Posting Production Costs according to Total Cost Method

SETUP

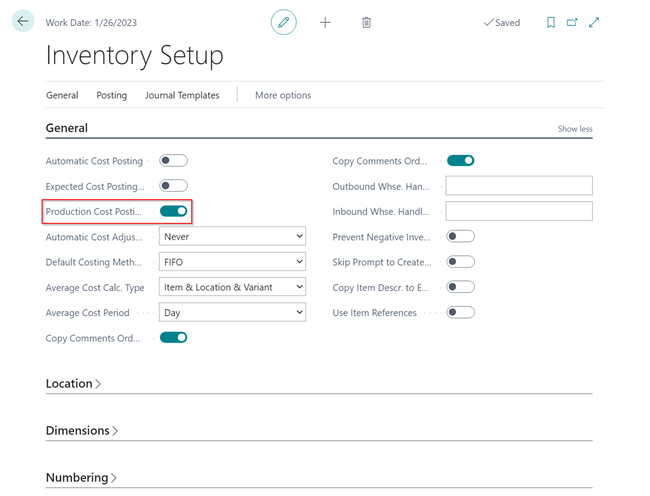

To enable the system to create additional production-related postings in Financial Accounting, you need to activate the “Production Cost Posting to G/L” field in the Inventory Setup.

|

|---|

| Figure Inventory Setup - Production Cost Posting to G/L |

SETUP OF ACCOUNTS

The accounts used to perform additional postings are specified in separate columns in the Inventory Posting Setup and General Posting Setup. Overview of additional postings for which the new accounts are used:

| Posting | Direct Production Costs | Indirect Production Costs | WIP Change Account | Prod. Accrual Account (Interim) | Prod. Accrual Account |

|---|---|---|---|---|---|

| Consumption | COGS (Debit) or Inventory Change Unfinished/Finished Goods (Debit) | Inventory Change WIP (Credit) | |||

| Capacity Posting Internal | Production Direct Costs (Debit) | Production Overhead (Debit) | Inventory Change WIP (Credit) | ||

| Capacity Posting Subcontracted | Subcontracted Direct Costs (Debit) | Subcontracted Overhead (Debit) | Inventory Change (Credit) | ||

| Output (Quantity) | Reversal of Inventory Change WIP to the amount of Expected Costs (Debit) | Inventory Change Finished Goods (Credit) | |||

| Status change to finished and Adjust Cost - Item Entries = Invoice | Production Overhead (Debit) | Inventory Change WIP (Debit) | Inventory Change Unfinished/Finished Goods (Credit) |

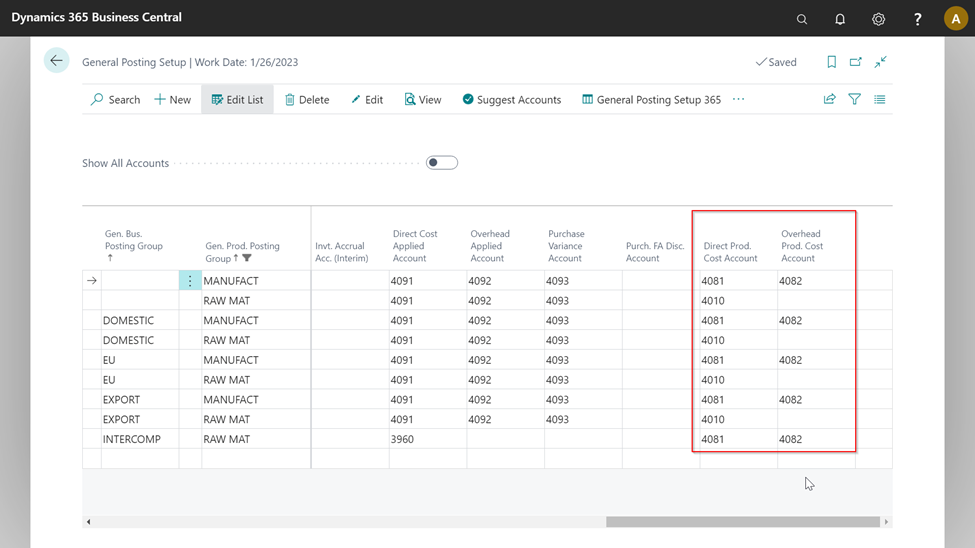

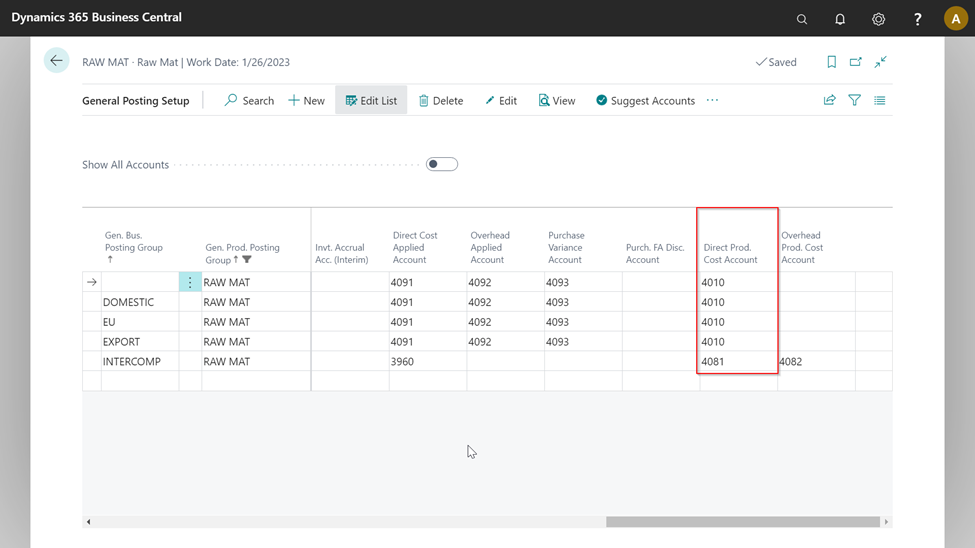

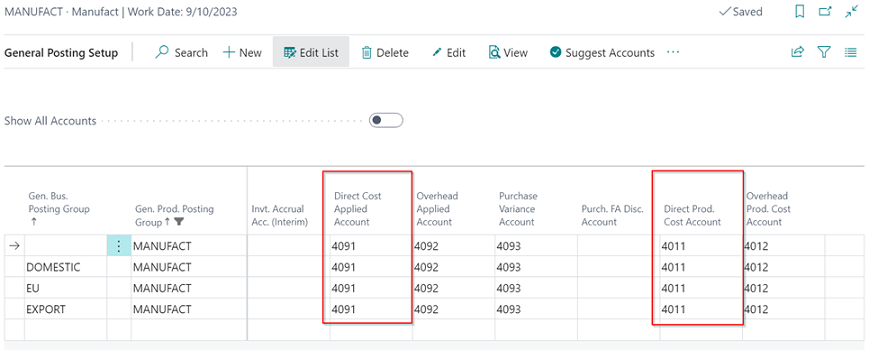

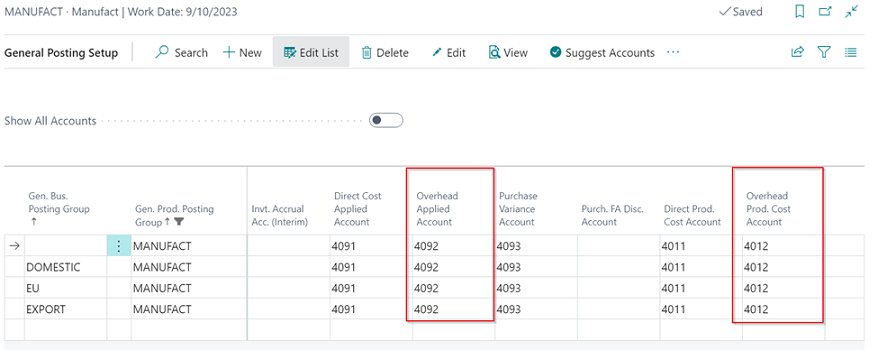

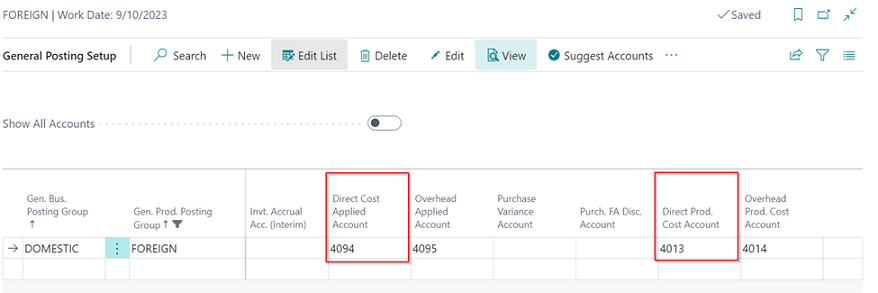

General Posting Setup

With Inventory 365, you can use the additional columns “Direct Production Costs” and “Indirect Production Costs” in the General Posting Setup.

|

|---|

| Figure Additional General Posting Setup |

| Field | Description |

|---|---|

| Direct Prod. Cost Account | Depending on the gen. product posting group, the accounts specified here are used to show the material use or the production direct costs/subcontracted direct costs for capacity postings. |

| Overhead Prod. Cost Account | If an indirect cost percentage or an overhead cost rate is specified for the machine or work centers of capacity postings, it will be posted by using the accounts specified in this column. |

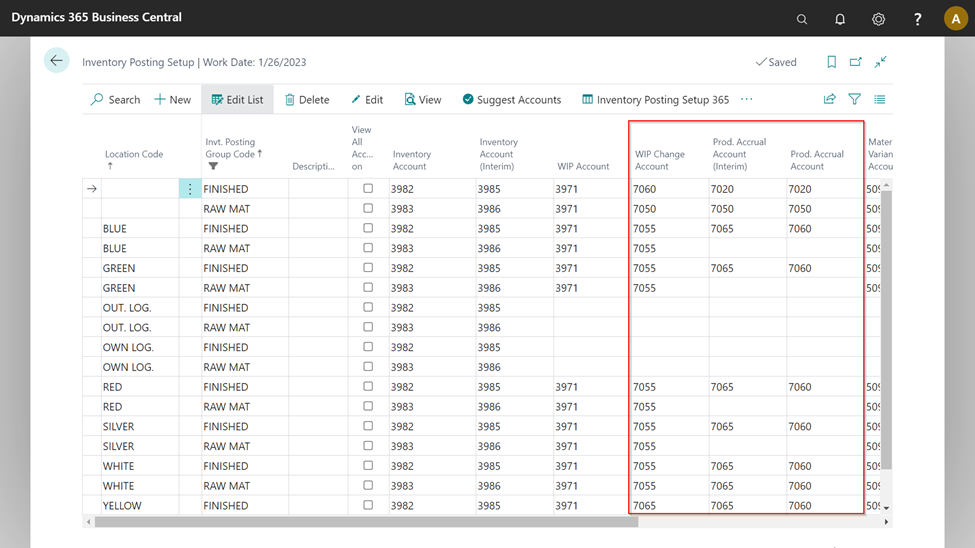

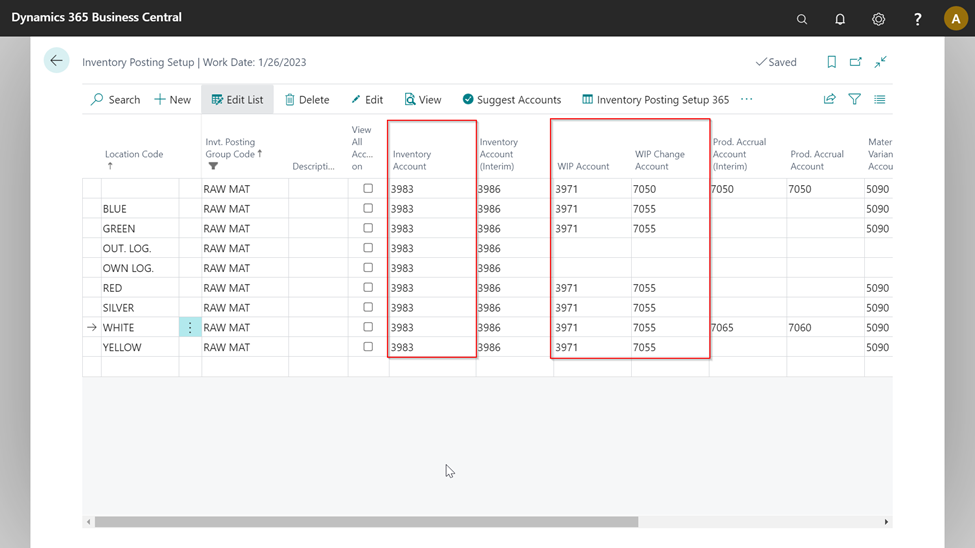

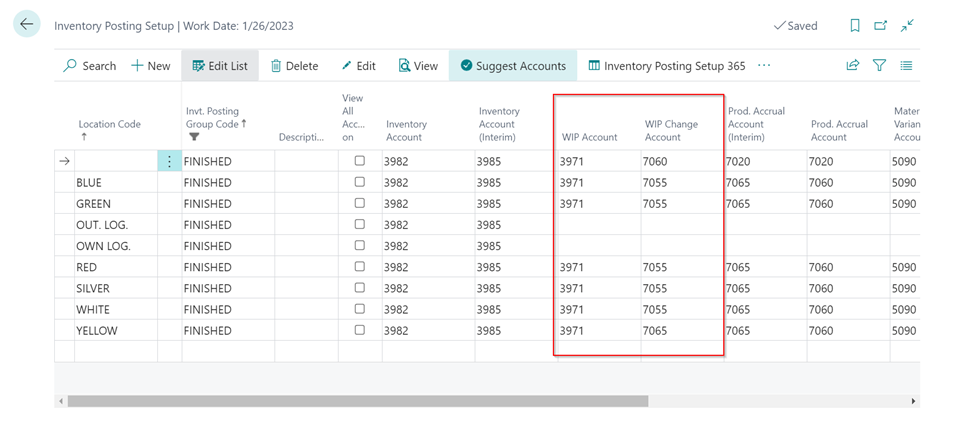

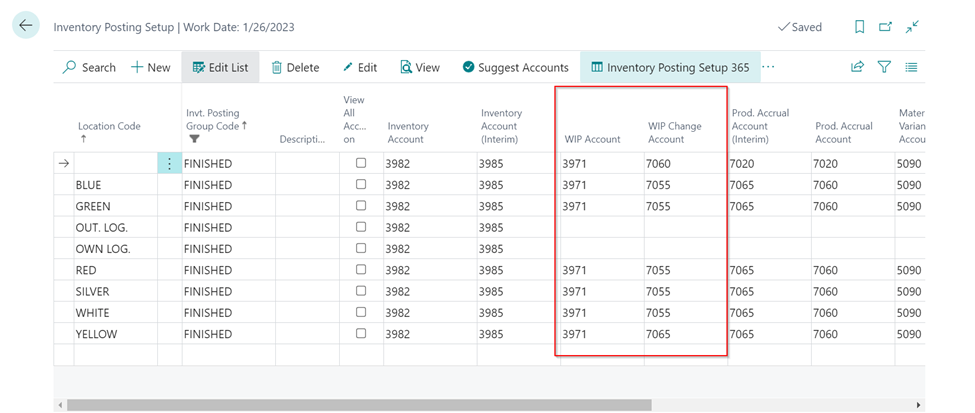

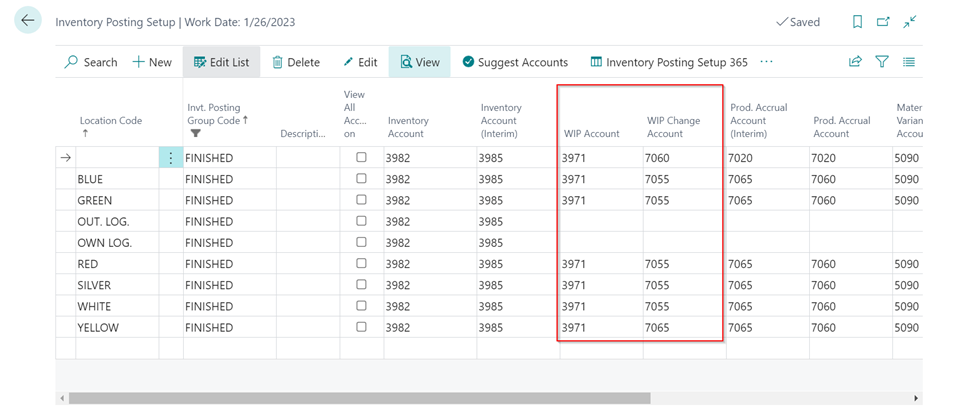

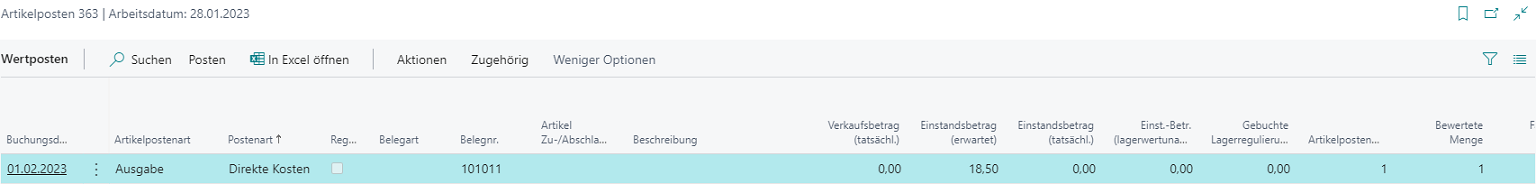

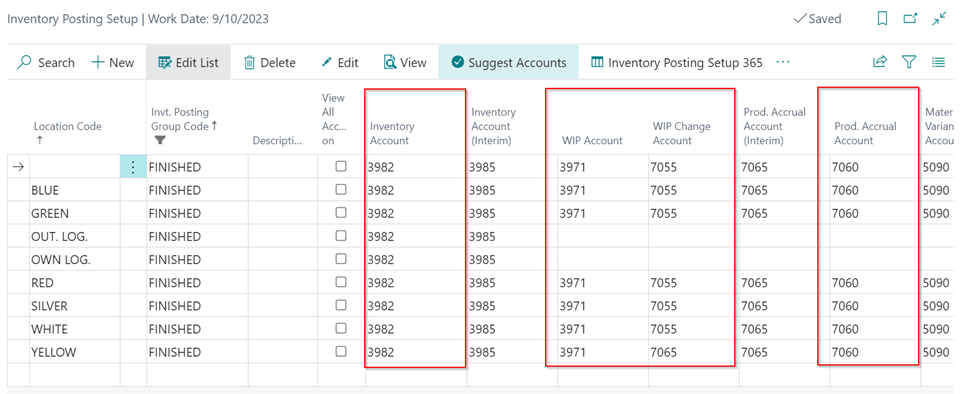

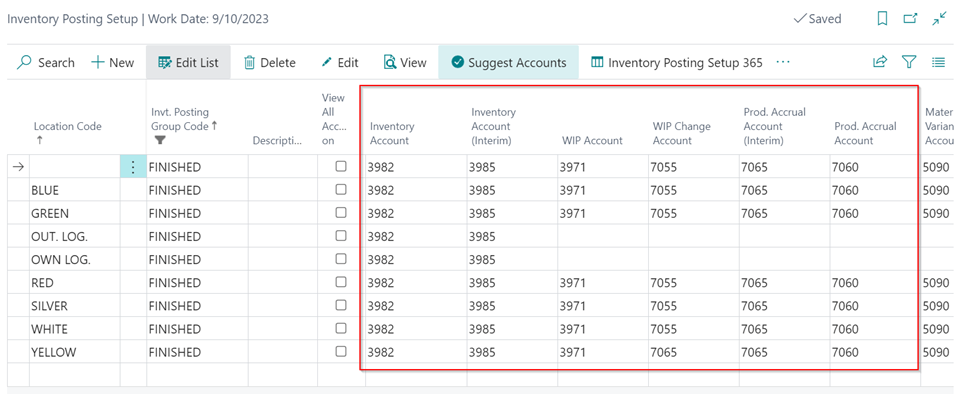

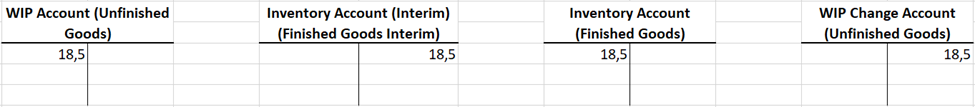

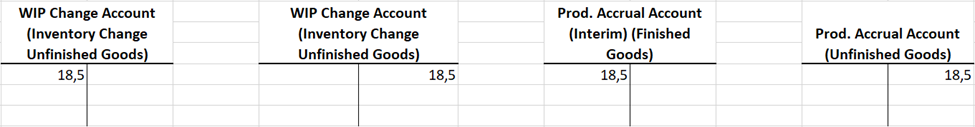

Inventory Posting Setup

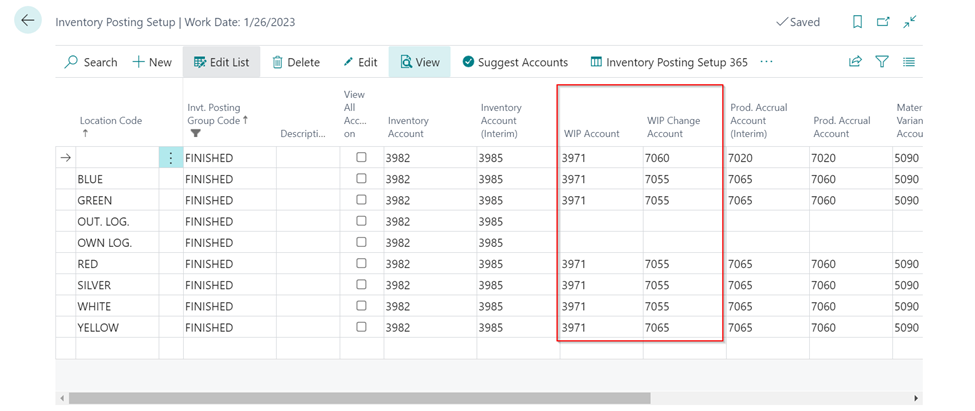

In the Inventory Posting Setup, you can specify the accounts for the inventory change of production orders in progress and the inventory change of finished goods.

|

|---|

| Figure Additional Inventory Posting Setup |

| Field | Description |

|---|---|

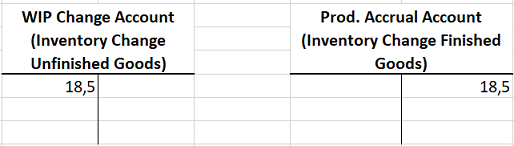

| WIP Change Account | The WIP Account Change field is used to specify the accounts for the inventory increase/decrease of production orders in progress. |

| Prod. Accrual Account (Interim) | The Prod. Accrual Account (Interim) is only used if the Expected Cost Posting field has been activated in the Inventory Setup. When posting the output of a production order, the inventory change (interim) of finished goods is shown here. |

| Prod. Accrual Account | The Prod. Accrual Account is used for the inventory increase of finished goods when completing the production order. |

OVERVIEW OF ADDITIONAL POSTINGS

This chapter describes the additional postings by using an example with debit and credit accounts (t-accounts).

COGS (Cost of Goods Sold)

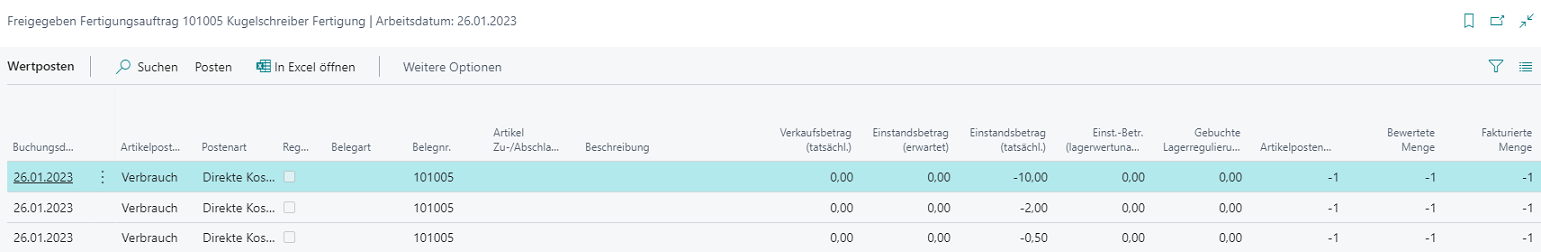

The COGS occurs when material or components of inventory are consumed in a production order. By doing so, the system will create item ledger and value entries of the Consumption type for the production order.

|

|---|

| Figure Example Value Entries - COGS |

The created entries contain the posting groups of the consumed item, which is inventory posting group = RAWMAT and gen. product posting group = RAWMAT in this example. To perform posting to Financial Accounting, the accounts to be used are determined by the specified inventory posting group and the gen. product posting group. Inventory Setup:

|

|---|

| Figure Example Inventory Posting Setup - COGS |

General Posting Setup:

|

|---|

| Figure Example General Posting Setup - COGS |

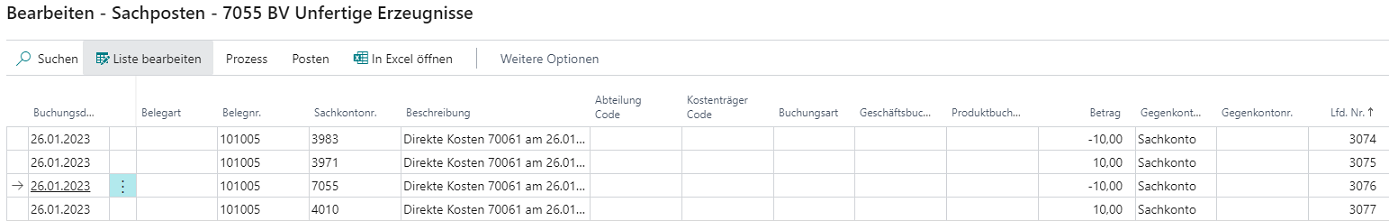

The following postings result in Financial Accounting::

|

|---|

| Figure Example G/L Entries - COGS |

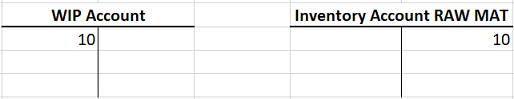

Standard Posting: In the first step, standard posting is performed by exchanging assets. Here, a debit posting is done on the inventory account and a credit posting on the WIP account, both accounts specified with the RAWMAT inventory posting group.

|

|---|

| Figure Example Standard Posting - COGS |

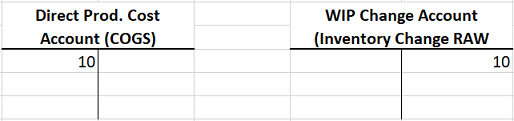

Additional posting in Inventory 365: In the next step, additional posting is performed by posting the costs of goods sold (COGS) as inventory change of work in progress. The COGS is shown in the Direct Production Costs column (General Posting Setup) and the inventory change is shown in the WIP Change Account column (Inventory Posting).

|

|---|

| Figure Example Additional Posting - COGS |

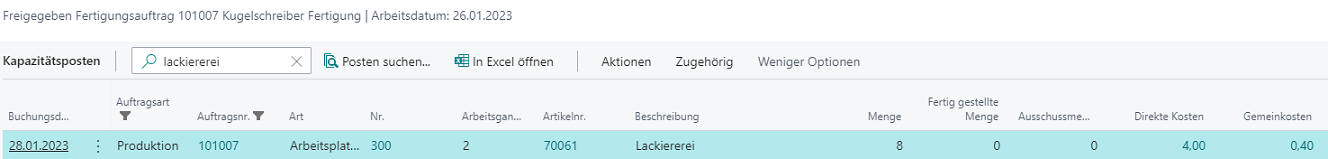

Internal Work Capacity Posting (Manufacturing Direct Costs)

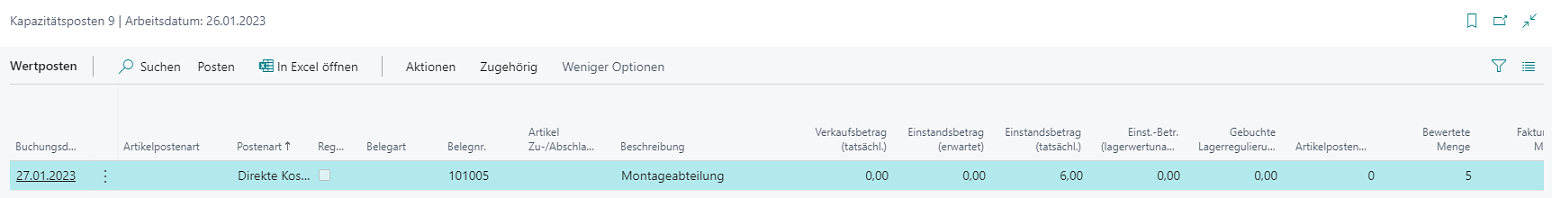

Internal work capacity postings are part of the manufacturing direct costs. Capacity postings occur when single work steps of the work plan have been completed and the time required to complete the work steps are reported back from the production order. This results in capacity and value entries created by the system.

|

|---|

| Figure Example Value Entries - Capacity Entries Manufacturing Direct Costs |

The time required to complete the work steps is valuated with the cost price specified for the machine or work center. The value entry contains the inventory posting group of the item to be manufactured and the gen. product posting group of the work center, which is inventory posting group = FINISHED and gen. product posting group = PRODUCTION in this example. To perform posting to Financial Accounting, the accounts to be used are determined by the specified inventory posting group and the gen. product posting group. Inventory Posting Setup:

|

|---|

| Figure Example Inventory Posting Setup - Capacity Manufacturing Direct Costs |

General Posting Setup:

|

|---|

| Figure Example General Posting Setup - Capacity Entries Manufacturing Direct Costs |

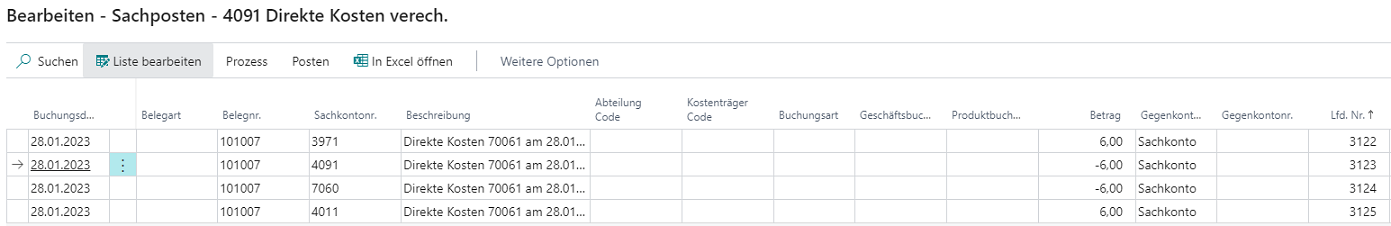

The following postings result in Financial Accounting::

|

|---|

| Figure Example G/L Entries - Capacity Entries Manufacturing Direct Costs |

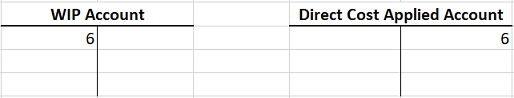

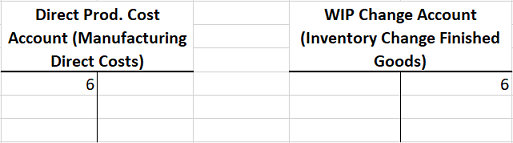

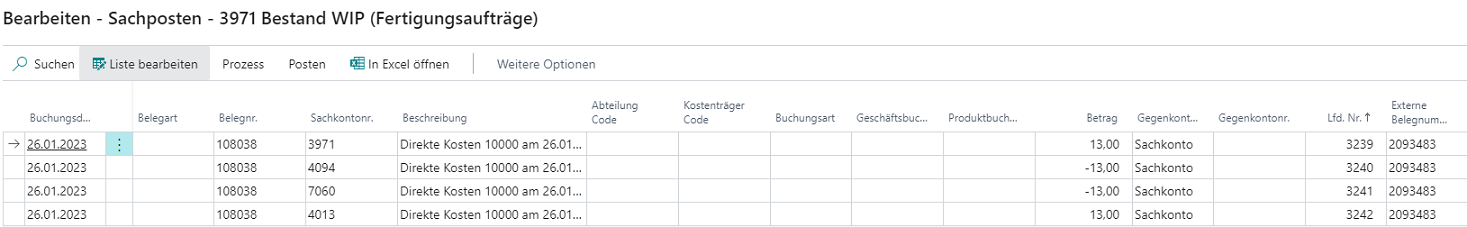

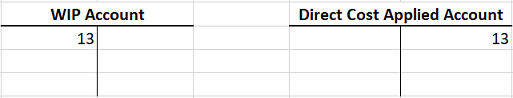

Standard Posting: In the first step, standard posting is performed by activating the valuated time as work in progress (WIP). Here, the valuated time is taken from the income statement via the Direct Cost Applied Account (General Posting Setup) and activated on the WIP Account in the balance sheet.

|

|---|

| Figure Example Standard Posting - Capacity Entries Manufacturing Direct Costs |

Additional posting in Inventory 365: In the next step, additional posting is performed by posting direct production costs as inventory change of work in progress. The direct production costs of the capacities are shown in the Direct Production Costs column (General Posting Setup) and the inventory change is shown in the WIP Change Account column (Inventory Posting).

|

|---|

| Figure Example Additional Posting - Capacity Entries Manufacturing Direct Costs |

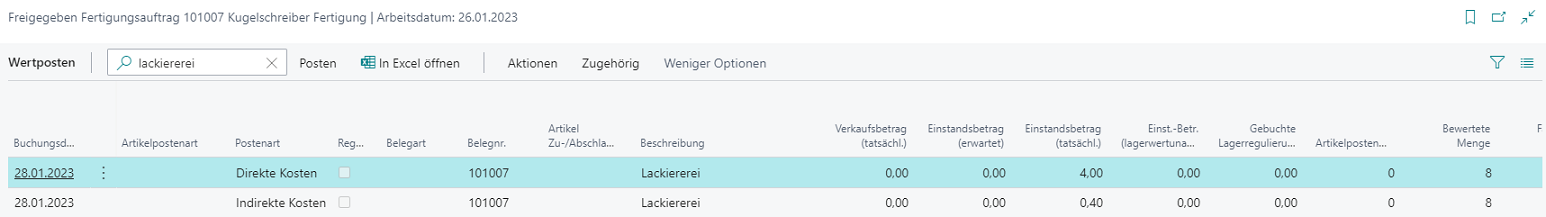

Internal Work Capacity Posting with Overhead (Manufacturing Overhead)

Manufacturing overhead costs are part of general production costs that cannot be directly assigned to a single product. Manufacturing overhead costs can be specified by using an overhead percentage or an overhead cost amount for the machine or work center. Capacity postings occur when single work steps of the work plan have been completed and the time required to complete the work steps are reported back from the production order. This results in capacity and value entries created by the system.

|

|---|

| Figure Example Capacity Entries - Manufacturing Overhead |

The value entries are created by separating them by direct costs (production direct costs) and indirect costs (production overhead costs):

|

|---|

| Figure Example Value Entries - Capacity Entries Manufacturing Overhead |

In addition to the work step’s direct costs, the completion time is valuated with the overhead rate. The value entry of indirect costs and the value entry of direct costs contain the same the inventory gen. posting group and product posting group, which is inventory posting group = FINISHED and gen. product posting group = PRODUCTION in this example. To perform posting to Financial Accounting, the accounts to be used are determined by the specified inventory posting group and the gen. product posting group.

Inventory Posting Setup:

|

|---|

| Figure Example Inventory Posting Setup - Capacity Manufacturing Overhead |

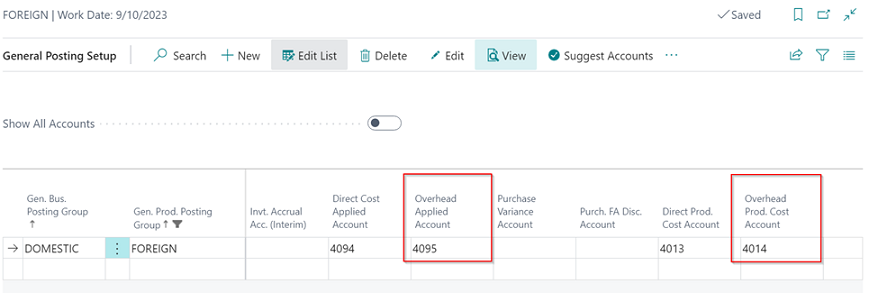

General Posting Setup:

|

|---|

| Figure Example General Posting Setup - Capacity Entries Manufacturing Overhead |

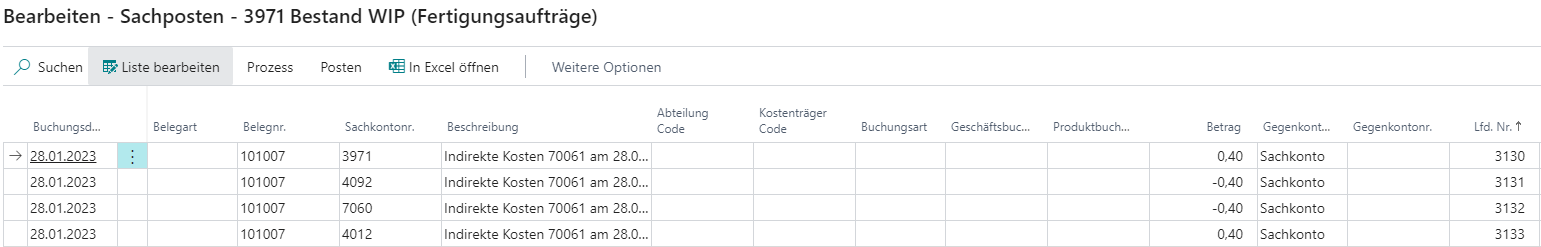

The following postings result for the indirect costs: Capacity posting – Indirect costs:

|

|---|

| Figure Example G/L Entries - Capacity Entries Manufacturing Overhead |

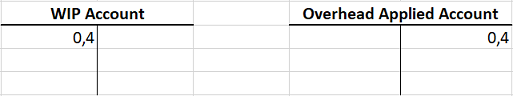

Standard Posting: In the first step, standard posting is performed by activating the overhead costs which result from time postings as work in progress. Here, the valuated time is taken from the income statement via the Overhead Applied Account (General Posting Setup) and activated on the WIP Account in the balance sheet.

|

|---|

| Figure Example Standard Posting - Capacity Entries Manufacturing Overhead |

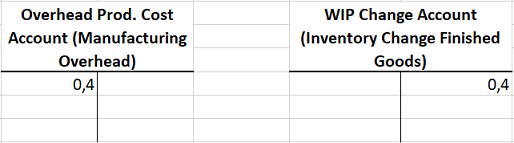

Additional Posting in Inventory 365: In the next step, additional posting is performed by posting the production overhead costs as inventory change of work in progress. The production overhead costs of the capacities are shown in the Overhead Prod. Cost Account column (General Posting Setup) and the inventory change is shown in the WIP Change Account column (Inventory Posting Setup).

|

|---|

| Figure Example Additional Posting - Capacity Entries Manufacturing Overhead |

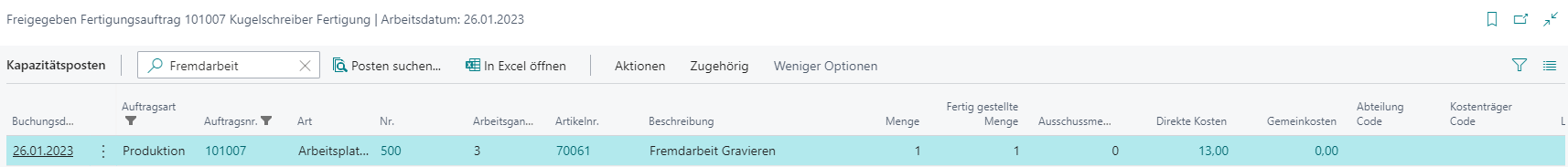

Subcontracted Work Capacity Posting (Subcontracted Direct Costs)

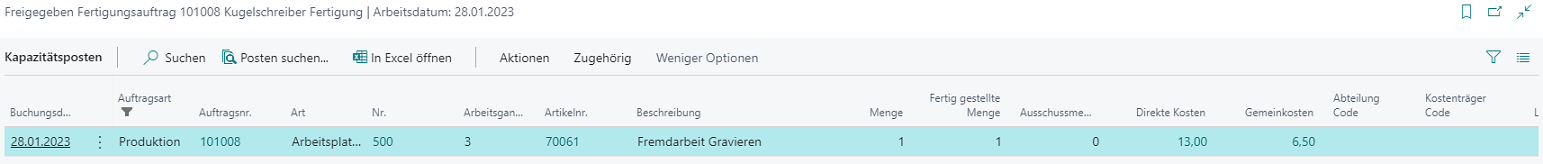

Subcontracted work capacity postings occur when a purchase order for subcontracted work is delivered. For this, the production order’s work plan must contain a work center with an assigned vendor. When the purchase order for subcontracted work is delivered, a capacity entry is created for the production order. When posting the invoice, the system will post and create a value entry for the subcontracted work performed.

|

|---|

| Figure Example Capacity Entries - Subcontracted Direct Costs |

|

|---|

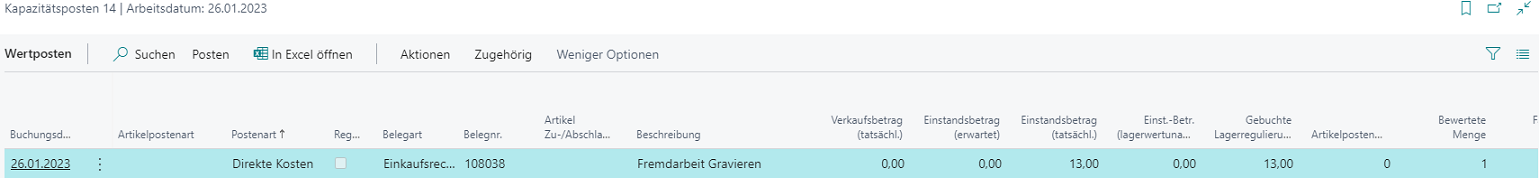

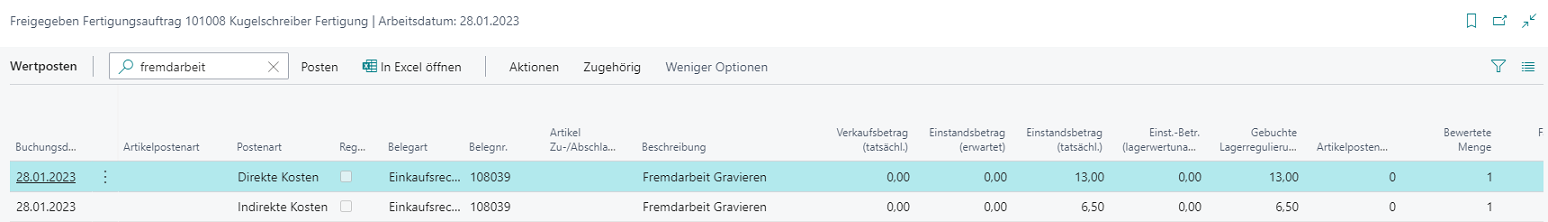

| Figure Example Value Entries - Capacity Entries Subcontracted Direct Costs |

The value entry contains the inventory posting group of the manufactured item and the gen. product posting group of the work center, which is inventory posting group = FINISHED and gen. product posting group = FOREIGN in this example.

Information

Since this capacity posting is done from the purchase order, the specification of accounts in the General Posting Setup is done by using the Gen. Business Posting Group.

Inventory Posting Setup:

|

|---|

| Figure Example Inventory Posting Setup - Capacity Entries Subcontracted Direct Costs |

General Posting Setup:

|

|---|

| Figure Example General Posting Setup - Capacity Entries Subcontracted Direct Costs |

The following postings result in Financial Accounting:

|

|---|

| Figure Example G/L Entries - Capacity Entries Subcontracted Direct Costs |

Standard Posting: In the first step, standard posting is performed by activating the subcontracted work as work in progress. Here, the subcontracted work is taken from the income statement via the Direct Cost Applied Account (General Posting Setup) and is activated on the WIP Account in the balance sheet.

|

|---|

| Figure Example Standard Posting - Capacity Entries Subcontracted Direct Costs |

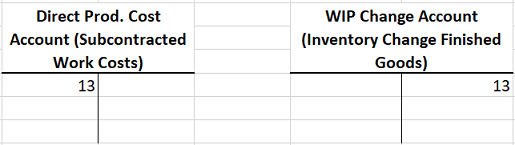

Additional Posting in Inventory 365: In the next step, additional posting is performed by posting the subcontracted work costs as inventory change of work in progress. Here, the subcontracted work costs are shown in the Direct Prod. Cost Account column (General Posting Setup) and the inventory change is shown in the WIP Change Account column (Inventory Posting Setup).

|

|---|

| Figure Example Additional Posting - Capacity Entries Subcontracted Direct Costs |

Subcontracted Work Capacity Posting with Overhead (Subcontracted Overhead)

Subcontracted overhead costs are posted if an overhead cost rate or a cost amount is specified for the respective work center. The indirect cost amount is copied to the purchase order of subcontracted work and shown as separate value entry after posting.

|

|---|

| Figure Example Capacity Entries - Subcontracted Overhead Costs |

|

|---|

| Figure Example Value Entries - Capacity Entries Subcontracted Overhead Costs |

The value entry contains the inventory posting group of the manufactured item and the gen. product posting group of the work center, which is inventory posting group = FINISHED and gen. product posting group = FOREIGN.

Information

Since this capacity posting is done from the purchase order, the specification of accounts in the General Posting Setup is done by using the Gen. Business Posting Group.

Inventory Posting Setup:

|

|---|

| Figure Example Inventory Posting Setup - Capacity Entries Subcontracted Overhead Costs |

General Posting Setup:

|

|---|

| Figure Example General Posting Setup - Capacity Entries Subcontracted Overhead Costs |

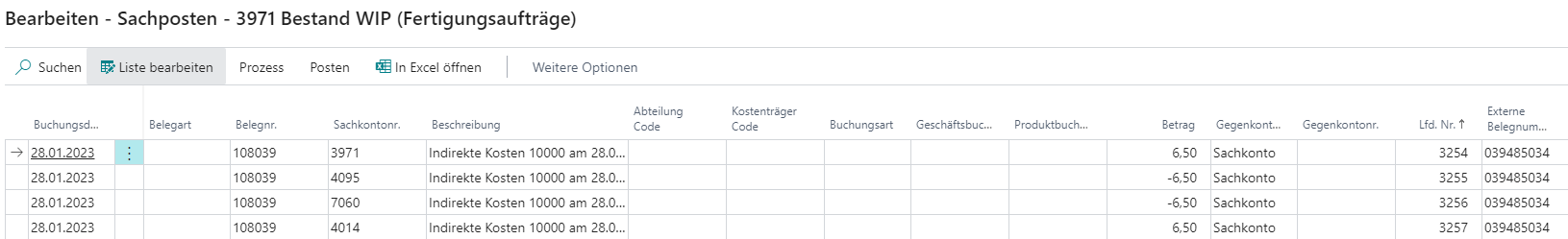

The following postings result in Financial Accounting:

|

|---|

| Figure Example G/L Entries - Capacity Entries Subcontracted Overhead Costs |

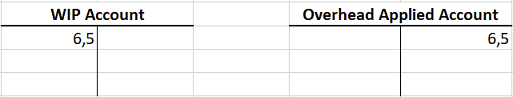

Standard Posting: When performing standard posting, the subcontracted overhead costs will be posted as work in progress. Here, the subcontracted overhead costs are taken from the income statement via the Overhead Applied Account (General Posting Setup) and activated on the WIP Account in the balance sheet.

|

|---|

| Figure Example Standard Posting - Capacity Entries Subcontracted Overhead Costs |

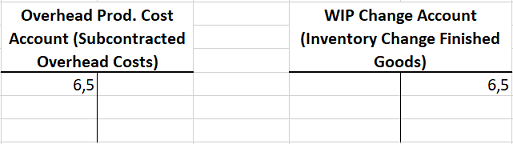

Additional Posting in Inventory 365: In the next step, additional postings are performed by posting the subcontracted overhead costs as inventory change for work in progress. Here, the subcontracted overhead costs are shown in the Overhead Prod. Cost Account column (General Posting Setup) and the inventory change is shown in the WIP Change Account column (Inventory Posting Setup).

|

|---|

| Figure Example Additional Posting - Capacity Entries Subcontracted Overhead Costs |

Production Order Output Posting

Output posting can be done when the last work step of the production order has been posted or the finished quantity has been reported back.

Information

This output posting is only considered in Financial Accounting if the Expected Cost Posting field in the Inventory Setup has been activated. If this field is deactivated, posting is only done when the production order is completed.

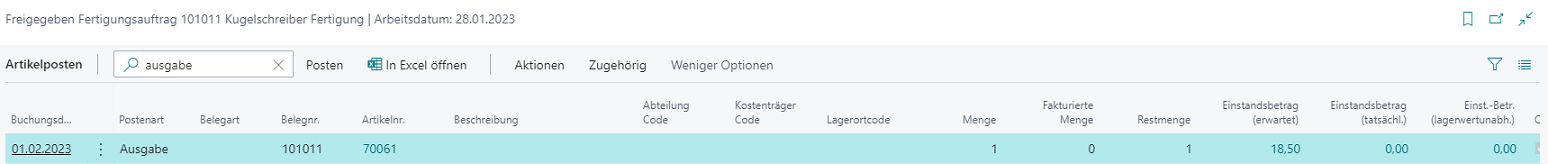

The following entries are created for the output posting: Item ledger entries:

|

|---|

| Figure Example Item Ledger Entry - Output |

Value Entries:

|

|---|

| Figure Example Value Entries - Output |

The value entry contains the inventory posting group and the gen. product posting group of the manufactured item, which is inventory posting group = FINISHED and gen. product posting group = FINISHED. For the determination of accounts, the accounts specified in the Inventory Posting Setup are used:

|

|---|

| Figure Example Inventory Posting Setup - Output |

With the Expected Cost Posting field activated, the following postings result in Financial Accounting:

|

|---|

| Figure Example G/L Entries - Output |

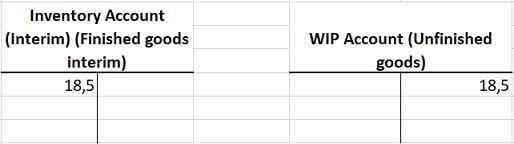

Standard Posting: Standard posting is performed by exchanging assets, which means a credit on the inventory account for unfinished goods by using the value of the expected cost price and a debit on the inventory account for finished goods (interim). Here, the accounts specified in the Inventory Setup are used, which is WIP Account for credit posting and the Inventory Account (Interim) for debit posting.

|

|---|

| Figure Example Standard Posting - Output |

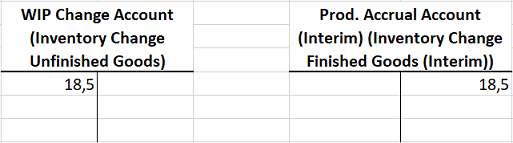

Additional Posting in Inventory 365: With additional posting in Inventory 365, the inventory change for unfinished goods is corrected and the preliminary inventory change for finished goods is created. The correction of the inventory change for unfinished goods is done by using the WIP Change Account column and the inventory increase for finished goods is done by using the Prod. Accrual Account (Interim) column.

|

|---|

| Figure Example Additional Posting - Output |

Closing Production Order without Posting Expected Costs

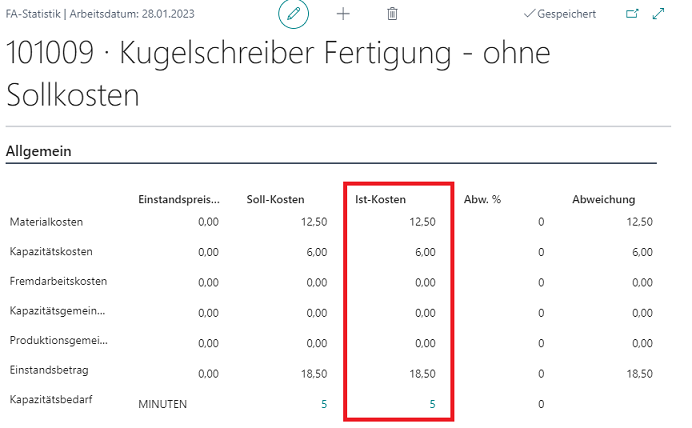

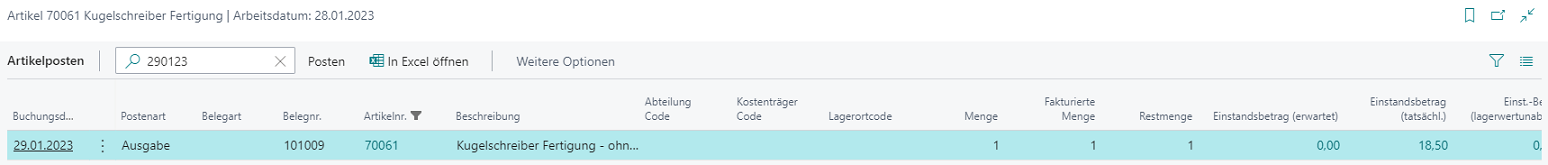

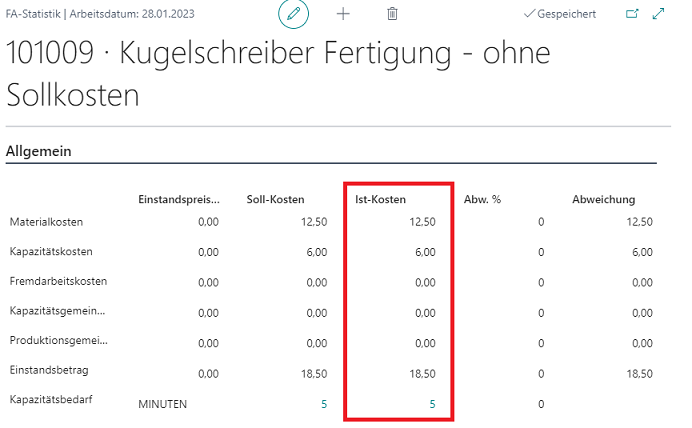

When the production order is completed, the actual costs are finally posted for the production order. To make sure that the actual cost amount is considered in the output’s value entry, the Adjust Cost - Item Entries batch job needs to be performed. The production order has the following actual costs:

|

|---|

| Figure Example 1 Actual Costs Production Order |

By performing the individual activation steps described above, the costs for material and capacity will be collected on the balance sheet account for unfinished work. With output posting, the item’s manufactured quantity is re-posted to inventory. Consequently, the account for work in progress (WIP) is reversed and the balance sheet account for finished goods is increased.

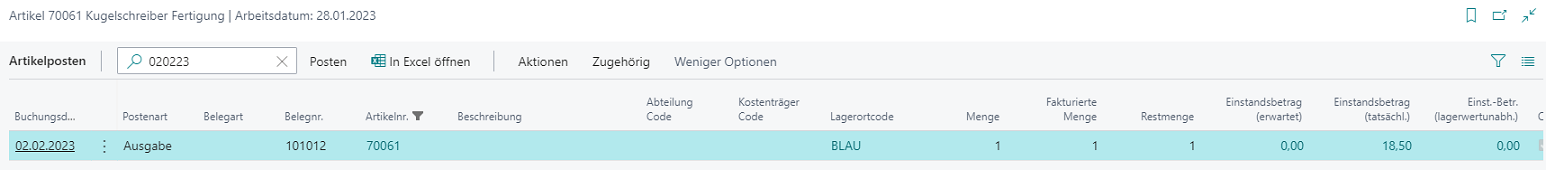

When the production order is closed and the Adjust Cost - Item Entries batch job is performed, the output will show the following item ledger and value entries: Item Ledger Entries:

|

|---|

| Figure Example 1 Item Ledger Entries - Finishing Production Order |

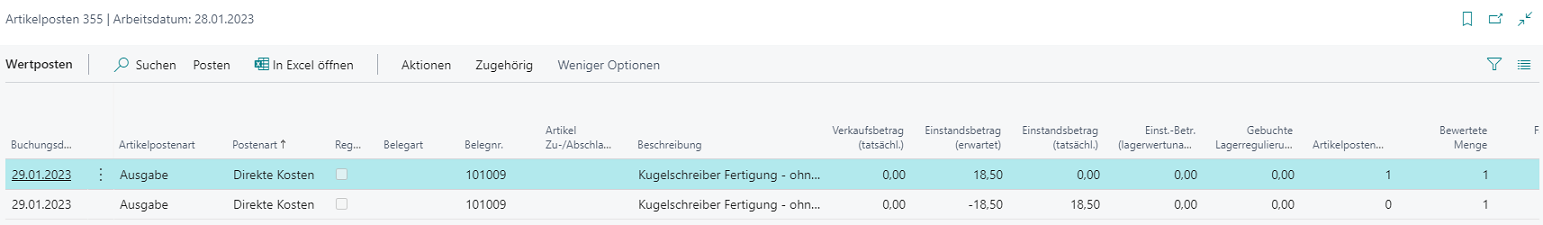

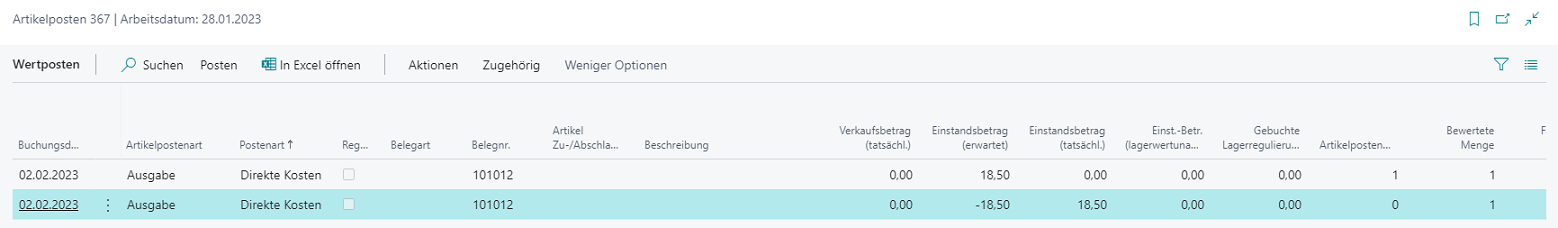

Value Entries:

|

|---|

| Figure Example 1 Value Entries - Finishing Production Order |

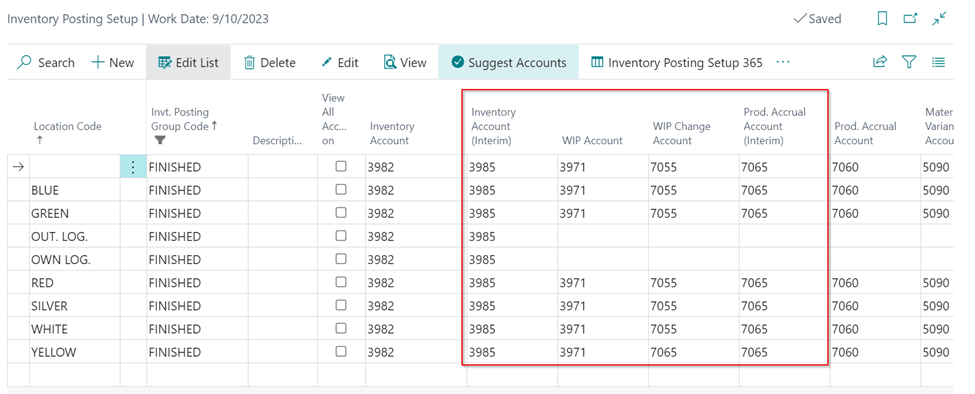

The value entry contains the posting groups of the manufactured item, which is inventory posting group = FINISHED and gen. product posting group = FINISHED in this example. Inventory Posting Setup:

|

|---|

| Figure Example 1 Inventory Posting Setup - Finishing Production Order |

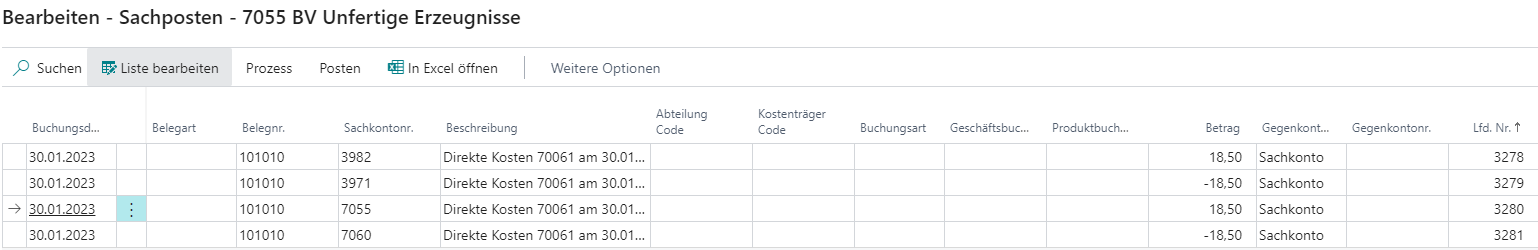

For the determination of accounts when closing the production order, the accounts specified in the Inventory Posting Setup are used. The following postings result in Financial Accounting:

|

|---|

| Figure Example 1 G/L Entries - Finishing Production Order |

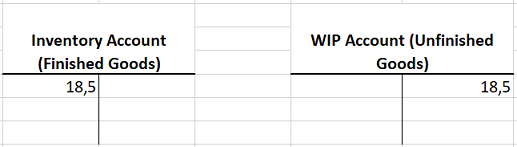

Standard Posting: In the first step, standard posting is performed by exchanging assets. Here, the inventory increase will be posted on the Inventory Account and the inventory of unfinished goods is reversed.

|

|---|

| Figure Example 1 Standard Posting - Finishing Production Order |

Additional Posting in Inventory 365: With additional posting in Inventory 365, the system will correct the inventory change for unfinished goods and create the inventory increase for finished goods

|

|---|

| Figure Example 1 Additional Posting - Finishing Production Order |

Closing with Posting Expected Costs

If the expected costs have already been posted for the production order, it is required to perform an adjustment when closing the production order to reflect the actual costs in the output.

Reminder

After having completed the production order, you need to run the Adjust Cost - Item Entries batch job to ensure that the value entry is created by using the actual costs in the output.

The production order has the following actual costs:

|

|---|

| Figure Example 2 Production Order Actual Costs |

Item Ledger Entries:

|

|---|

| Figure Example 2 Item Ledger Entries - Finishing Production Order |

Value Entries:

|

|---|

| Figure Example 2 Value Entries - Finishing Production Order |

The value entry contains the posting groups of the manufactured item, which is inventory posting group = FINISHED and gen. product posting group = FINISHED in this example. When closing the production order, the accounts specified in the Inventory Posting Setup will be used for posting in Financial Accounting:

|

|---|

| Figure Example 2 Inventory Posing Setup - Finishing Production Order |

The following ledger entries result in Financial Accounting::

|

|---|

| Figure Example 2 G/L Entries - Finishing Production Order |

Standard Posting: First, standard posting is performed. Here, the preliminary inventory of finished goods is reversed and re-posted to the inventory of unfinished goods. In the next step, the inventory of unfinished goods is reversed, and the actual inventory of finished goods is increased.

|

|---|

| Figure Example 2 Standard Posting - Finishing Production Order |

Additional Posting in Inventory 365: With additional posting in Inventory 365, the expected inventory change is reversed and the actual inventory change for finished goods is posted.

|

|---|

| Figure Example 2 Additional Posting - Finishing Production Order |

|

|---|

| Personal support available at www.ckl-software.de/en/ |