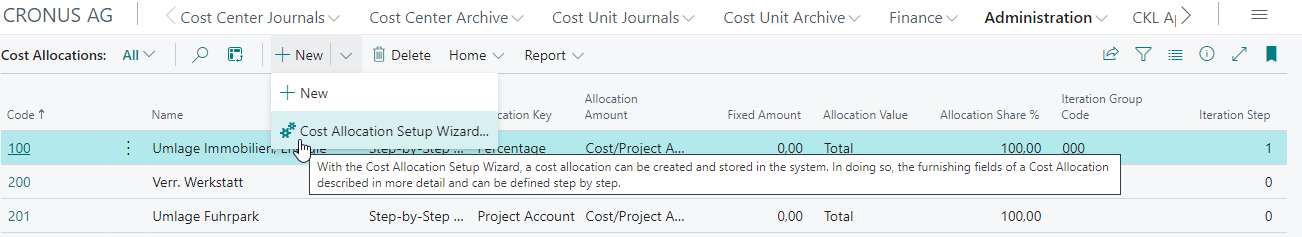

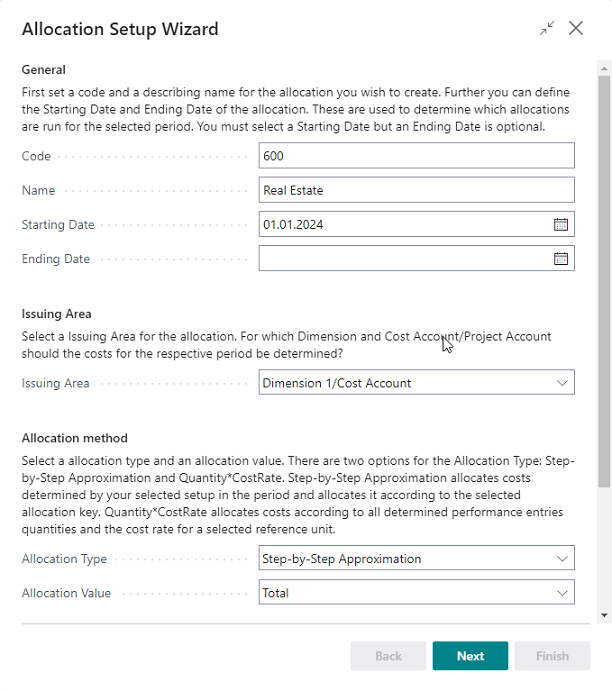

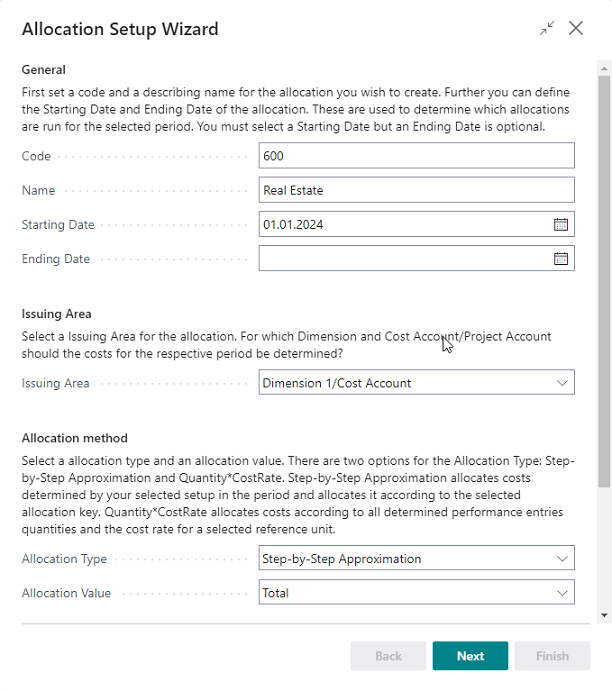

Cost Allocation Setup Wizard

The Cost Allocation Setup Wizard can be used to define basic setup parameters for an allocation. The setup fields of the allocation are described in more detail and can be defined step by step. In addition, an allocation line and allocation assignment can be defined. The allocation can then be individually changed and expanded.

|

| Abb. Example Cost Allocation Setup Wizard |

|

| Abb. Example Cost Allocation Setup Wizard - Step 1 |

|

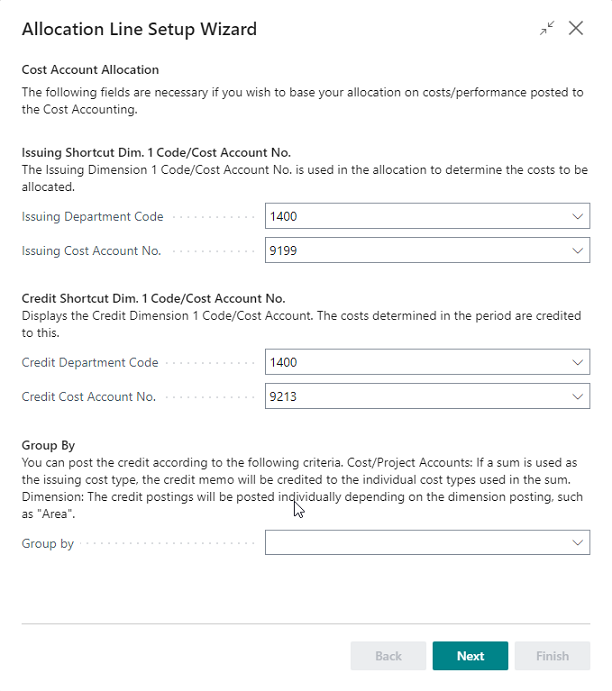

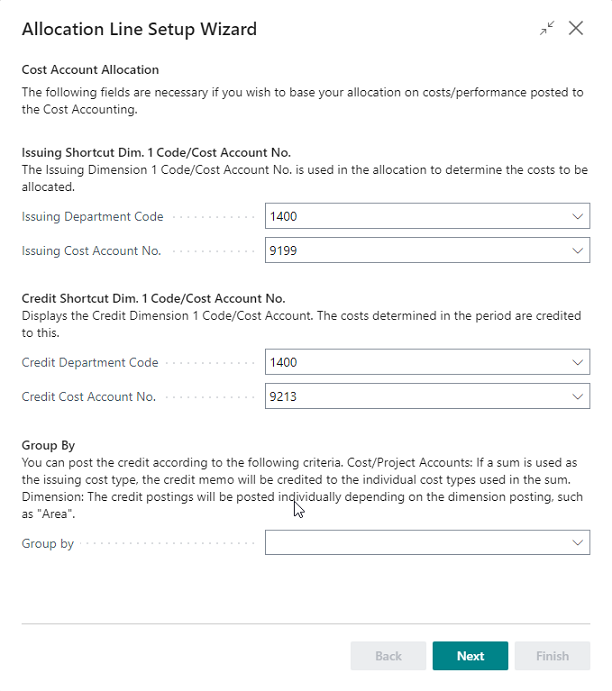

| Abb. Example Cost Allocation Setup Wizard - Step 2 |

|

| Abb. Example Cost Allocation Setup Wizard - Step 3 |

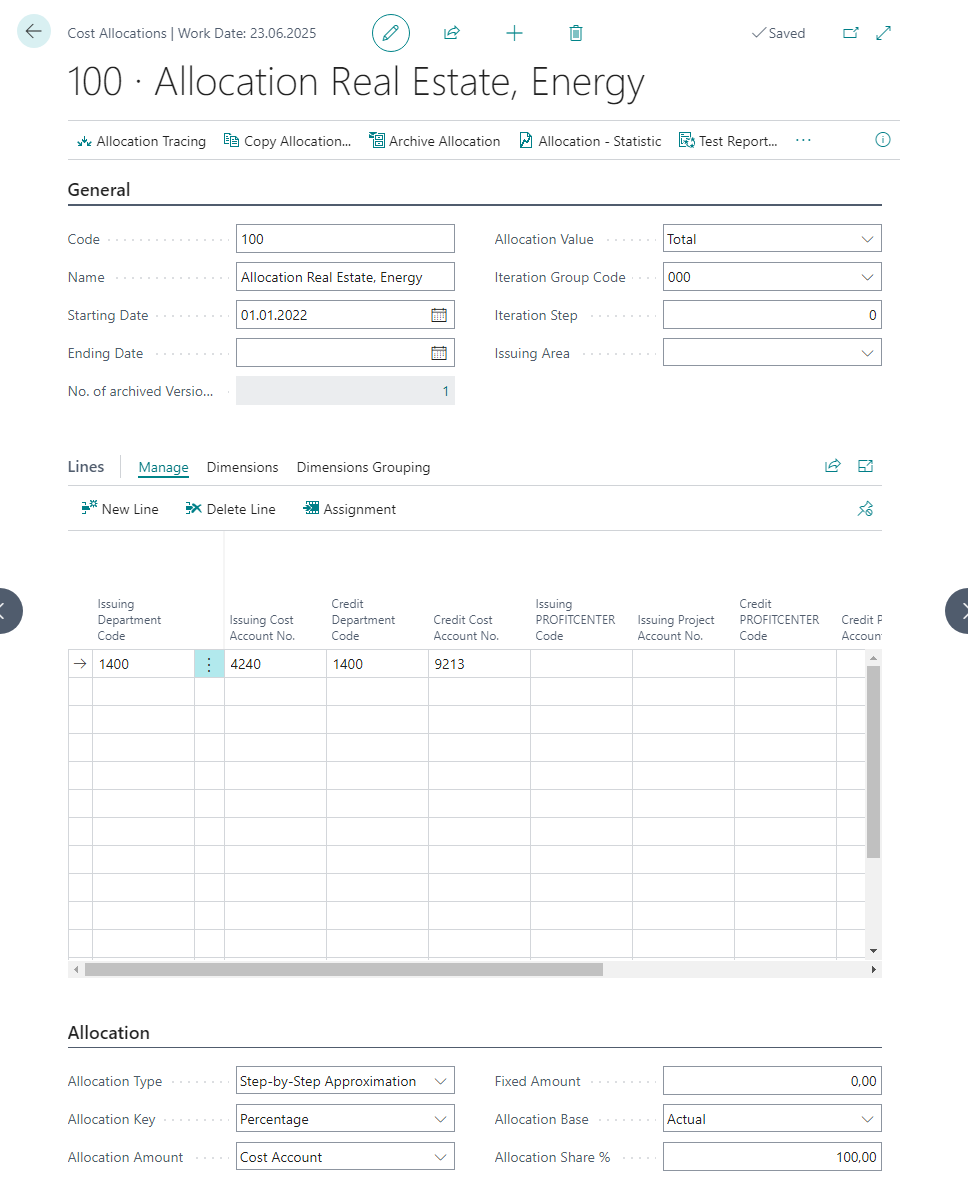

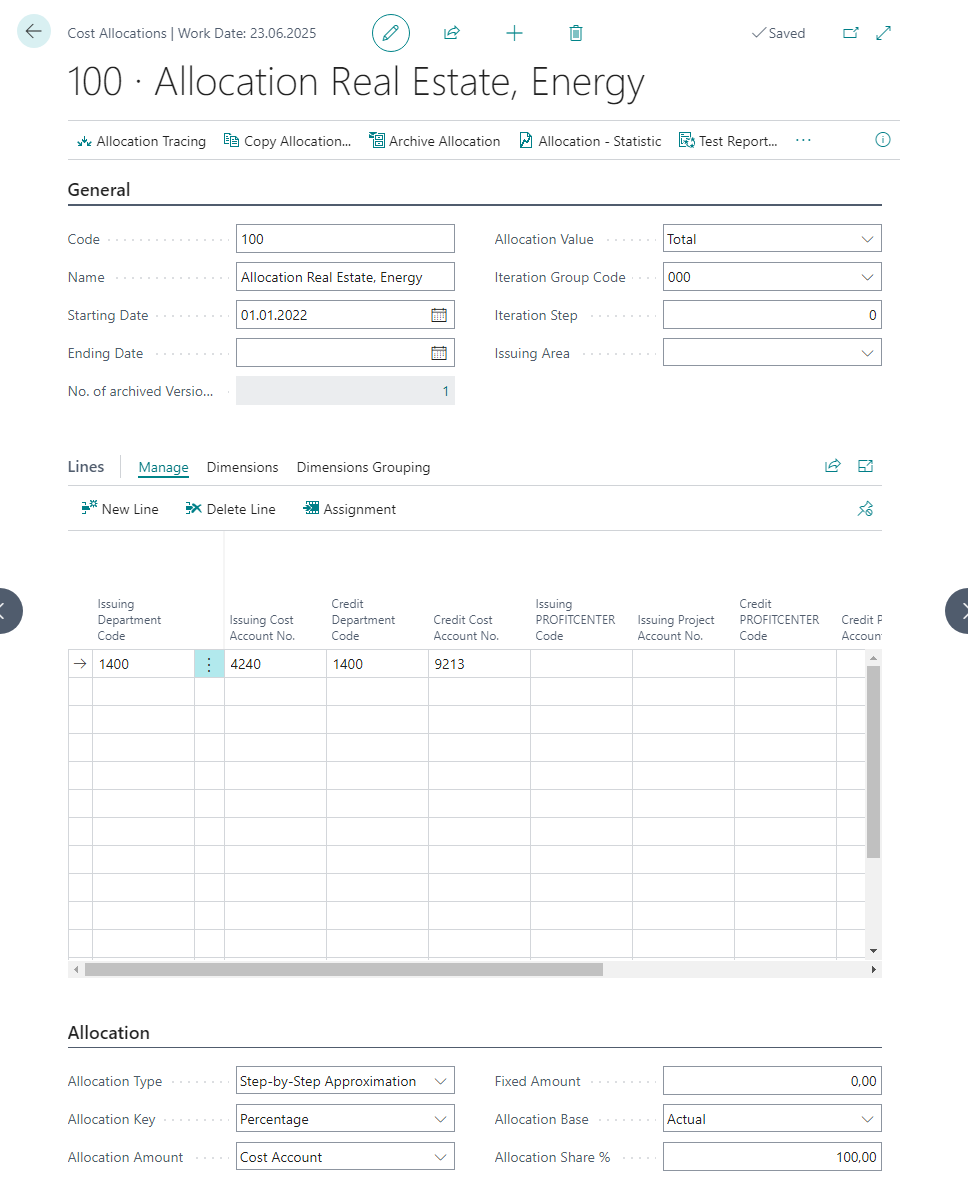

All fields within the allocations are described in more detail below.

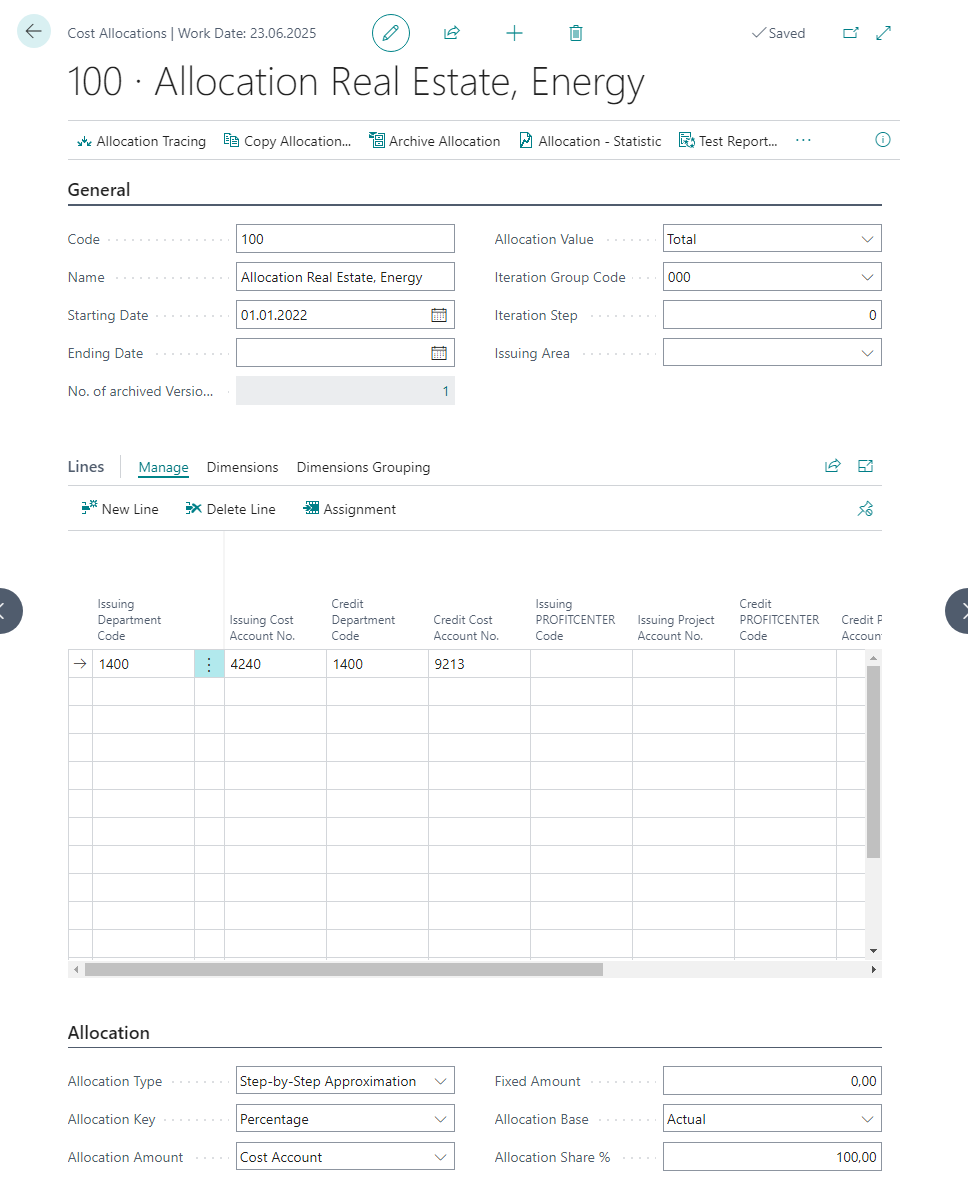

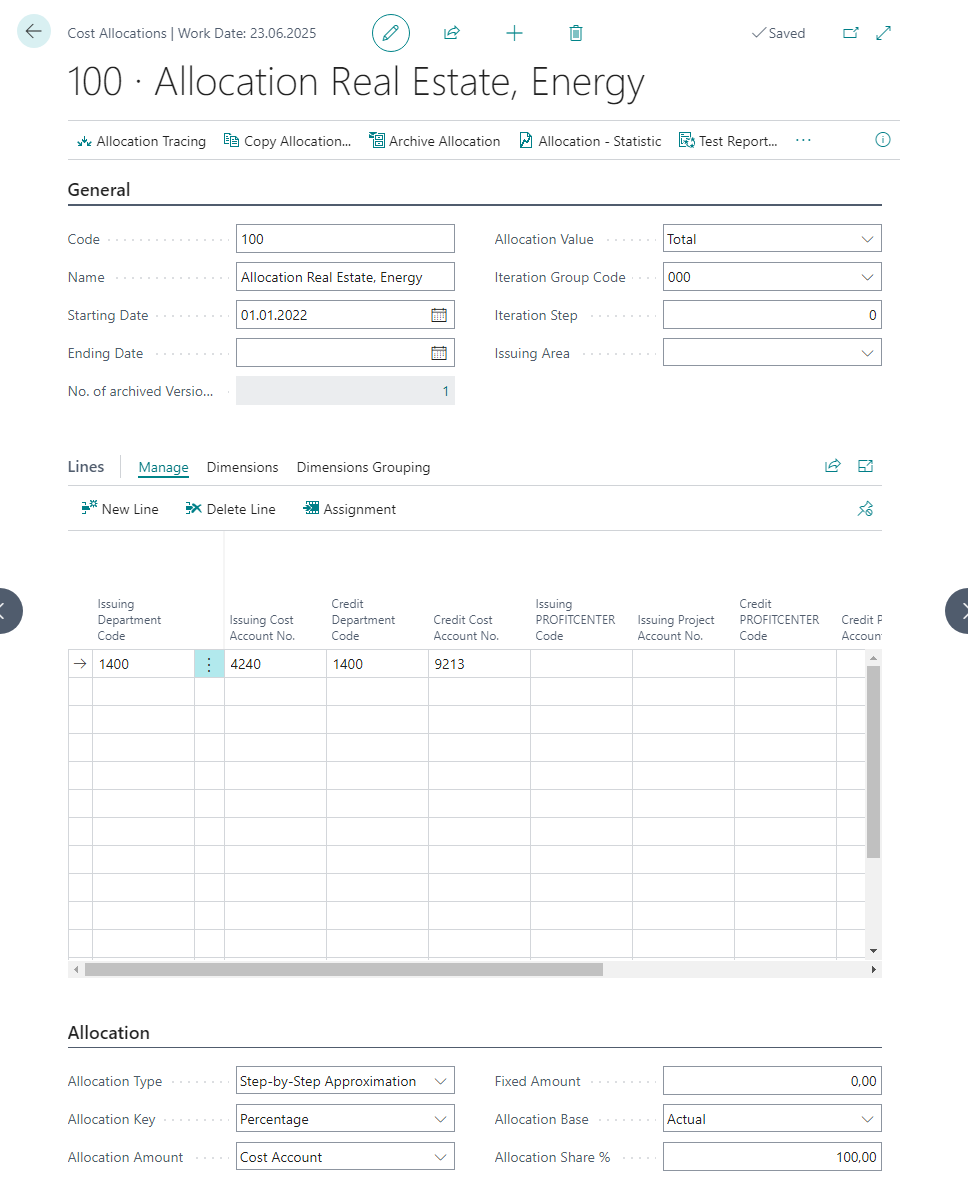

|

| Figure Administration - Cost Allocations |

|

| Figure Example Cost Allocations |

| Option |

Description |

| General |

|

| Code |

This field is used to enter a code for the allocation. Note: It is recommended to use a numerical code. |

| Name |

This field is used to enter a name for the allocation. Note: It is recommended to enter cost centers that are already issuing or receiving. |

| Starting Date |

This field is used to enter the starting date on which you want the system to activate the allocation. |

| End Date |

This field is used to enter the end date on which you want the system to end the allocation. Note: The end date is optional and can be used for allocations whose parameters e. g. change or are completely omitted in the next fiscal year. |

| No. of Archived Versions |

If you archive the allocations, the number of archived allocations will be shown here. If you click on the value, the system will directly open the allocation archive. |

| Allocation Value |

This field is used to specify for the allocation to distribute the amounts as: Total: The allocation will distribute the sum of the fix and variable amounts of the cost or project accounts. Fix: The allocation will distribute only fix amounts of the cost or project accounts. Variable: The allocation will distribute only variable amounts of the cost or project accounts. |

| Iteration Group Code |

Each allocation must be assigned to an iteration group. Within this iteration group, the allocations are processed according to a fix order, which must also be indicated on the allocation card. Iteration groups are used to determine which allocations belong to a group. The allocations of an iteration group are processed one after another. The number of loops of the iteration group indicates how many times the allocations are processed one after another. |

| Iteration Step |

This field is used to specify the iteration order. The allocation is first processed within the iteration group. The allocations of an iteration group are generally processed one after another. |

| Issuing Area |

Reduce the number of fields in the Allocation Line View to increase visibility and streamline your setup. By selecting Dimension 1/Cost Account only the necessary fields for an allocation based on issuing Dimension 1/Cost Accounts are made visible. By selecting Dimension 2/Project Account only the necessary fields for an allocation based on issuing Dimension 2/Project Accounts are made visible. |

| Lines |

|

| Issuing COST ACCOUNT Code |

This field is used to enter the cost account with the costs you want to allocate. |

| Issuing Cost Type No. |

This field is used to enter the cost account’s cost type with the costs to allocate. |

| Credit Cost Type Code |

This field is used to enter the cost account with the costs to allocate and which receives a credit memo from an allocation. The application will populate this field by using the value of the issuing cost account. |

| Credit Cost Account No. |

This field is used to enter the account to which you want to post the credit memo for the cost account. |

| Issuing PROJECT ACCOUNT Code |

This field is used the project account with the costs to allocate. |

| Issuing Project Account No. |

This field is used to enter the project account number with the costs to allocate. |

| Credit PROJECT ACCOUNT Code |

This field is used to enter the project account with the costs to allocate and which receives a credit memo from an allocation. The application will populate this field by using the value of the issuing project account. |

| Reference Unit Code |

This field is used to specify a reference unit if you have selected the “Performance” allocation key. Thus, the application will refer to the posted quantities/performances during allocation. |

| Reference Cost Account Code |

This field is used to define a reference cost account if you have selected the “Cost Account” allocation key. Thus, the application will refer to the posted quantities of these accounts during allocation. |

| Reference Cost Account No. |

This field is used to define a reference cost account if you have selected the “Cost Account” allocation key. Thus, the application will refer to the posted quantities of these accounts during allocation. |

| Project Reference Unit Code |

This field is used to define a reference project account if you have selected the “Project Performance” allocation key. Thus, the application will refer to the posted quantities/performances during allocation. |

| Cost Rate |

The allocation can distribute the costs according to the following values for the “Quantity * Cost Rate” allocation type: Unit Cost Performance Source: The costs will be allocated according to the specified unit costs of the resource or work center. Direct Cost Performance Source: The costs will be allocated according to the specified direct costs of the resource or work center. Overhead Cost Performance Source: The costs will be allocated according to the specified overhead costs of the resource or work center. |

| Credit Project Account No. |

This field is used to specify the account to be used to post the credit memo to the project account. |

| Group by |

You can post the credit according to the following criteria: Cost/Project Accounts If a sum is used as the issuing cost type, the credit memo will be credited to the individual cost types used in the sum. Dimension: The credit postings will be posted individually depending on the dimension posting, such as "Area". |

| Ignore Issuing Dimension Codes on Reference Units |

Place a check mark in this field if quantity postings are not posted in relation to the issuing cost account. With this field activated, the application will only consider the performances of the receiving cost account to distribute the values. |

| Description |

This field is used to enter a description for the allocation which can be freely selected. |

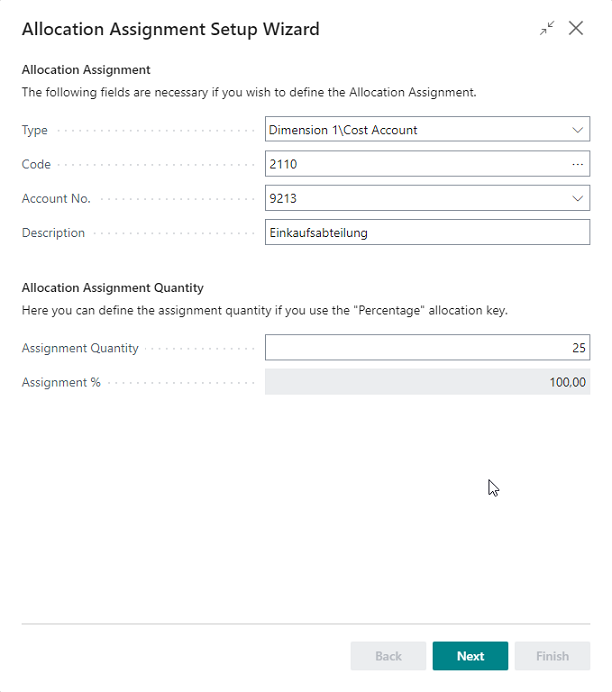

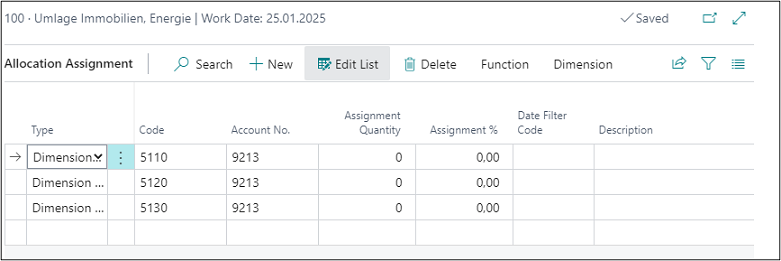

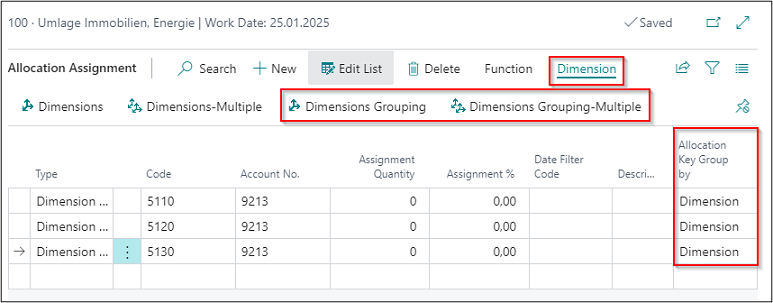

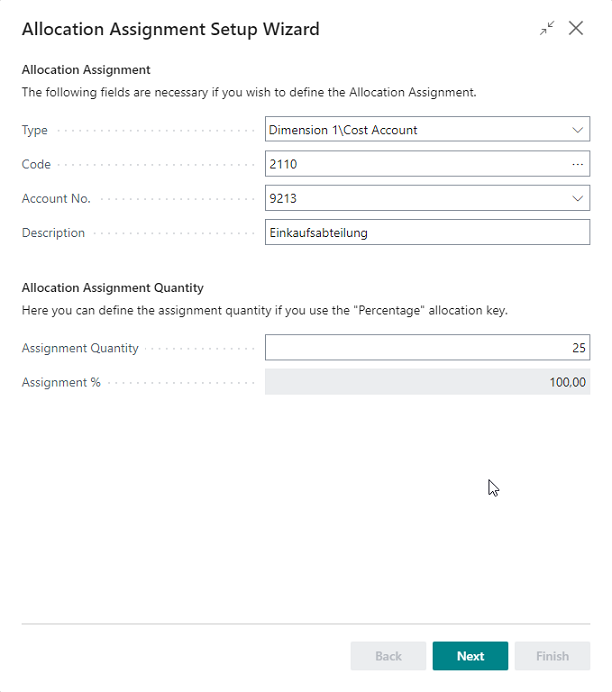

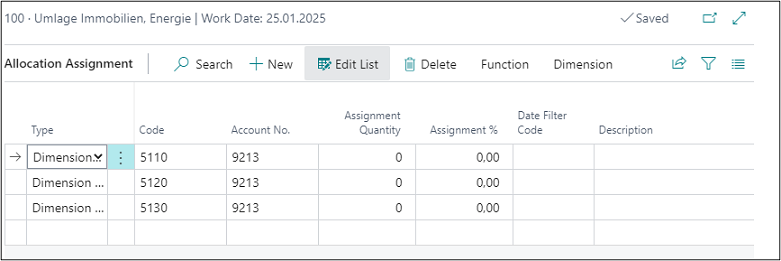

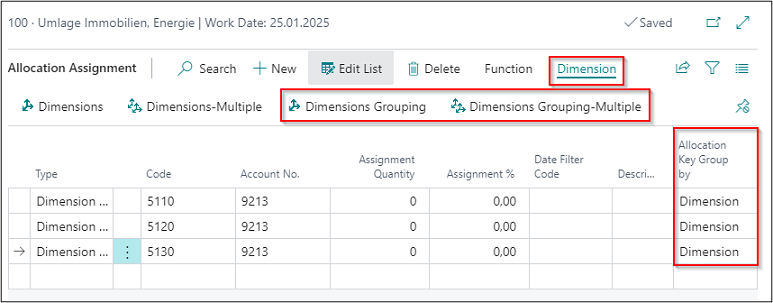

Allocation Assignment

|

| Figure Allocation Assignment |

| Option |

Description |

| Type |

You can select one of the following types: Dimension 1/Cost Account: Select this option if you want to debit selected cost accounts. Dimension 1 Filter/Cost Account: Select this option if you want to debit specific cost accounts, such as the cost accounts "1200..1400". Dimension 1/Project Account: Select this option if you want to debit selected project accounts. Dimension 1 Filter/Project Account: Select this option if you want to debit specific project accounts, such as the project accounts "1000..1001". Std. Alloc. Assign.\Cost Account: Select this option if you want to debit cost accounts of a created standard allocation. Std. Alloc. Assign.\Proj. Account: Select this option if you want to debit project accounts of a created standard allocation. |

| Code |

Depending on the type, enter the cost accounts or project accounts in this field that receive costs. |

| Account No. |

This field is used to enter the account that receives the costs for the cost account. |

| Assignment Quantity |

This field is used to enter the assignment quantity if you use the “Percentage” allocation key. |

| Assignment % |

This field is used to enter the assignment percentage if you use the “Percentage” allocation key. |

| Date Filter Code |

During the distribution of costs, the application can refer to historical allocation values from e. g. the previous month, which can be specified in this field. Furthermore, you can select one of the following additional options: Week: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective week based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Last Week: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective previous week based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Month: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective month based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Last Month: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective previous month based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Month of Last Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective month of previous year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Last Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective previous year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Period: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective period based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Last Period: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective previous period based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Period of Last Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective period of previous year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Fiscal Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective fiscal year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. Last Fiscal Year: This option determines the recorded performances, cost account entries, project account entries or project performances in the respective previous fiscal year based on the posting date of the issuing cost account and thus determines the allocation key for allocation assignment. |

| Description |

This field can be used to enter a description for the line. |

| Allocation Key Group by |

You can post the debit posting by using the following option: Dimension The credit memo entries will be posted individually depending on the dimension posting, such as "Area". |

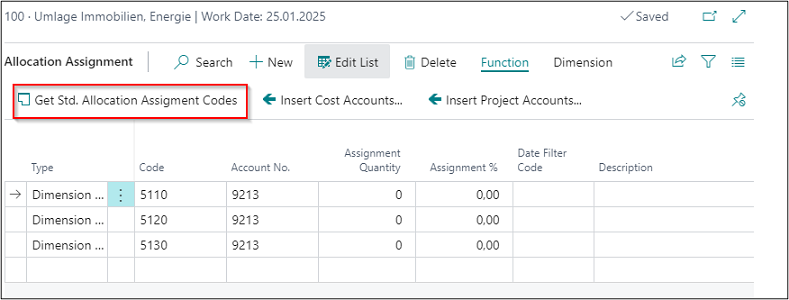

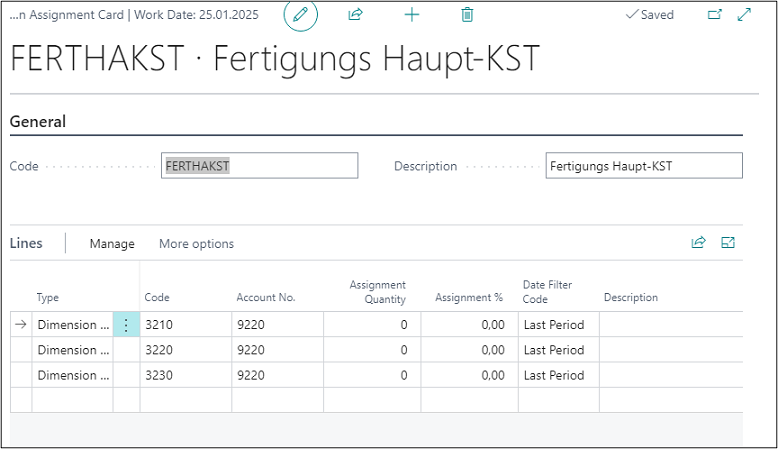

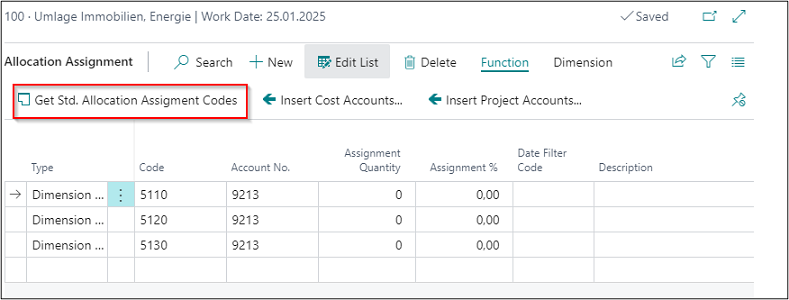

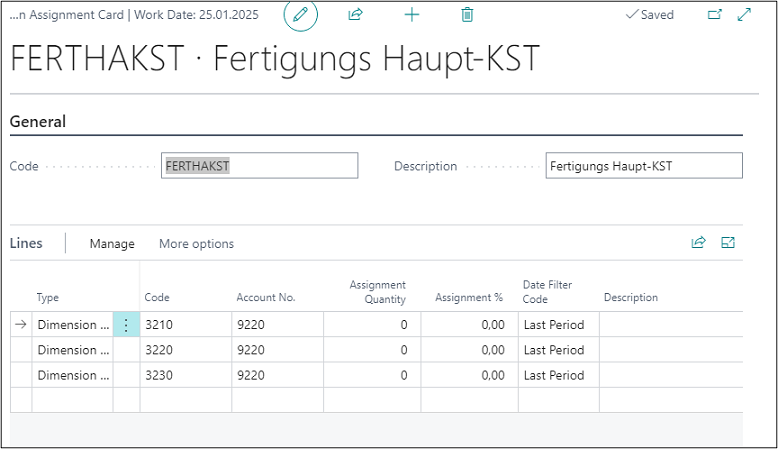

Default Allocation Assignment Codes

You can define templates for the allocation assignments to specify the individual allocation assignment lines. Such templates or default allocation assignments serve are useful to enter large number of allocation assignment lines.

|

| Figure Default Allocation Assignment Codes |

|

| Figure Example Default Allocation Assignment Codes |

| Option |

Description |

| General |

|

| Code |

This field is used to enter a code for the default allocation assignment. |

| Description |

This field is used to enter a description for the default allocation assignment. |

| Lines |

|

| Type |

You can select one of the following types: Dimension 1/Cost Account: Select this option if you want to debit selected cost accounts. Dimension 1 Filter/Cost Account: Select this option if you want to debit specific cost accounts, such as the cost accounts "1200..1400". Dimension 1/Project Account: Select this option if you want to debit selected project accounts. Dimension 1 Filter/Project Account: Select this option if you want to debit specific project accounts, such as the project accounts "1000..1001". Std. Alloc. Assign.\Cost Account: Select this option if you want to debit cost accounts of a created standard allocation. Std. Alloc. Assign.\Proj. Account: Select this option if you want to debit project accounts of a created standard allocation. |

| Code |

Depending on the type, enter the cost accounts or project accounts in this field that receive costs. |

| Account No. |

This field is used to enter the account that receives the costs for the cost account. |

| Assignment Quantity |

This field is used to enter the assignment quantity if you use the “Percentage” allocation key. |

| Assignment % |

This field is used to enter the assignment percentage if you use the “Percentage” allocation key. |

| Date Filter Code |

During the distribution of costs, the application can refer to historical allocation values from e. g. the previous month, which can be specified in this field. Furthermore, you can select one of the following additional options: Week, Last Week, Month, Last Month, Month of Last Year, Year, Last Year, Period, Last Period, Period of Last Year, Fiscal Year and Last Fiscal Year. |

| Description |

This field can be used to enter a description for the line. |

| Allocation Key Group by |

You can post the debit posting by using the following option: Dimension: The credit memo entries will be posted individually depending on the dimension posting, such as "Area". |

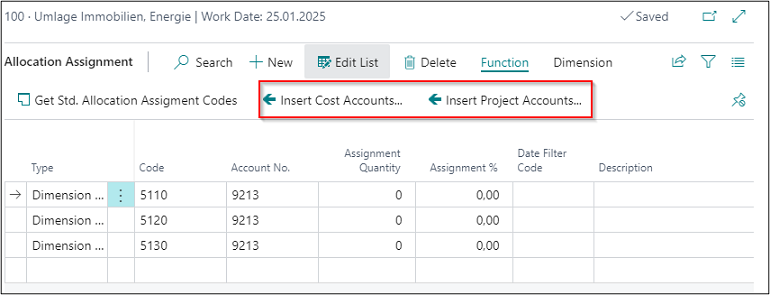

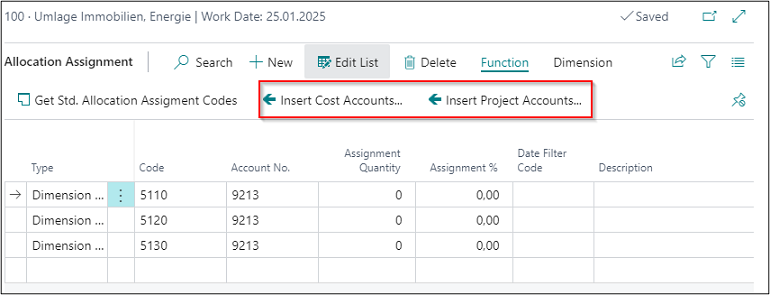

Insert Cost/Projects Accounts

You can also add various cost accounts or project accounts both in the allocation assignment lines and in the default allocation assignments by using the “Insert Cost Accounts” or “Insert Project Accounts” function on the respective cards and select the corresponding cost or project accounts.

|

| Figure Insert Cost or Projects Accounts |

Dimension

If you want to add dimensions to allocation postings, open the Dimension menu item to specify the dimension for one or several cost/project accounts.

| Option |

Description |

| Dimension Code |

This field is used to specify the code for the default dimension. |

| Dimension Value Type |

Here you can specify the dimension value code which will be suggested when using the default dimension. |

| Value Posting |

This field is used to specify how to handle the default dimension and its values. The following options are available: Code Mandatory: If you select this option, a dimension, such as a cost account group, will always be required for posting. Same Code: If you select this option, the same dimension as specified will always be required for posting. No Code: If you select this option, no dimension may be specified during posting. |

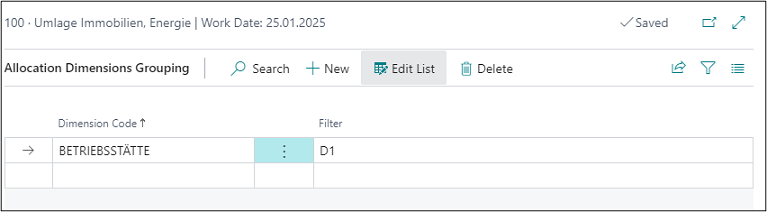

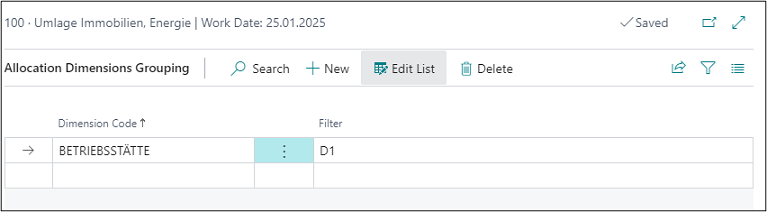

Dimension Grouping

It is possible to group a dimension by cost accounts/project account or dimensions. This can be done for single or several records. If you have selected the Dimension option in the “Allocation Key Group” field, you can define the dimension you want to use for grouping in the following window.

For example, you can group the allocation of real estate costs with reference to an operational site.

|

| Figure Dimension Grouping |

|

| Figure Example Dimension Grouping |

| Option |

Description |

| Dimension Code |

This field is used to select the dimension you want to use to group the debit transactions. |

| Filter |

If you do not want to apply grouping to all records, you can filter on a specific record, such as "D1" for site Düsseldorf Nord. |

Allocation tab

|

| Figure Example Allocation |

| Option |

Description |

| Allocation Type |

This field is used to define the allocation type to distribute costs. You can choose from the following two options: Step-by-Step Approximation: The step-by-step method is used to allocate costs of an issuing cost account in one or more steps completely or only partially to the receiving cost accounts. Quantity * Cost Rate: With this method, the costs of the issuing cost accounts – as with the step-by-step method by performance – are allocated according to the performances posted on the receiving cost accounts. In contrast to the step-by-step method by performance, however, the posted performances are valued at the cost rate of the reference unit of the issuing cost account (e. g. distribution of electricity costs to various main cost accounts by kilowatt hours at a certain price). The allocation is made by using a cost rate per reference quantity, which may result in a surplus or shortfall on the issuing cost account. This surplus/shortfall shows the profitability of the cost accounts and thus has an important control function. |

| Allocation Key |

If you have specified “Step-by-Step Approximation” allocation type, you can specify the allocation key to apply: Performance: The distribution of costs in this allocation method is variable, as it always refers to the performances recorded by the receiving cost accounts in the period. Cost Account: In essence, this procedure corresponds to a step-by-step approximation by performance, where the percentages are calculated based on the costs of a reference cost type already posted to the receiving cost accounts (e. g. distribution of freight costs according to sales numbers of the individual receiving cost accounts). Percentage: In the step-by-step method by percentage, the values are allocated to the receiving cost accounts by using fix percentages. Project Account: If the costs are allocated using the “Project Account” allocation key, it is assumed that the costs are transferred to the project account. The allocation is based on a reference project account, where the percentage is determined for the individual receiving project accounts after posting. Project Performance: The distribution of costs in this allocation method is variable, as it always refers to the performances recorded by the receiving project accounts in the period. Note: If you have selected the “Quantity*Cost Rate” allocation type, it is not required to specify the allocation key. |

| Distribution amount |

This field is used to define whether the costs relate to a Cost Account: The allocation will use a cost account which is defined as issuing and distributes the costs according to the distribution key. Fixed Amount: The allocation will distribute costs according to a fixed amount. Note: If you have selected the “Quantity * Cost Rate” allocation type, it is not required to specify the allocation key. |

| Fixed Amount |

If you have selected a “Fixed Amount” as allocation amount, you need to enter a value in this field. Note: If you have selected the “Quantity*Cost Rate” allocation type, it is not required to specify the allocation key. |

| Allocation Base |

Here you can enter the allocation base. You can specify the values to be allocated to refer to Actual or Budget. Note: If you have selected the “Quantity*Cost Rate” allocation type, it is not required to specify the allocation key. |

| Allocation Share % |

For example, if you enter 100 %, the costs will be allocated completely. This allows you to set up a percentage threshold for the amounts to be distributed. |

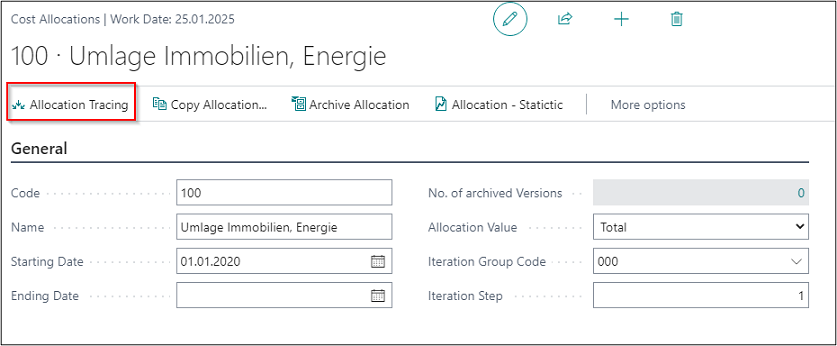

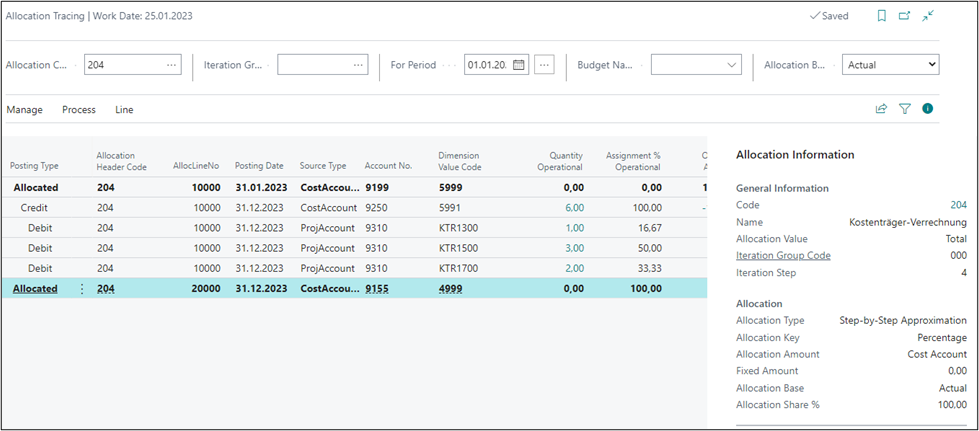

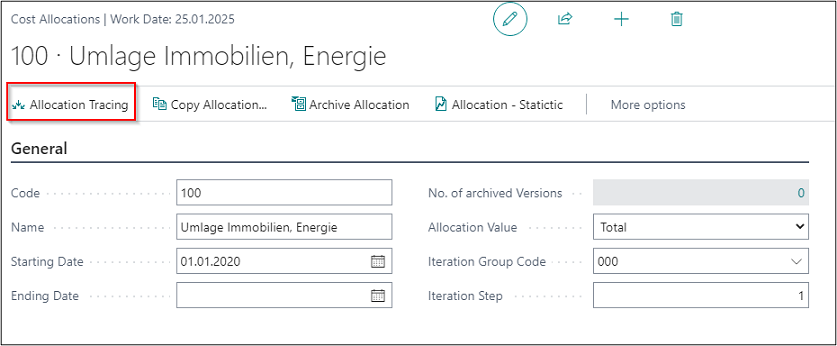

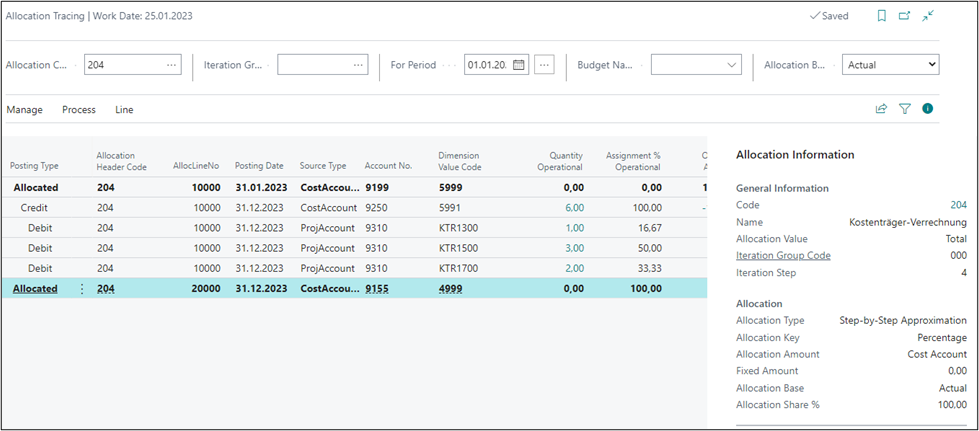

Allocation Tracing

The source data is already visible in detail before the allocation is posted. Therefore, it is possible to check them in advance. For example, the allocation key or allocation original amount can be previously shown and checked. In addition, the user can identify any filter errors in the issuing and credited values as well as in the cost rates and correct them accordingly.

|

| Figure Allocation Tracing |

|

| Figure Example Allocation Tracing |

| Option |

Description |

| Allocation Code Filter |

This field is used to enter the allocation code you want to check in the allocation tracing. |

| Iteration Group Code Filter |

This field is used to the iteration group code want to check in the allocation tracing. |

| For Period |

This field is used to enter the month for which you want to allocate the values. |

| Budget Name |

If you are using budget allocations, you can enter the budget here. |

| Allocation Base |

The following options are available: Actual: Select this option if you want the allocation to be distributed based on the actual values. Budget: Select this option if you want to distribute the allocation based on the budget values. |

| Posting Type |

This field shows the cost accounts or project accounts to be issued and credited. |

| Allocation Header Code |

This field shows the allocation code. |

| Allocation Line No. |

This field shows the line number within the allocation. |

| Source Type |

This field indicates whether the values come from cost accounts or project accounts. |

| Account No. |

This field shows the issuing, crediting, receiving cost accounts or project accounts. |

| Dimension Value Code |

This field shows the receiving cost accounts or project accounts. |

| Quantity |

This field shows the quantities which is used as the distribution quantity in the allocation. |

| Allocation % |

This field shows the percentage distribution of costs. |

| Operational Amount Fix |

This field shows the fixed operational credit or debit amount. |

| Operational Amount Var |

This field shows the variable operational credit or debit amount. |

| Tax Amount Fix |

This field shows the fixed tax credit or debit amount. |

| Tax Amount Var |

This field shows the variable tax credit or debit amount. |

| Reference Unit Code |

This field shows the reference unit whose quantities are used during allocation. |

| Date Filter Code |

This field indicates whether the allocated values refer to a date filter, such as the previous month. |

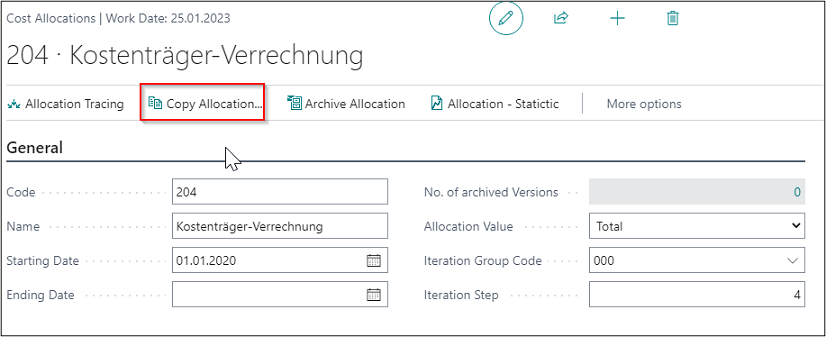

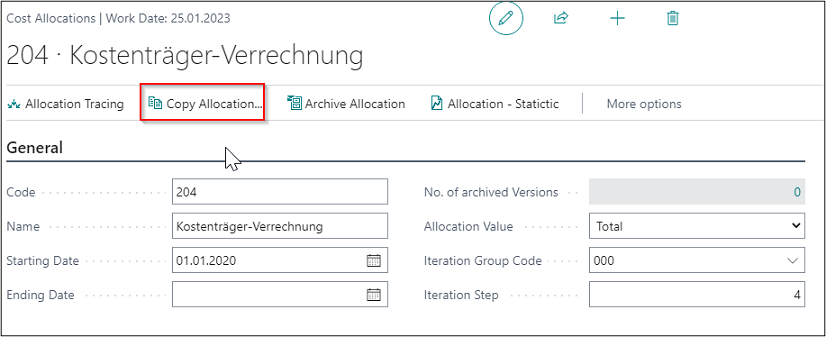

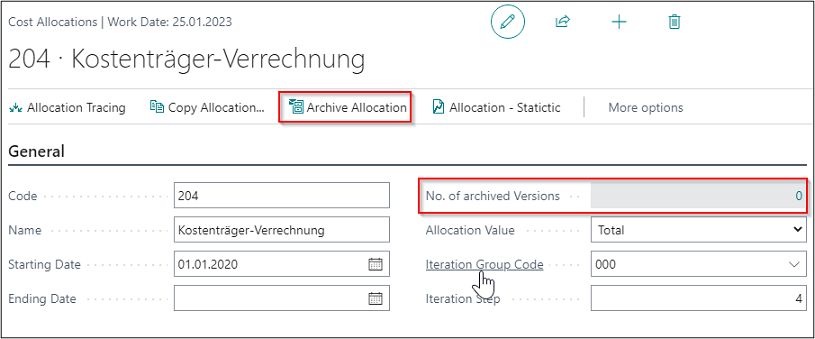

Copy Allocation

|

| Figure Call Copy Allocation |

|

| Figure Copy Allocation |

| Option |

Description |

| Allocation Header new |

This field is used to enter the new allocation code you want to create as a copy. |

| Code |

This field is used to enter the allocation code to be copied. |

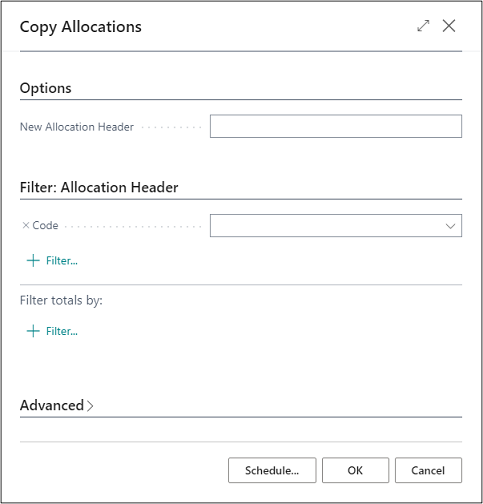

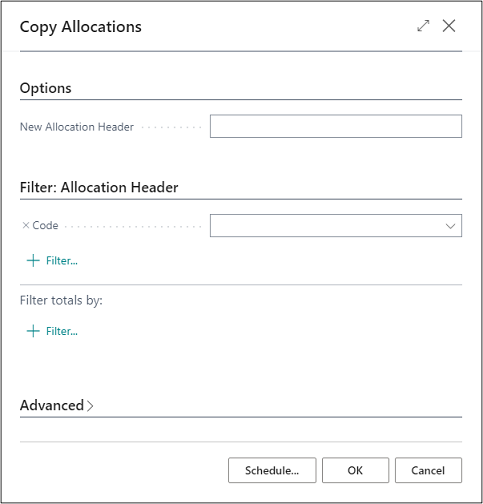

Archive Allocation

For example, if the percentages in the allocation distribution change, you can archive an allocation before you make the changes so that you can access the original allocation later on.

|

| Figure Call Archive Allocation |

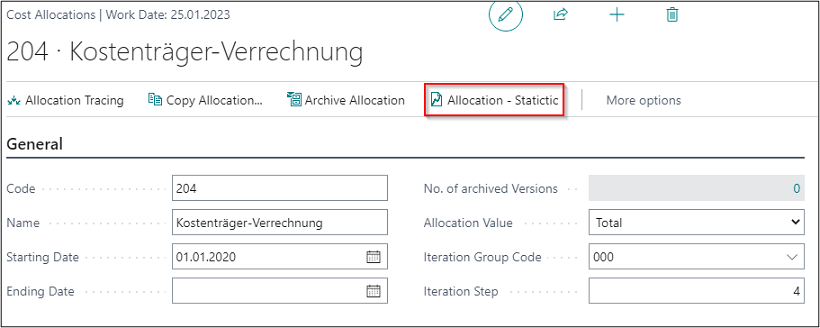

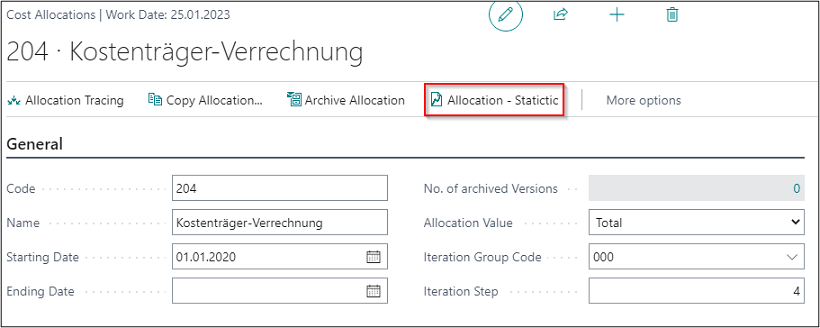

Allocation Statistic

|

| Figure Call Allocation - Statistic 1 |

|

| Figure Call Allocation - Statistic 2 |

| Option |

Description |

| For Period |

This field is used to enter the month you want to use in the statistics. |

| Allocation Header Code |

This field is used to enter the allocation you want to use in the statistics. |

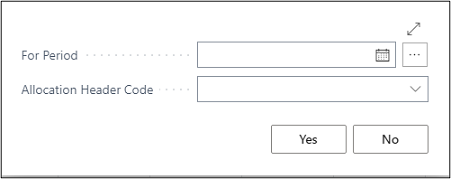

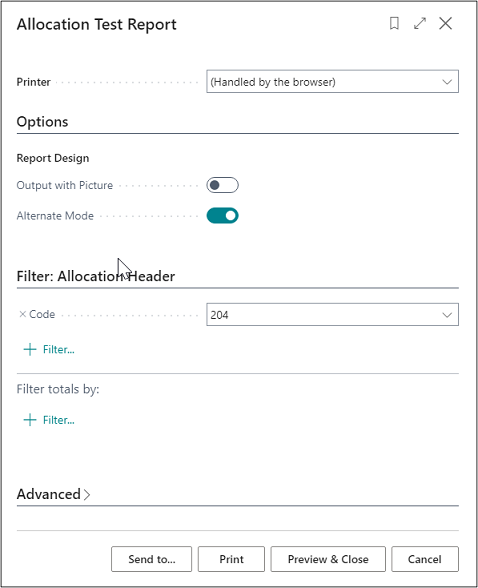

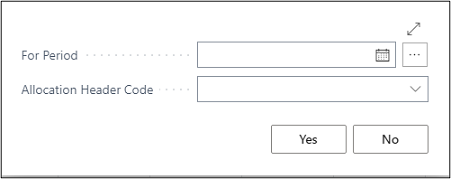

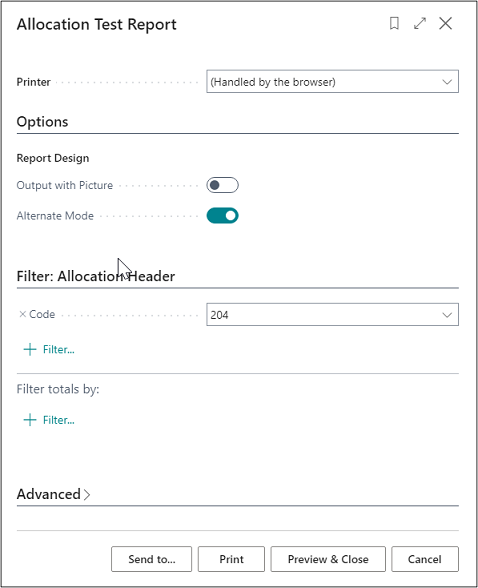

Test Report

On the Allocation Card, select "Function" -> "Test Report".

|

| Figure Allocation Test Report |

|

| Figure Example Allocation Test Report |

| Option |

Description |

| Output with Picture |

Activate this field if you want to print your company logo in the report. |

| Alternate Mode |

This field is used to activate section lining in the report. |

| Code |

This field contains the allocation which is checked in the test report. |

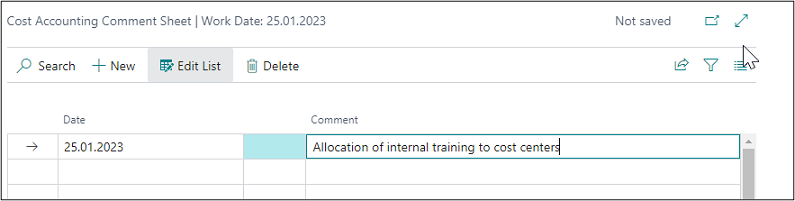

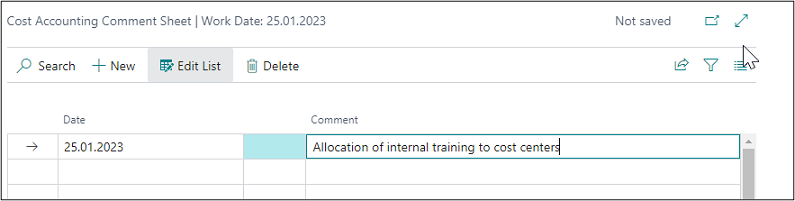

To enter comments, select "Related -> Allocation -> Comments" on the Allocation Card.

|

| Figure Allocation Comments |

| Option |

Description |

| Date |

This field is used to enter a date for the comments. |

| Comment |

This field is used to enter the comment text. |

ALLOCATION ARCHIVE

If you archive an allocation, it will be saved in the allocation archive. It can be restored if you want to reuse it.

|

| Figure Allocation Archive |

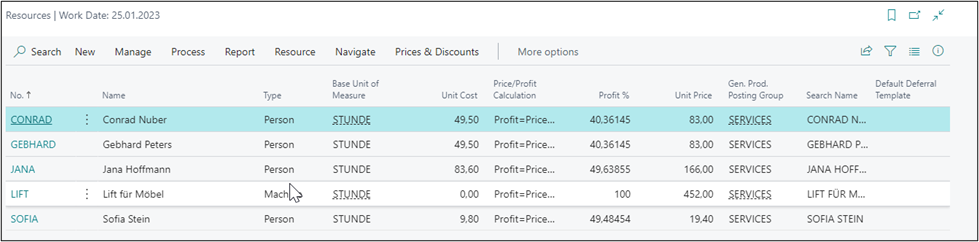

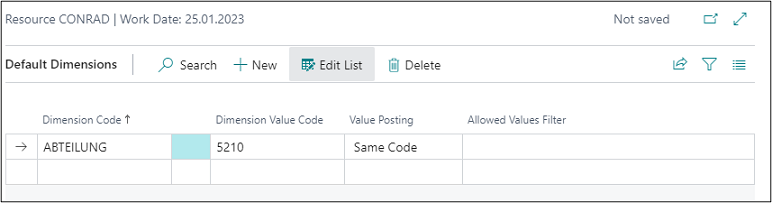

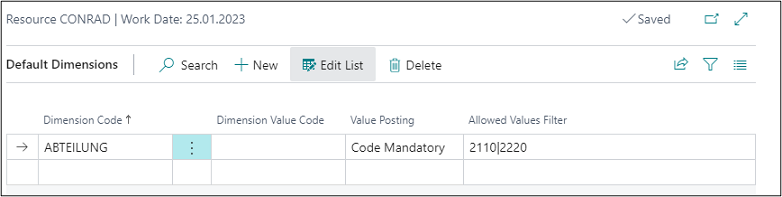

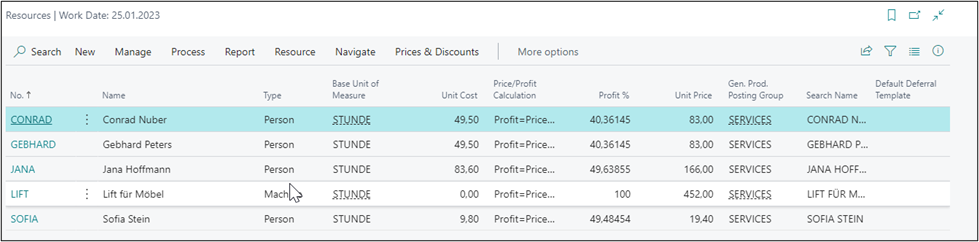

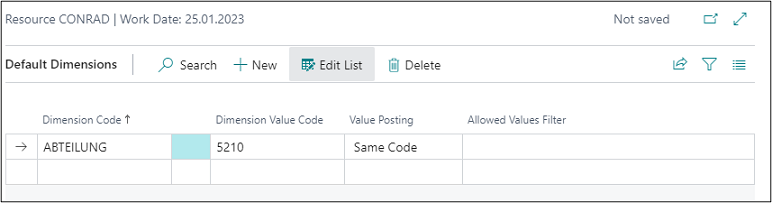

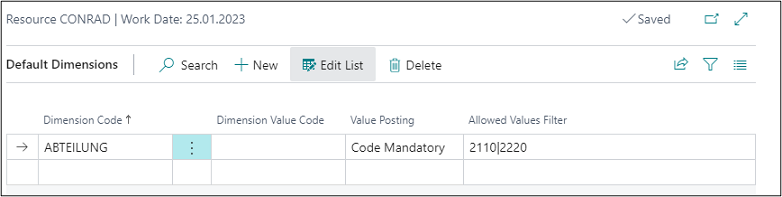

RESSOURCES

|

| Figure Ressources |

|

| Figure Ressources - Dimensions 1 |

|

| Figure Ressources - Dimensions 2 |

| Option |

Description |

| Dimension Code |

This field is used to specify the dimension you want to assign to the resource. For example, if you want to assign a master cost account to an employee, enter "Department Code". |

| Dimension Value Code |

This field is used to specify the cost account you want to assign the employee to. |

| Value Posting |

This field is used to specify how to handle the default dimension and its values. The following options are available: Code Mandatory: If you select this option, a dimension, such as a cost account group, will always be required during posting. Same Code: If you select this option, the same dimension as specified will always be required during posting. No Code: If you select this option, no dimension may be specified during posting. |

| Allowed Filters |

In this field, you can specify the allowed cost account which can be selected by the user for this resource. |

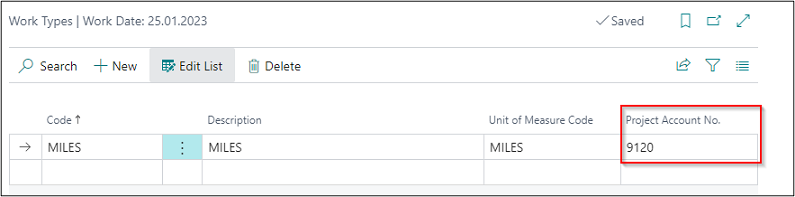

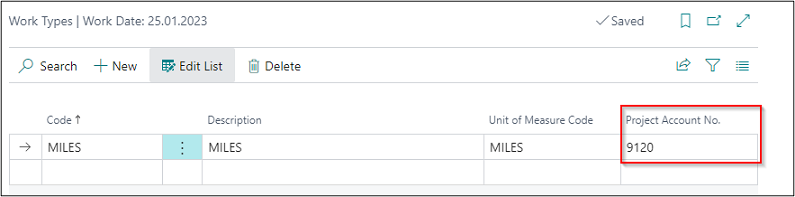

WORK TYPES

|

| Figure Work Types |

| Option |

Description |

| Project Account No. |

This field is used to enter the account number to be used for debit posting of the project accounts during the transfer to Cost Accounting. |

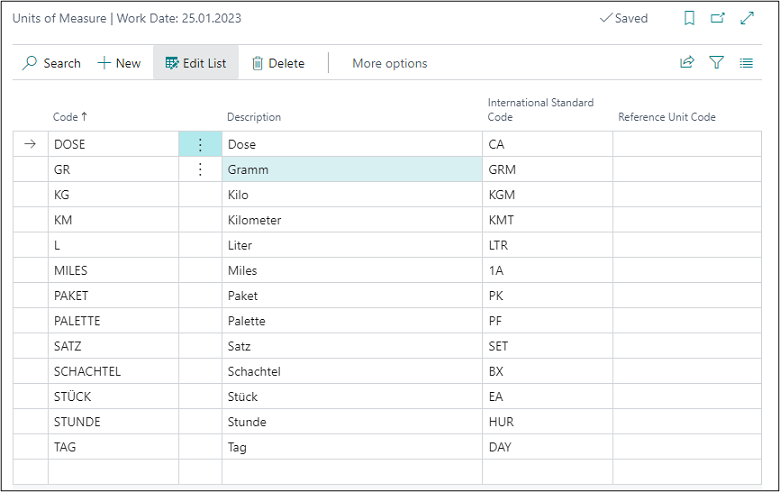

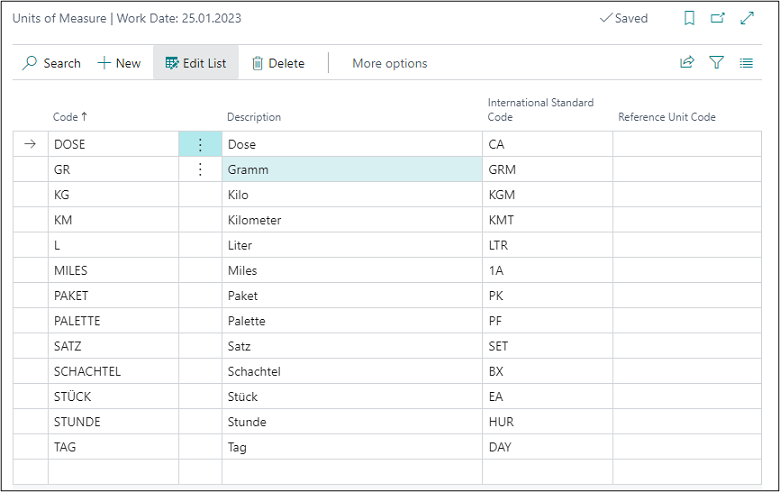

UNITS OF MEASURE

|

| Figure Units of Measure |

| Option |

Description |

| Reference Unit Code |

This field is used to enter the reference unit of cost accounting as a mapping to the resource unit. This ensures that the quantities with the correct units are also considered and posted in Cost Accounting. |

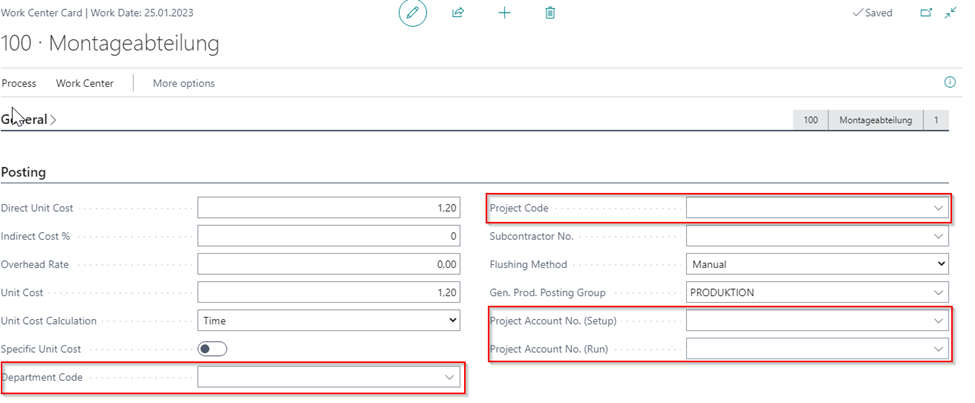

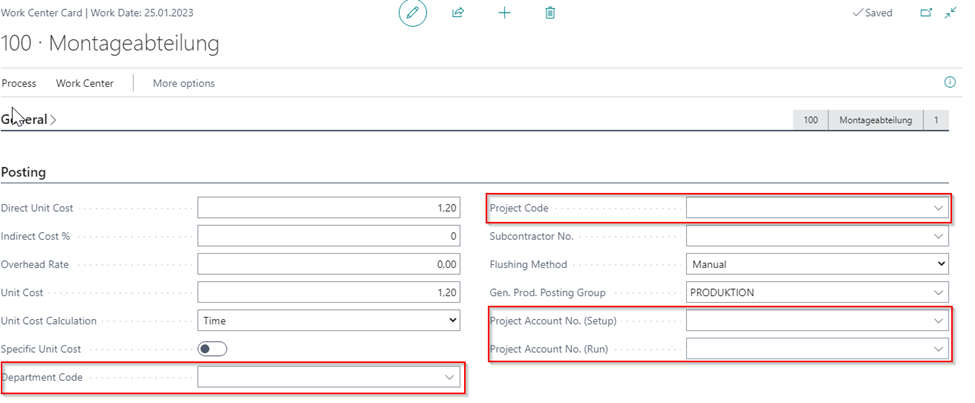

WORK CENTERS

|

| Figure Work Centers |

| Option |

Description |

| Department Code |

This field is used to enter the master cost account of the work center. |

| Project Account Code |

This field is used to enter the project account of the work center. |

| Project Account No. (Setup) |

If you want to use setup times of the work center for reference allocation to evaluate the production performances, you can enter the account for setup times in this field. |

| Project Account No. (Run) |

If you want to use processing times of the work center for reference allocation to evaluate the production performances, you can enter the account for processing times in this field. |

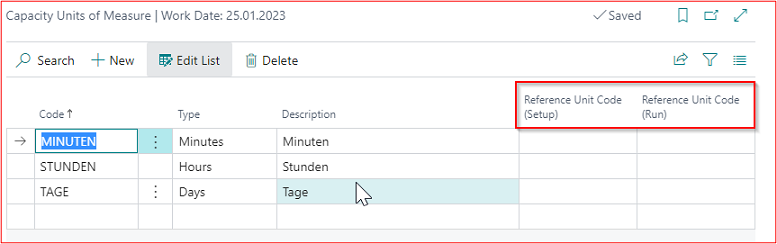

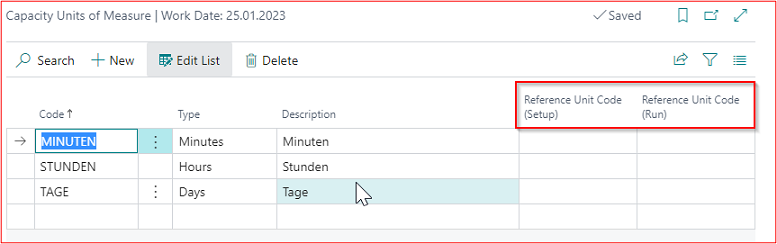

CAPACITY UNITS OF MEASURE

|

| Figure Capacity Units of Measure |

| Option |

Description |

| Reference Unit Code (Setup) |

To link capacity units of measure with the corresponding reference unit for setup times, you can specify the reference unit in this field. |

| Reference Unit Code (Run) |

To link capacity units of measure with the corresponding reference unit for processing times, you can specify the reference unit in this field. |