Costing Policy Change

COSTING POLICY CHANGE STEPS

The system carries out the following four steps to change the costing policy:

- All open positive item entries of the item are determined. This corresponds to the incoming transactions, such as purchases, transfer inputs, actual reports of production and assembly orders.

- A negative adjustment is posted for each of these positive item entries.

- The program changes the costing policy from the costing method, item tracking code, base unit of measure and, if necessary, the (fixed) standard costs of the item master record and in all associated inventory data.

- For the original positive open item entries additions are then once again created with the new costing policy and the new standard cost (fixed) if a tick has been set.

- The program ensures that the reservations for the originally open positive item entries now apply to the new item entries.

- The program creates a new costing policy entry for the item. The entry shows the new costing method, the new item tracking code and/or the new base unit of measure code, the starting date and the number of the first item entry for which the costing policy is valid.

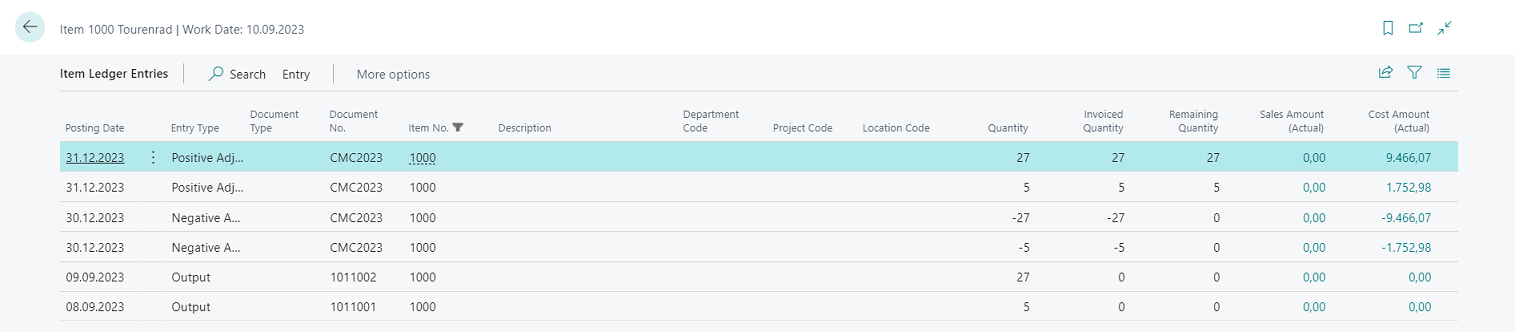

Item entry of a costing policy change:

|

|---|

| Figure Item Ledger Entries of a Costing Policy Change |

Information

When the costing policy is changed, the dimensions of the original entry are not used, but rather always the standard dimensions of the item master record.

PREREQUISITE

The following conditions must be met to change the costing policy:

- There may not be any open negative item entries.

- There may not be any partially completed production order lines. If such lines exist, you can simply change the quantity in the production order line to the value of the quantity completed and finish the production order. A new production order should then be created with the quantity still outstanding. This procedure allows you to proceed with changing the costing method.

- No open transfer orders may exist for the item for which the output side is posted and the input side is still missing. This is because it is not possible to move quantities directly from the transit storage locations.

- There may not be any item entries with the same or later date than the validity date from the requirement window Adopt costing policy.

Warning

Before changing the costing policy, we recommend creating a data backup of the database. In addition, the changes should first be changed on a test system to enable the resulting new values to be thoroughly checked without affecting the genuine data.

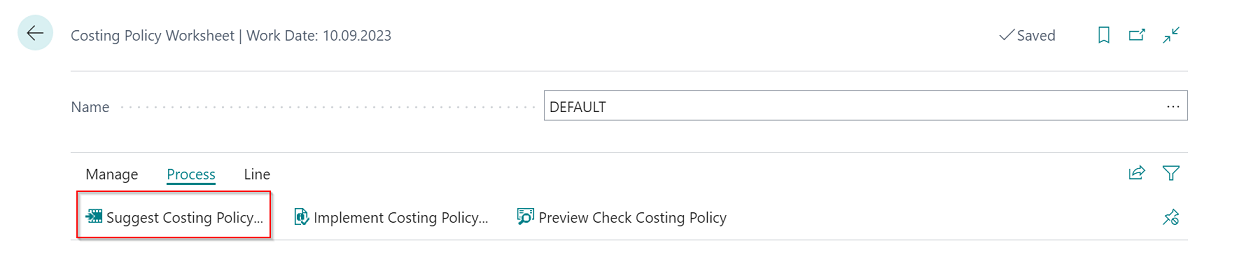

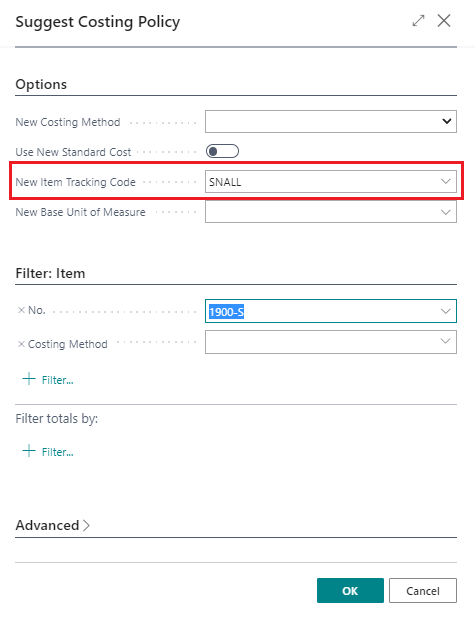

SUGGEST COSTING POLICY

To change the costing policy of one or more items, open the costing policy worksheet (see chapter Costing Policy Worksheet). The function suggest costing policy enables you to automatically fill the proposal journal with the desired items.

|

|---|

| Figure 1 Suggest Costing Policy... |

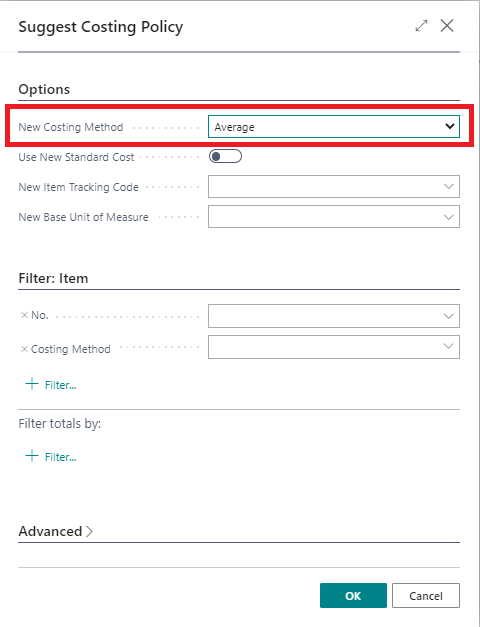

The new costing policy must be stated, e.g. the new costing method. In addition, items can be filtered via the register to enable particular items to be included in the proposal.

|

|---|

| Figure 2 Suggest Costing Policy... |

| Field | Description |

|---|---|

| New Costing Method | The costing method is entered here to which the items are to be changed. |

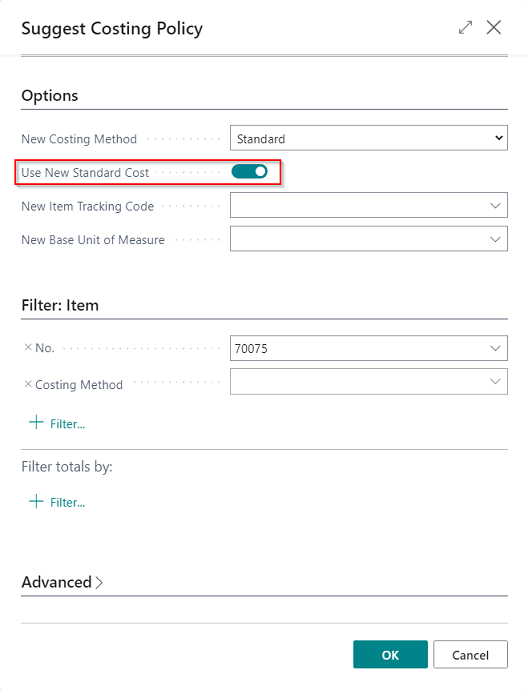

| Use New Standard Cost | Is only applied to changing to the standard costing method. If the check box is selected, the new standard cost fixed is already used for recalculation of the item inventory value. If you leave the field empty, the program uses the old fixed standard cost when recalculating the open item entries as a result of which the inventory value reflects the old fixed standard cost. The program then adopts the new fixed standard cost in the next entry made for the item. |

| New Item Tracking Code | The item tracking code is entered here to which the items are to be changed. |

| New Base Unit of Measure Code | The base unit of measure is entered here to which the items are to be changed. |

In the register Filter item, filters can be set for the item master to ensure only particular items are adopted in the costing policy worksheet.

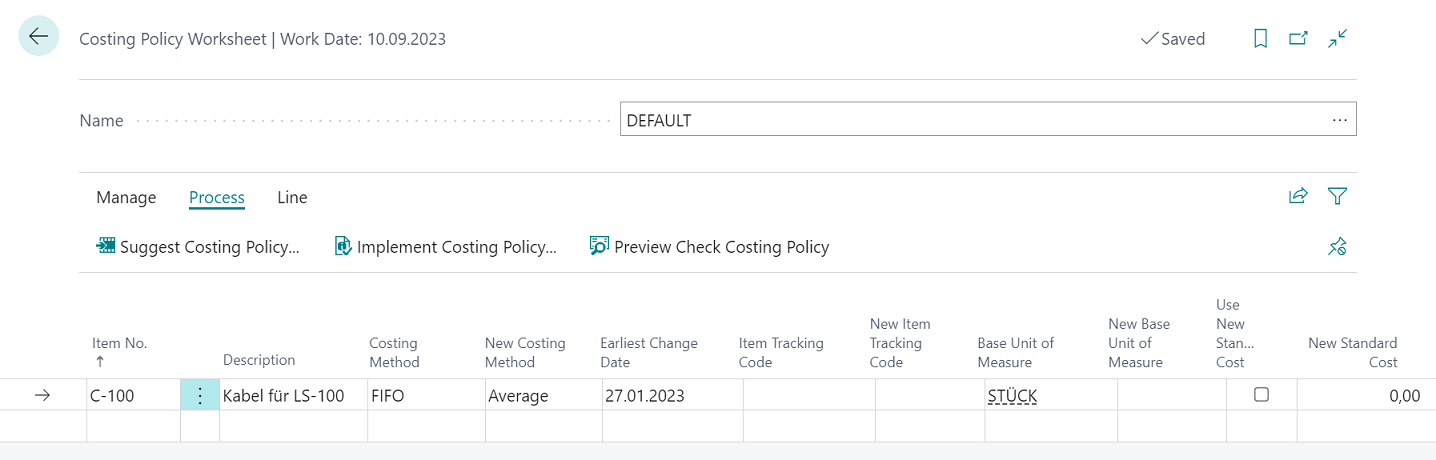

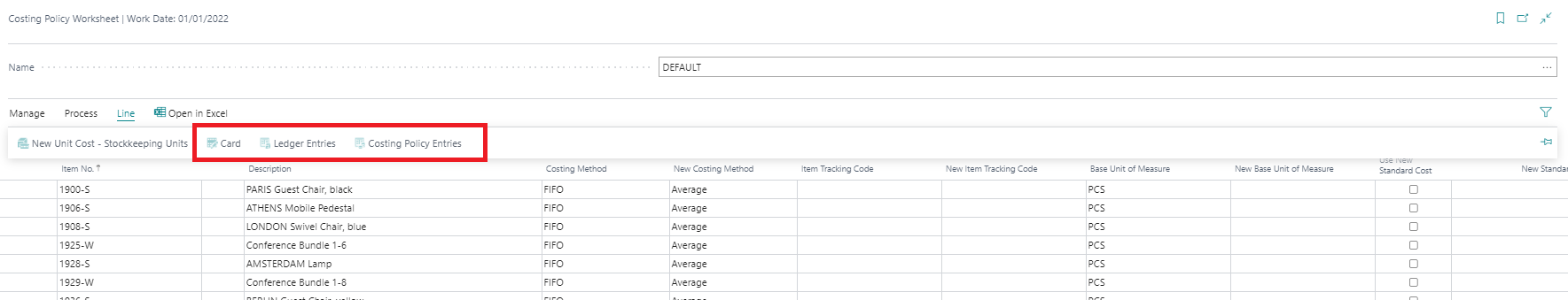

|

|---|

| Figure Example Costing Policy Worksheet |

The following information is to be found in the costing policy worksheet:

| Field | Description |

|---|---|

| Item No. | Number of the item for which the costing policy was proposed. |

| Description | Description of the item for which the costing policy was proposed. |

| Costing Method | The previous costing method of the item. |

| New Costing Method | The new costing method which is to be changed to. |

| Earliest Change Date | Shows the earliest possible point in time at which the current costing method, item tracking code or base unit of measure can be changed to the new one for the item. This is dependent on the most recent posting date of item ledger entries for the item. |

| Item Tracking Code | The previous item tracking code of the item |

| New Item Tracking Code | The new item tracking code which is to be changed to. |

| Base Unit of Measure | The previous base unit of measure code of the item |

| New Base Unit of Measure | The new base unit of measure code which is to be changed to. |

| Use New Standard Cost | This field is set if standard was selected as new costing method. When proposing the costing policy, this field can already be activated. As a result, this determines that the value from the field "New standard cost" is already used for the entry of the costing policy worksheet. If the field is not activated, the value from the field standard cost (fixed) is used for the entry. |

| Standard Cost | Value of the field standard cost of the item card. |

| New Standard Cost | Upon activation of the field Use new standard cost, the new valid standard cost can be filed here. |

| New Unit Cost – stockkeeping unit exist | Activation of the check box shows if stock data are available for the item. |

| Unit Cost | Value of the field standard cost of the item card. |

| Last Direct Unit Cost | Value of the field last direct unit cost of the item card. |

|

|---|

| Figure Costing Policy Worksheet - Further information |

You can go to the respective item card or item entry via the start line. If there are already costing policy entries from earlier changes, these can also be viewed via the start line.

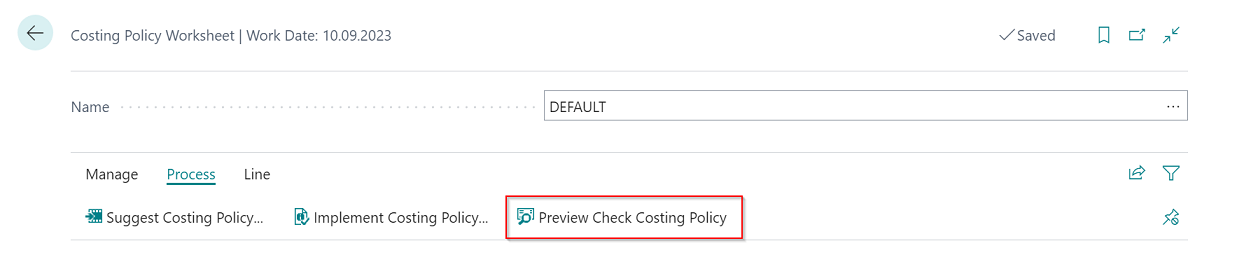

PREVIEW CHECK COSTING POLICY

This routine let's you check beforehand whether you would encounter any issues on actually implementing the costing policy changes. All potential issues, except for those connect to the earliest possible date for a change, get listed and can be resolved directly from the issue list. All the lines present in the journal will be checked.

|

|---|

| Figure Preview Check Costing Policy |

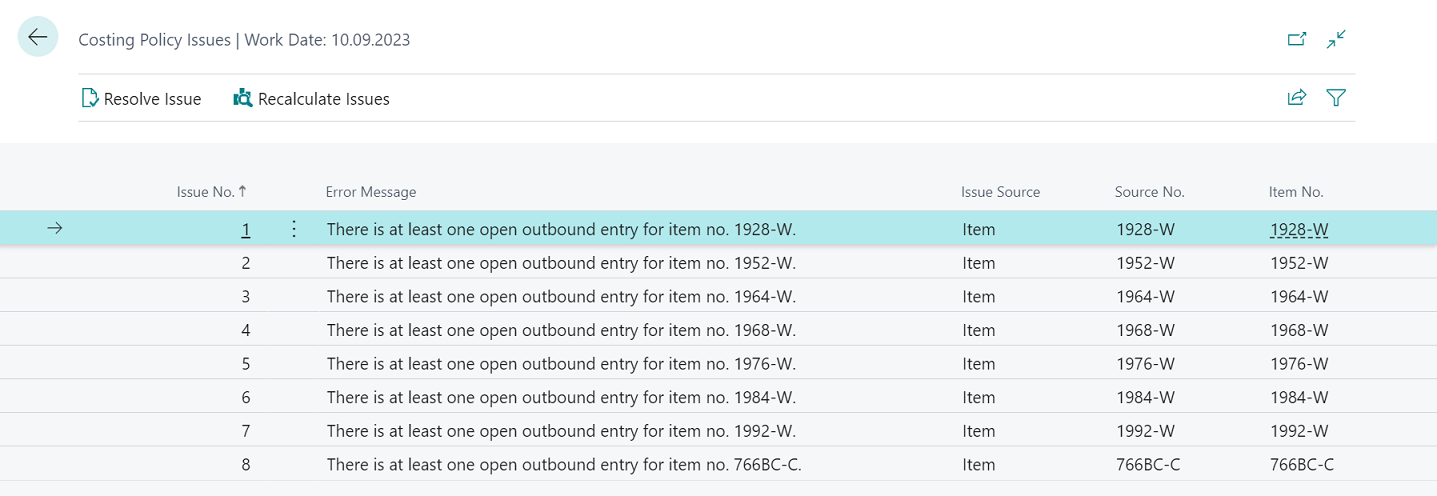

|

|---|

| Figure Costing Policy Issues |

The following information is to be found in the costing policy issues window:

| Field | Description |

|---|---|

| Issue No. | Shows the number of the issue. Current issues are numbered sequentially; list numbers are likely to change with every issue recalculation. |

| Error Message | Displays the error message which would occur on actually trying to implement the cost policy change. |

| Issue Source | Specifies the source entity of the issue. You can use the Resolve Issue action to get directly to the source. |

| Source No. | If the source of the issue is a specific document or master data entity, this field shows the exact identifyer of the issue source. If the issue comes from a setup table, this field will be blank. |

| Item No. | Specifies the item which is linked to the issue. This field will be blank, if the issue is not linked to a particular item. |

The costing policy issues window can be used to solve the presented problems directly.

| Field | Description |

|---|---|

| Resolve Issue | Calls the record which is connected to the issue. You can go there directly in order to resolve the issue. If possible, you will be directed to the exact field which is connected to the issue. |

| Recalculate Issues | Performs another preview check, so that you can control from here whether you have succeeded in resolving in any issues. |

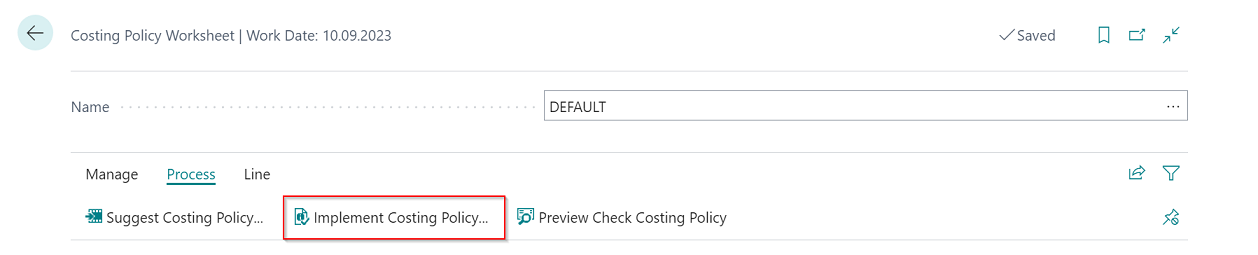

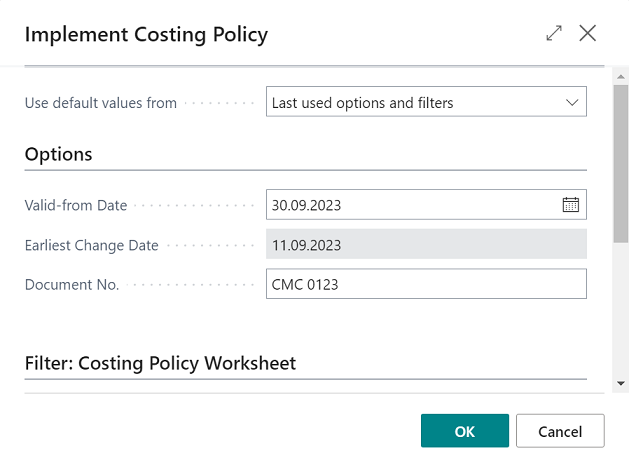

IMPLEMENT COSTING POLICY

To implement the costing policy and as a result carry out the change, the corresponding function is retrieved in the costing policy worksheet.

|

|---|

| Figure 1 Implement Costing Policy... |

|

|---|

| Figure 2 Implement Costing Policy... |

The following parameters must be included:

| Field | Description |

|---|---|

| Valid from date | The reference date is entered here from which the new costing policy is to apply. The new item entries are posted with this date. |

| Earliest Change Date | Shows the earliest possible date for a costing method, item tracking code or base unit of measure change across all items suggested in the current costing policy worksheet. Earlier dates may apply, if you filter the worksheet, e.g. by item. |

| Document no. | This document number is used for posting the new item entries. |

In the register Filter costing policy worksheet, filters can be placed on the lines from the costing policy worksheet, e.g. if the costing policy change is only to be carried out for a small portion in the first step.

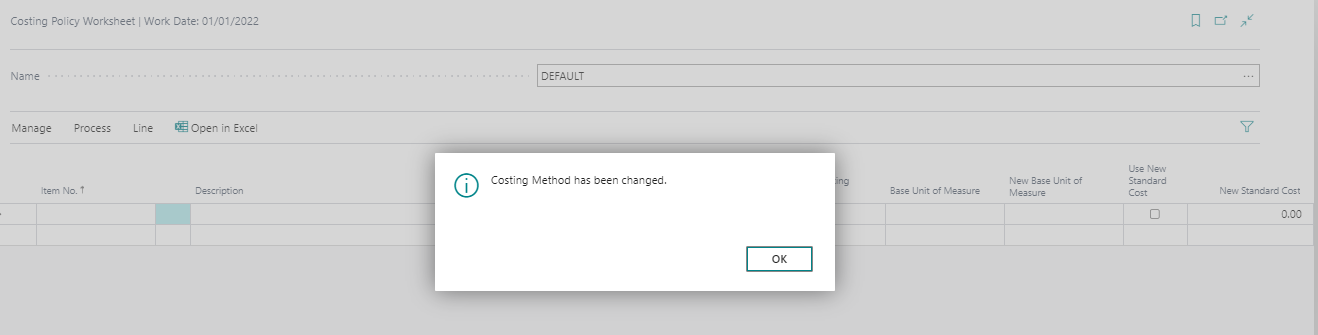

|

|---|

| Figure Message Costing Method has been changed |

Reminder

After changing the costing policy, inventory costs actual standard prices must be executed.

Tip

Due to the great number of entries, it can take a while until the batch processing implement costing policy completes its task. Consequently, we recommend not carrying out the batch processing during normal business hours.

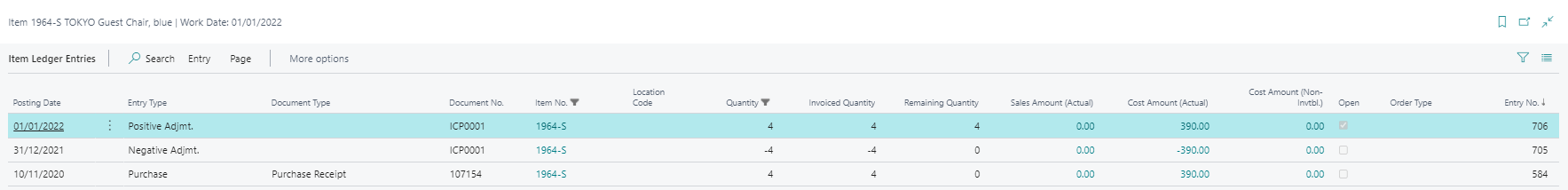

RESULT

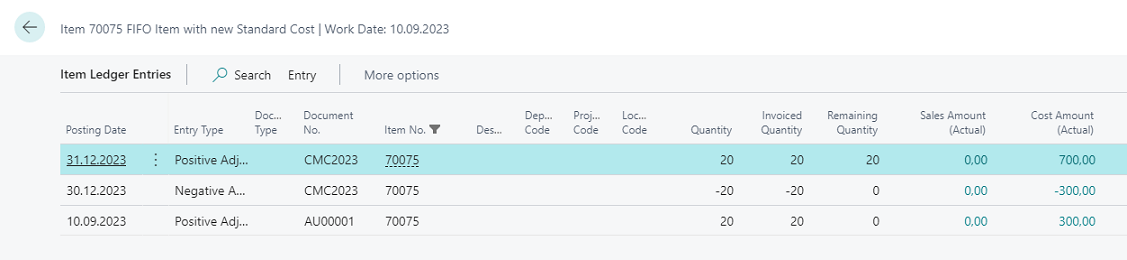

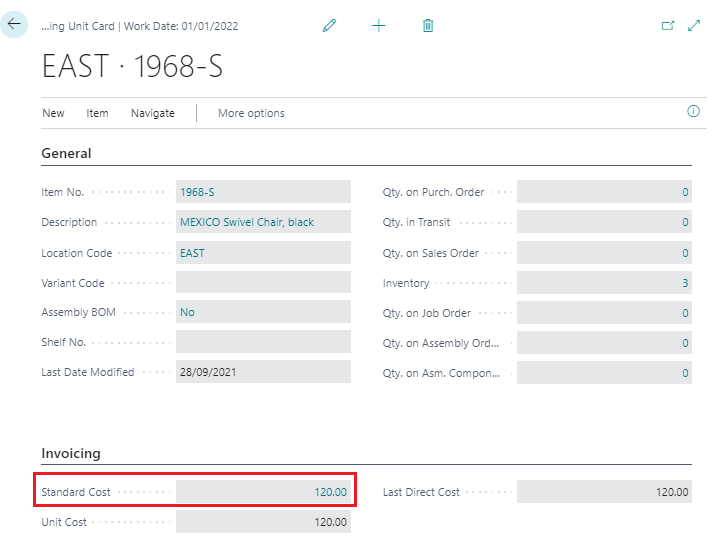

Through the change in the costing policy, the former stocks, which were present before the change date, are posted out and after the change to Valid from reference date reposted. As a result, the following item entries arise:

|

|---|

| Figure Example Item Ledger Entry |

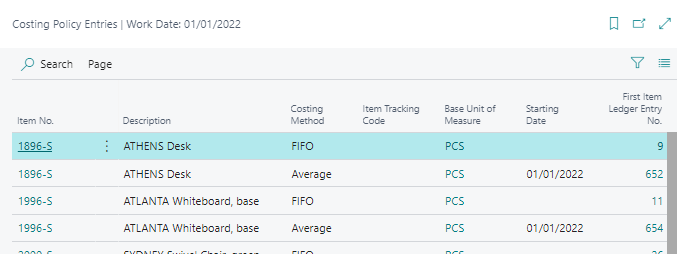

In addition to the item entries, the following costing policy entries arise:

|

|---|

| Figure Example Costing Policy Entries |

CHANGE TO STANDARD COSTING METHOD

If there is a change in the standard costing method, the fixed cost from the field standard cost of the item card or stock data is relevant. The standard cost normally arises from a previous calculation of the cost components of the item. In the case of production items, these are normally the costs from the unit lists and work plans. If an item is changed to the standard method, the field standard cost must either be filled out in advance on the item, e.g. via the standard cost work sheet or the externally calculated standard cost is included in the costing policy worksheet and transferred with the change in the item card.

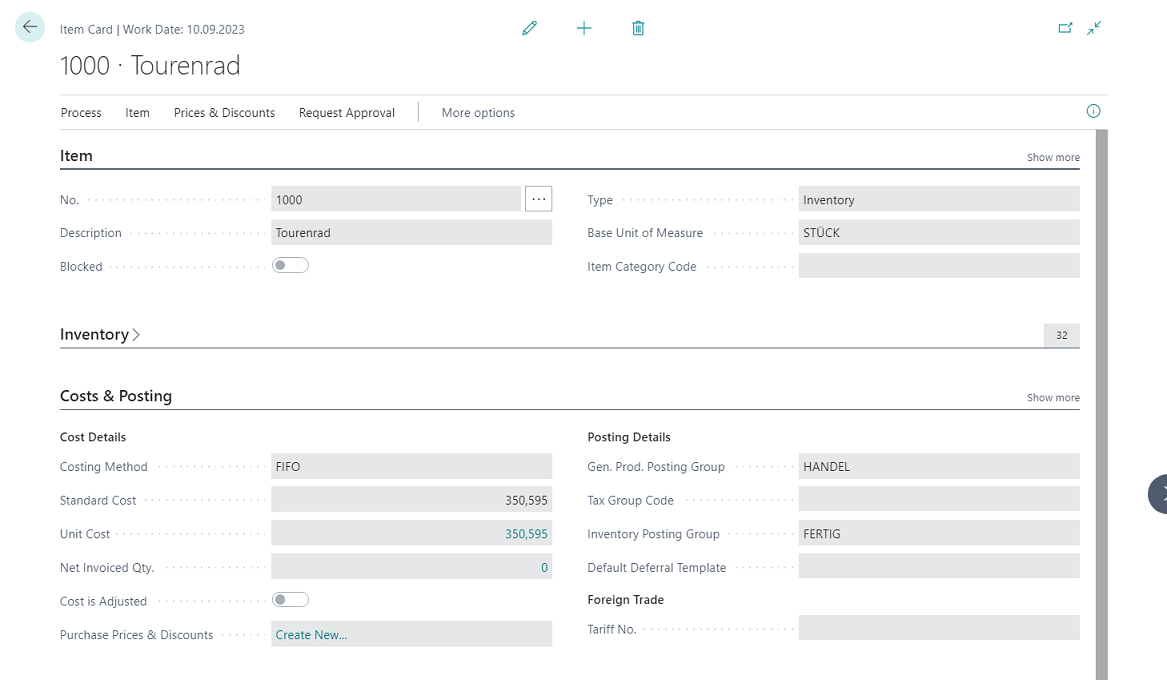

Change with existing standard cost

If the correct standard cost is already filed in the item card or stock for the item that is to be changed, this can be applied in the costing policy worksheet. Item card of a FIFO item in which the standard cost is already filed and is accordingly also reflected in the entries:

|

|---|

| Figure Item with standard cost |

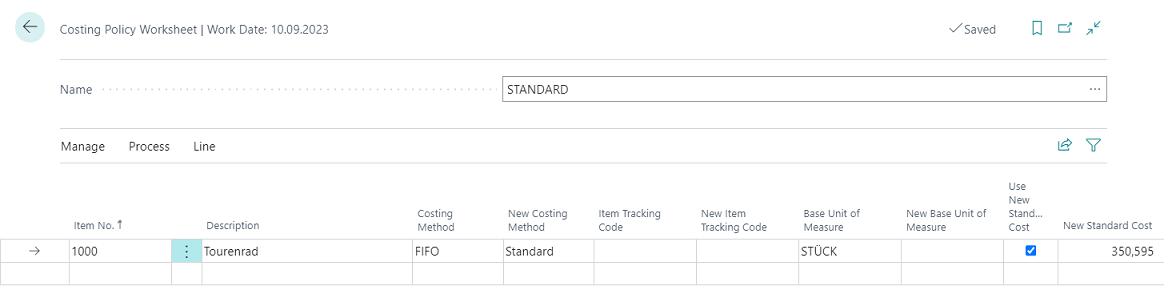

In the event of a change in the costing method from FIFO to STANDARD, this standard cost can be applied in the costing policy worksheet. In this case, no tick is placed in the check box Use new standard cost. The proposal obtains the values from the item card and writes these in the costing policy worksheet.

|

|---|

| Figure Costing Policy Worksheet - Item with standard cost |

In the costing policy change, the debit is made with the old standard cost according to the previous costing method. For the posting of the quantity, the value from the field New standard cost is used.

Reminder

After changing the costing policy, inventory costs actual standard prices must be executed.

Warning

If the standard cost of the item card does not match the values of the posted entries, then the costing policy worksheet applies the value from the field standard cost fixed (latest) when changing the costing method. The inventory costs actual standard prices function readjusts with the actual values of the posted entries according to the value flow, as a result of which the values do not correspond.

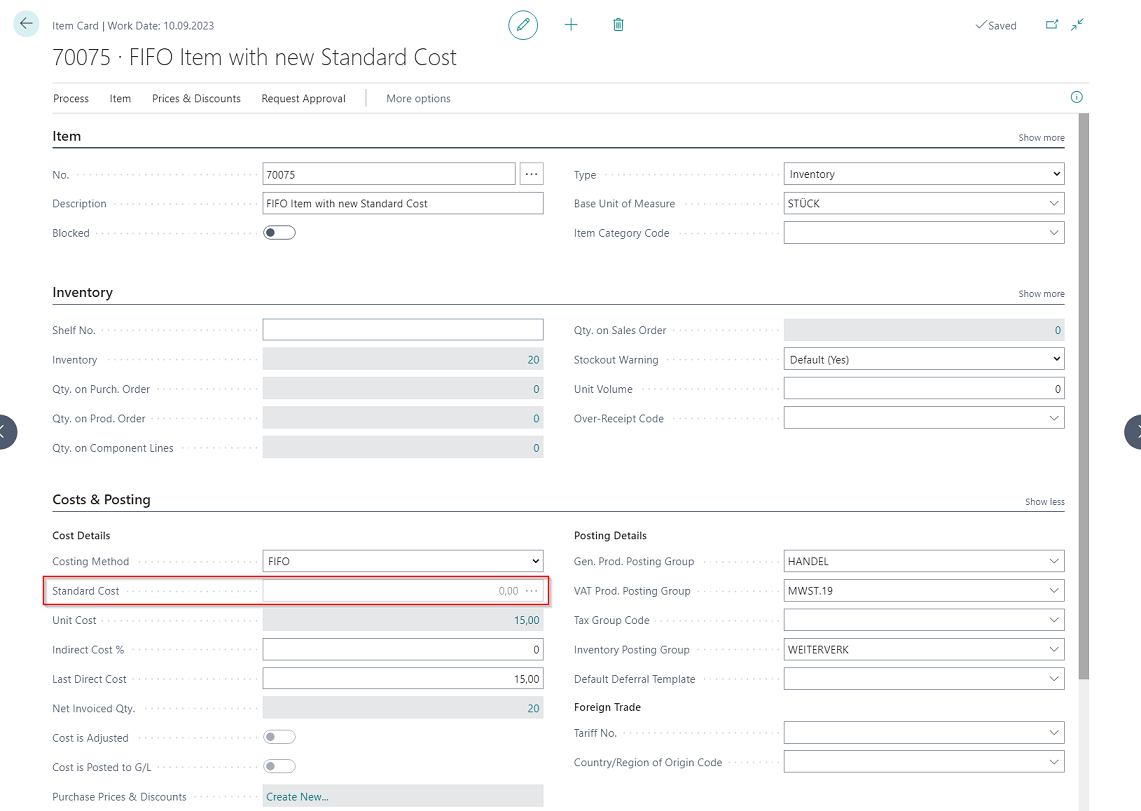

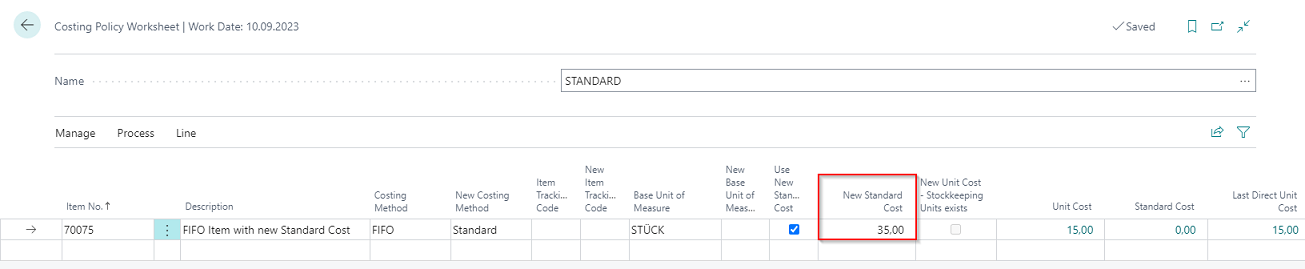

Change with new standard cost

If a new standard cost is to be applied when changing the costing method, it can be stated in the costing policy worksheet. If the field standard cost of the item card or stock data is already filled with the correct value, this is applied. Item card of a FIFO item without standard cost.

|

|---|

| Figure Item with new Standard Cost |

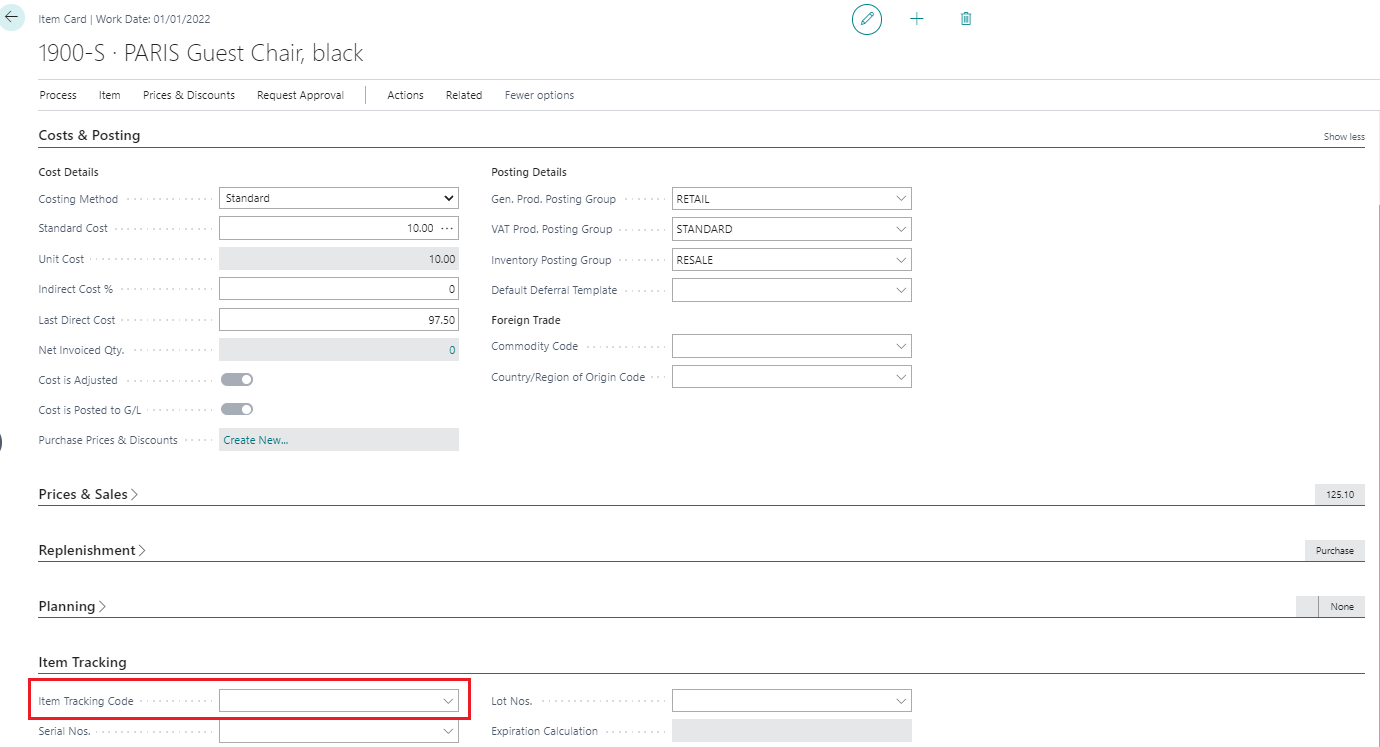

In the costing policy worksheet, when executing the function suggest costing policy it is stated that a new standard cost should be used.

|

|---|

| Figure Use New Standard Cost |

In the costing policy worksheet, the new valid standard cost can be entered in the field new standard cost.

|

|---|

| Figure Costing Policy Worksheet - Item with new Standard Cost |

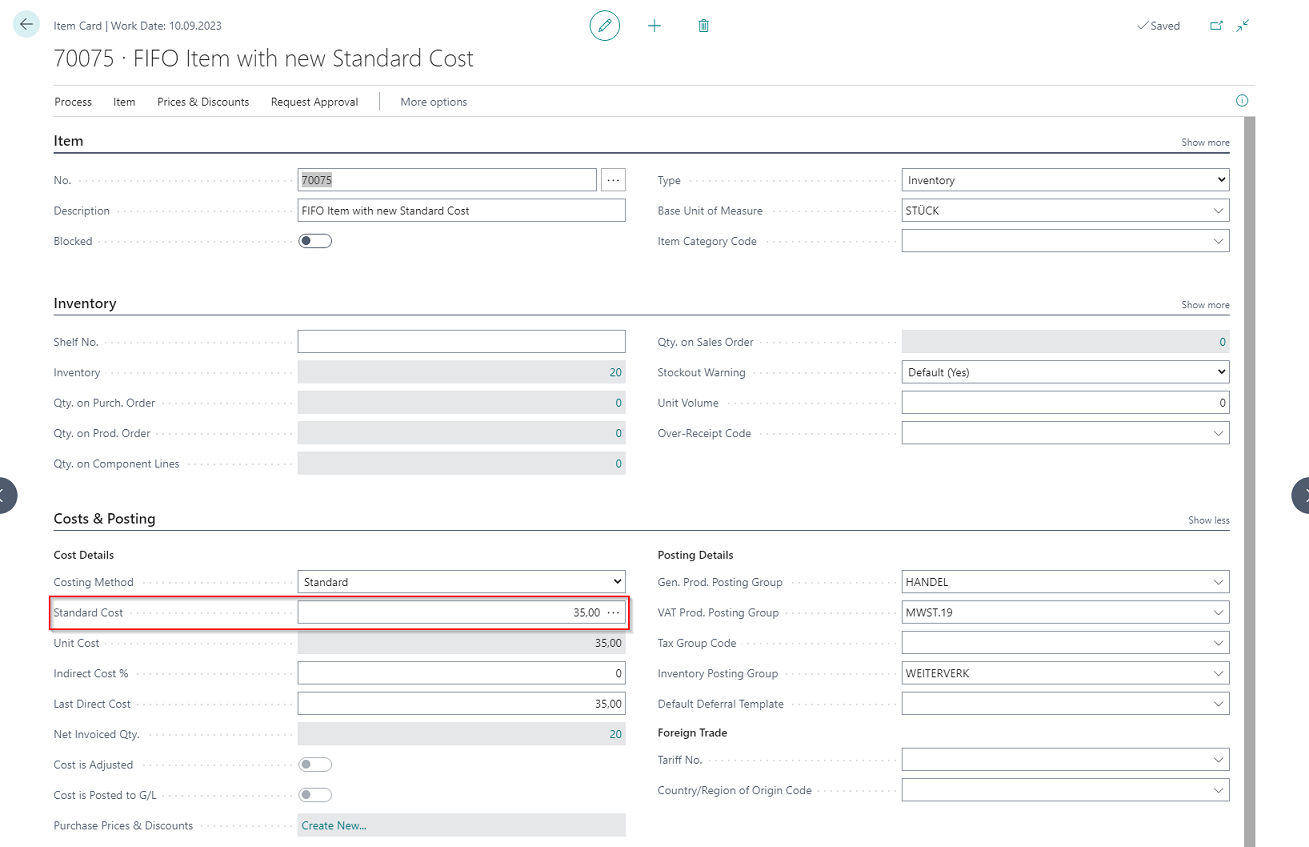

If the costing policy worksheet is adopted, the posting occurs with the new value and the field standard cost is filled in accordingly in the item card. Item card after change of the costing policy:

|

|---|

| Figure Item Card - new Standard Cost |

Item Ledger Entries after Costing Policy Change:

|

|---|

| Figure Item Ledger Entries after Costing Policy Change |

Reminder

After changing the costing policy, Adjust Cost - Item Entries must be executed.

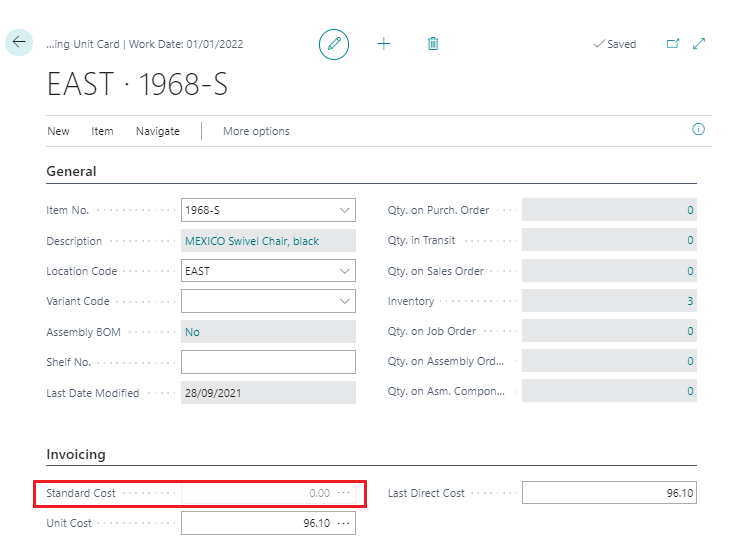

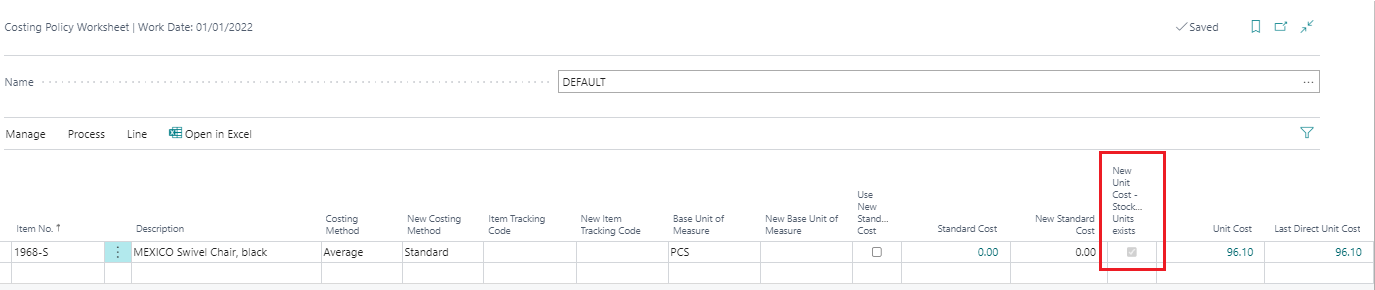

Change to standard costing method with inventory data

If inventory data are available for an item, the standard cost is saved in the respective stock data and referred to for the evaluation Item costing method FIFO with inventory data:

|

|---|

| Figure Item with inventory data |

If an item with inventory data is used in the costing policy worksheet, the line is marked in the field New standard cost - stock data available.

|

|---|

| Figure Costing Policy Worksheet - Item with inventory data |

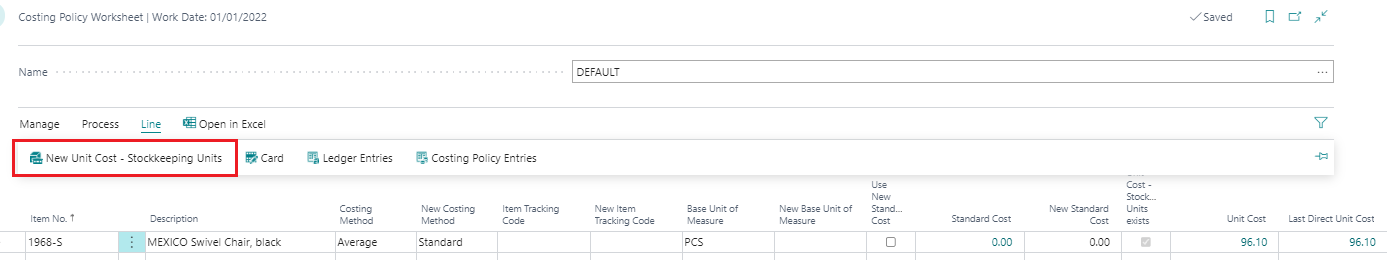

The stock data can be viewed via the button line:

|

|---|

| Figure New Standard Cost - Inventory Data |

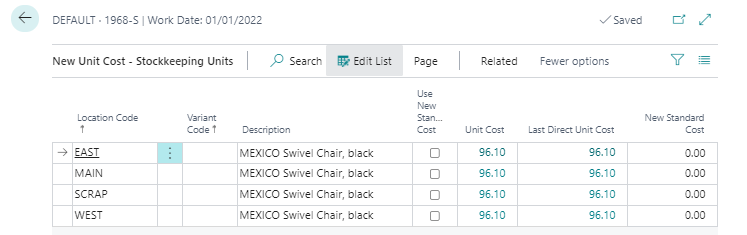

Window new unit cost - inventory data:

|

|---|

| Figure 1 Overview new Standard Cost - Inventory Data |

| Field | Description |

|---|---|

| Location Code | If the stock data are structured according to storage location, a line is displayed here per storage location, for which a new standard cost can be filed. |

| Variant Code | If the stock data are structured according to storage location, a line is displayed here per version, for which a new standard cost can be filed. |

| Description | Description of the item used in the costing policy worksheet. |

| Use New Standard Cost | Is only applied to changing to the standard costing method. If the check box is selected, the new standard cost is already used for posting the item inventory value. If you leave the field empty, the program uses the old standard cost when recalculating the open item entries as a result of which the inventory value reflects the old fixed standard cost. The program then adopts the new standard cost in the next entry made for the item. |

| Unit Cost | Value of the field standard cost of the item card. |

| Last Direct Unit Cost | Value of the field last direct costs of the item card. |

| New Standard Cost | Value of the field standard cost of the stock data. |

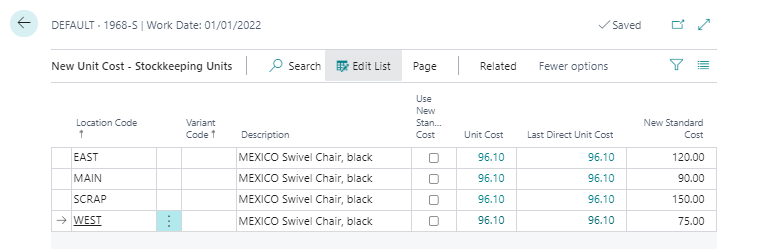

The new standard cost is filed in this list and is consequently filed behind the respective line in the costing policy worksheet.

|

|---|

| Figure 2 Overview new Standard Cost - Inventory Data |

When executing the costing policy change, the standard costs are used for the posting and the values are filed in the respective stock data.

|

|---|

| Figure Item with Inventory Data after Costing Policy Change |

Item ledger entries after change of the costing policy:

|

|---|

| Figure Item Ledger Entries after change of Costing Policy |

Reminder

After changing the costing policy, Adjust Cost – Item Entries must be executed.

CHANGING ITEM TRACKING CODE

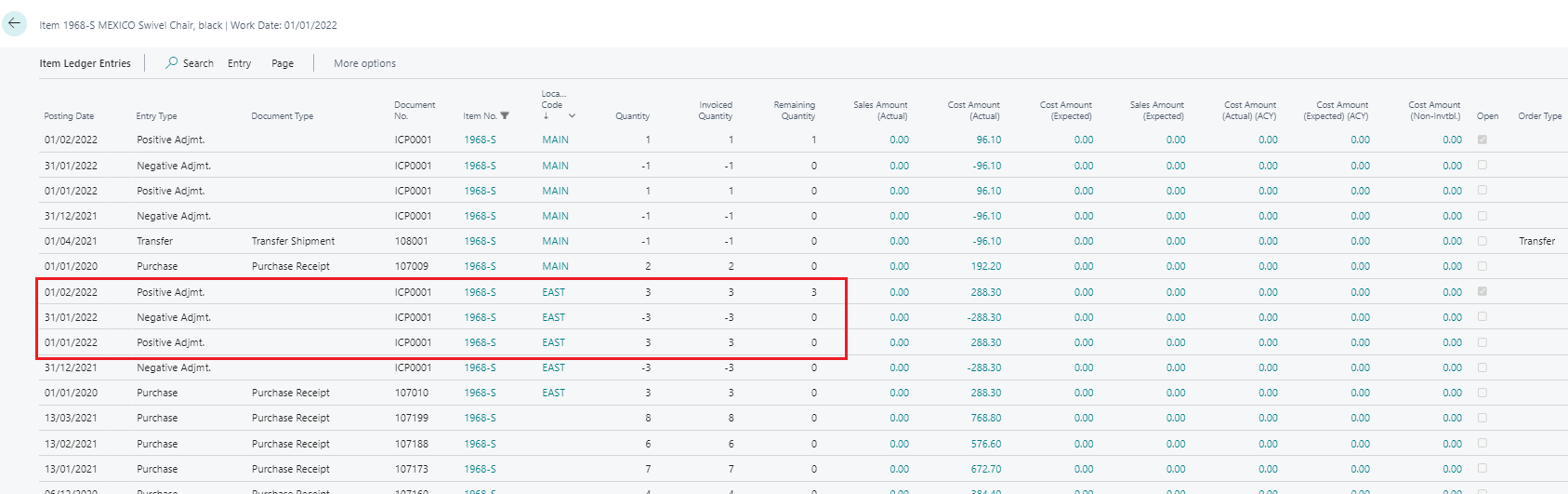

If an item is already posted, the item tracking code on the item cannot be changed or reset in standard. Through Costing Method 365 a change can be made with the costing policy worksheet. Item previously without item tracking:

Information

The following procedure is exemplary for changing the item tracking code from an item that previously has no item tracking code to a new/existing item tracking code. The procedure is valid and identical for all other variants when changing the item tracking code. For example, when changing for an item with an item tracking code to a new/existing item tracking code or from an item with an item tracking code to item tracking code = empty.

|

|---|

| Figure Item without Item Tracking Code |

Prerequisite

The same procedure applies as when changing the costing method. Furthermore, with the change of the item tracking code existing stocks are posted out before the change and thereafter reposted with the right tracking code.

Setting a new item tracking code

The existing quantity of the item has to be posted out via the item journal. After this, the new costing policy can be proposed.

|

|---|

| Figure Suggest Costing Policy - New Item Tracking Code |

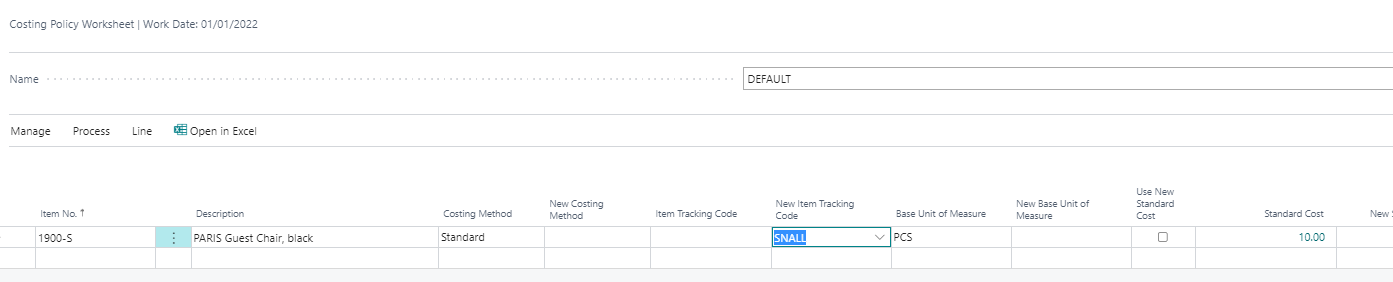

The new item tracking code is set in the costing policy worksheet.

|

|---|

| Figure Costing Policy Worksheet - New Item Tracking Code |

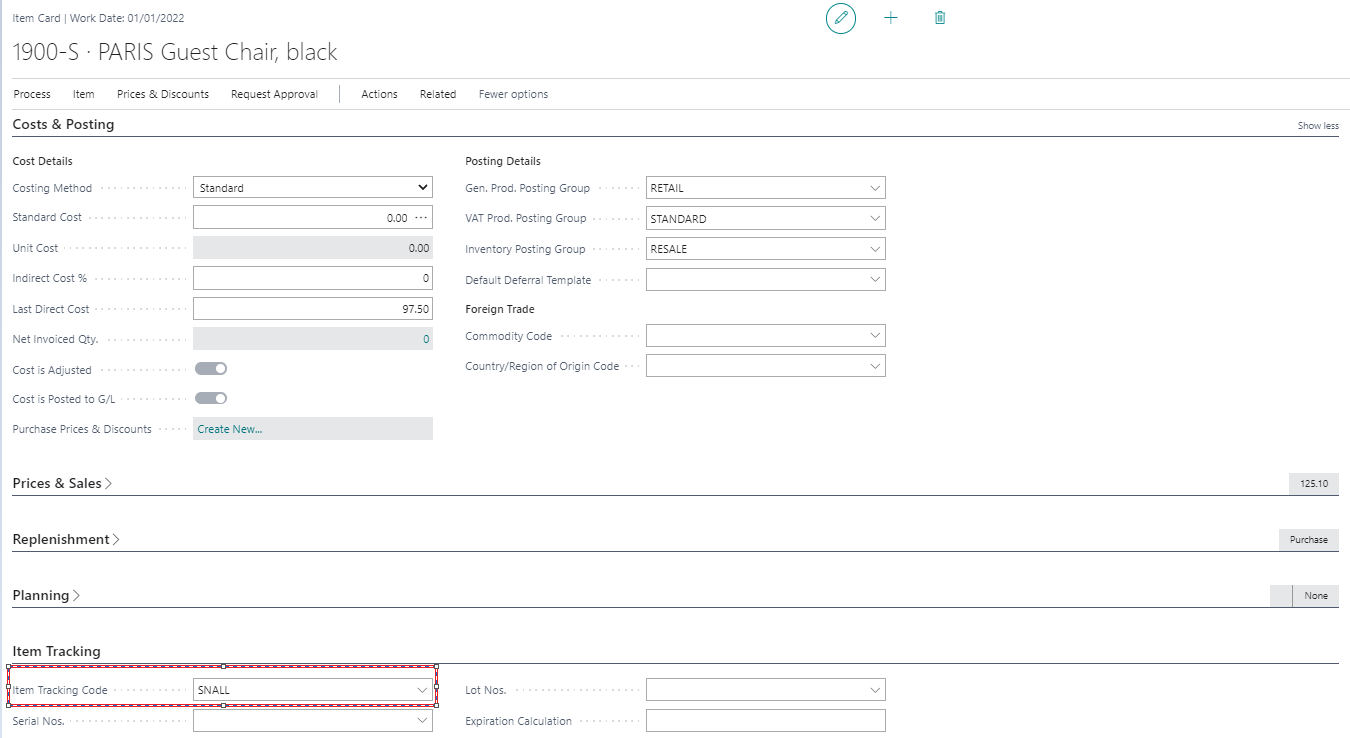

The new item tracking code is set upon adoption of the costing policy:

|

|---|

| Figure Item Card after change |

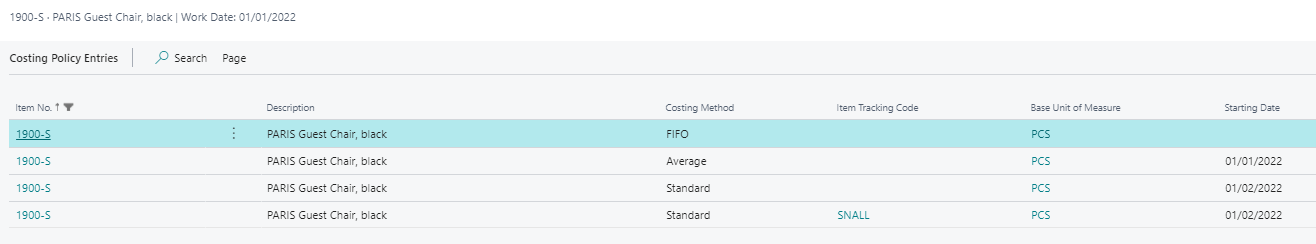

Costing policy entries are made. Item postings are not created by the system:

|

|---|

| Figure Costing Policy Entries - New Item Tracking Code |

After the change, the stocks must be reposted via the item journals.

Erinnerung

After changing the costing policy, Adjust Cost – Item Entries must be executed.

CHANGING BASE UNIT OF MEASURE

If an item is already posted, the base unit of measure on the item cannot be changed in standard. Through Costing Method 365 a change can be made with the costing policy worksheet.

Prerequisite

The same procedure applies as when changing the costing method. The unit which is to be changed to must exist as item unit in the item master.

Setting a new base unit of measure

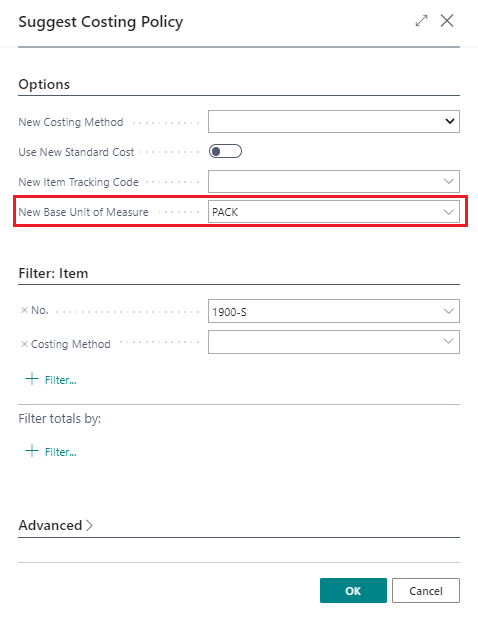

To set the new base unit of measure, the same steps are executed as for changing the costing method. The items with the necessary change are retrieved from the costing policy worksheet.

|

|---|

| Figure Suggest Costing Policy - New Base Unit of Measure |

The old base unit of measure and the new one, which is to be changed to, can be seen in the costing policy worksheet. Upon adoption of the proposal, a debit with the old base unit of measure and posting with the new base unit of measure is made. Item entry after changing the base unit of measure:

Reminder

After changing the costing policy, Adjust Cost – Item Entries must be executed.

Tip

Upon changing the base unit of measure, there is no system-supported conversion of the quantities to the new unit. The quantities from the old unit are adopted one to one in the new unit.

Warning

To ensure the newly set unit uses the correct quantities, the existing quantities should be posted out via the item journal before changing the base unit of measure and the correct quantities reposted after the change.

MANUAL USE OF THE COSTING POLICY WORKSHEET

The costing policy worksheet can also be manually filled by entering the item for which the costing method, item tracking code and/or base unit of measure is to be changed. Proceed here as follows:

- In the field Item no. enter the item number. As soon as you leave the field, the program automatically fills the fields description, costing method, item tracking code and base unit of measure code with values from the item card.

- In the field new costing method enter the costing method, in the field new item tracking code the item tracking code and in the field new base unit of measure code the base unit of measure code which the item is to be used in future.

- If you select standard as the new costing method, you can decide whether the program is to already use the new fixed standard cost when recalculating the current item inventory value. To do this, place a tick in the field use new standard cost. If you leave the field empty, the program uses the old fixed standard cost when recalculating the open item entries as a result of which the inventory value reflects the old fixed standard cost. The program then adopts the new fixed standard cost in the next entry made for the item.

- If you select standard as new costing method, in the field new standard cost enter the new fixed standard cost.

|

|---|

| Personal support available at www.ckl-software.de/en/ |